How AI can boost productivity and jump start growth | J.P. Morgan ...

AI is a revolution, the optimists say. AI is a bubble, the skeptics reply. We think AI’s impact could be truly transformative, as we discuss in our 2024 Mid-Year Outlook. The path ahead is uncertain. But powerful forces could drive AI forward.

AI's Impact on the Economy

In this article, we apply an economist’s perspective to an issue at the heart of the optimist-skeptic debate: How might AI impact the overall economy? Among the questions we tackle:

- How AI could potentially drive productivity growth

-

The prospects for investing in AI

The prospects for investing in AI - The potential impact of AI on the U.S. economy

Although valuations on AI stocks have had quite a run, we don’t see signs of a bubble. In assessing AI’s economic prospects, productivity is a key metric. Faster productivity growth allows the economy to grow more rapidly, and living standards to rise more rapidly, without generating excess inflationary pressures.

The U.S. economy hasn’t experienced sustained productivity gains since the 1990s. To quantify the potential impact of AI, we modify an International Monetary Fund (IMF) framework. We conclude that AI’s impact could be much greater than the productivity assumptions baked into projections by government agencies such as the Congressional Budget Office.

The U.S. economy hasn’t experienced sustained productivity gains since the 1990s. To quantify the potential impact of AI, we modify an International Monetary Fund (IMF) framework. We conclude that AI’s impact could be much greater than the productivity assumptions baked into projections by government agencies such as the Congressional Budget Office.

Jobs at Risk and Economic Impact

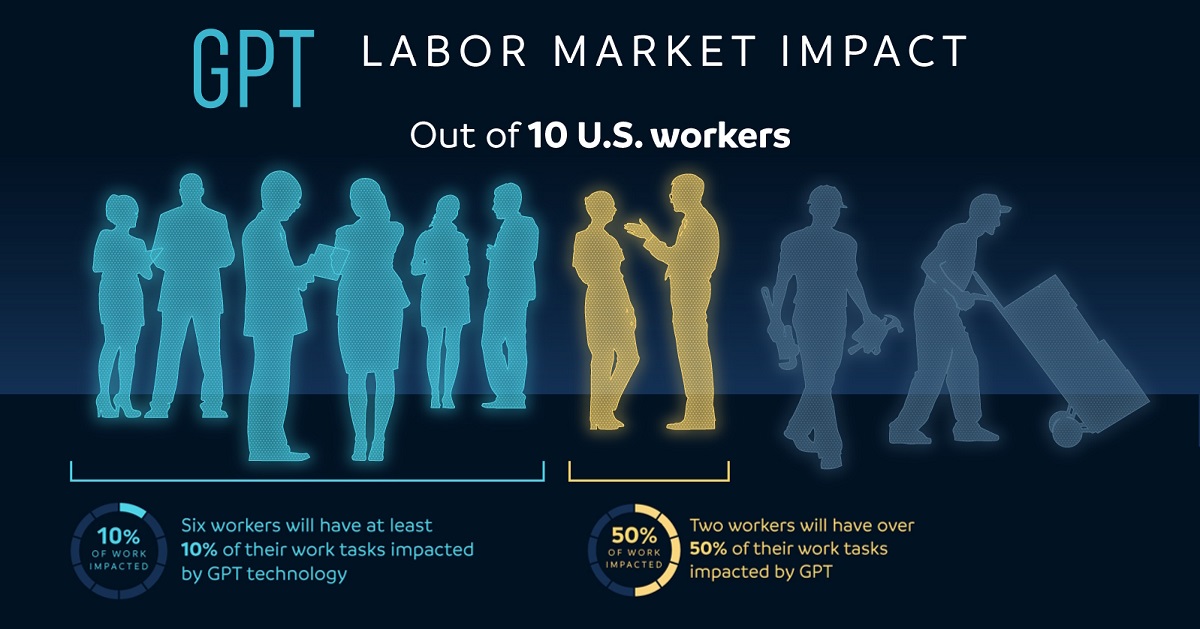

The IMF identifies which jobs could potentially be displaced by AI. We assume that half of the vulnerable jobs in the United States will be automated away over the next 20 years. The cumulative productivity gain would be about 17.5% or $7 trillion beyond the current Congressional Budget Office projection for GDP.

It's important to remember that technological innovation boosts overall economic productivity only when it changes the amount of labor and capital needed to create a given service or product in the economy.  Not surprisingly, white-collar professional service jobs such as budget analysis and technical writing look more vulnerable than other occupations.

Not surprisingly, white-collar professional service jobs such as budget analysis and technical writing look more vulnerable than other occupations.

Global Impact of AI

Across the global economy, AI will impact some economies more than others. Estimates of AI’s economic impact vary widely. A specific uncertainty relates to the cost of implementing AI technologies in the workplace. Public policy focused on job training and transitioning vulnerable workers will likely be needed to minimize the upheaval from a greater pace of job displacement.

Sector and Company Perspectives

AI’s economic impact will depend on whether (and how) CEOs and management teams make AI a critical part of their business strategies and operations. While most U.S. companies are considering how they could use AI, adoption rates need to rise to have a significant impact on the overall economy.

Infrastructure and Investment Opportunities

The technology makes possible a wide array of potential use cases across various industry sectors. AI adoption will likely pressure inflation rates higher in the short run. AI-related capital investment is being funded by highly profitable companies with low levels of debt, a notable contrast from past technology-driven capex periods.

Companies in the AI infrastructure sectors have been meaningfully boosting their sales projections. How might you think about AI investments in your own portfolio?  AI has already catalyzed a wave of excitement, investment and earnings growth. For now, we suggest clients focus on the AI infrastructure buildout: semiconductors, data centers, and new power generation.

AI has already catalyzed a wave of excitement, investment and earnings growth. For now, we suggest clients focus on the AI infrastructure buildout: semiconductors, data centers, and new power generation.