Goldman Sachs raises S&P 500 year-end target to 5,600 ...

On June 17, Goldman Sachs announced that it has increased its 2024 year-end target for the S&P 500 Index to 5,600, up from the previous target of 5,200. This decision was driven by the strong earnings growth exhibited by five major U.S. tech companies, namely Microsoft, Nvidia, Google, Amazon.com, and Meta Platforms.

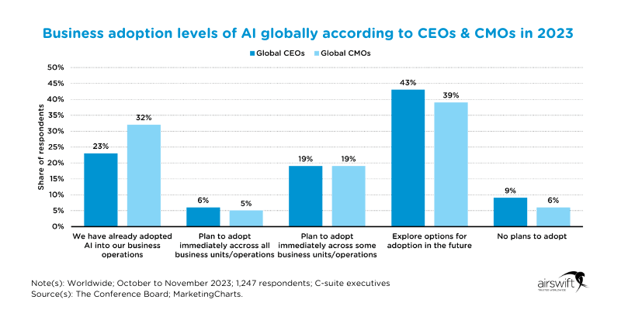

According to the brokerage's note released after market close on Friday, these tech giants have collectively experienced a 45% surge and now represent 25% of the S&P 500 equity cap. The rally in stock prices is attributed to positive revisions in consensus 2024 earnings estimates for these companies and an increased investor interest in artificial intelligence (AI).

The revised target indicates a potential upside of approximately 3.1% from the index's most recent close at 5,431.60. Goldman Sachs anticipates stable real yields by the end of the year and foresees a robust earnings growth that will sustain a 15x price-to-earnings (P/E) ratio for the equal-weight S&P 500 Index.

Risks and Volatility

The analysts at Goldman Sachs highlighted that the upcoming U.S. presidential election poses a significant risk to the S&P 500 level, falling between their 3-month and year-end forecast horizons. The election is scheduled for November this year.

Historically, index volatility tends to increase in election years leading up to the event. However, post-election, volatility typically subsides, and the S&P 500 index tends to rebound to higher levels.

It is important to note that market dynamics may be influenced by political events, and investors should be mindful of potential fluctuations in the lead-up to and aftermath of such occurrences.

For further information, you can refer to the original article by Reuters.