AI-driven Fraud Detection in Banking | Analytics Steps

Fraud lurks like a dark shadow over the financial industry. Cybercriminals are growing more adept in their approaches, and standard fraud detection technologies simply cannot keep up. Now, the discussion has shifted to fraud detection utilizing AI in banking, which is a light of innovation and a potential solution in the ongoing struggle against dishonesty and deception. The Association of Certified Fraud Examiners found that fraud costs organizations an estimated 5% of their annual revenue, amounting to billions annually. Banks may reduce these costs by detecting unscrupulous actors early on — or, better yet, by noticing behavioral trends and patterns that can prevent fraud before it occurs. To do this, financial institutions need to incorporate AI into their fraud detection tactics.

Importance of AI in Banking

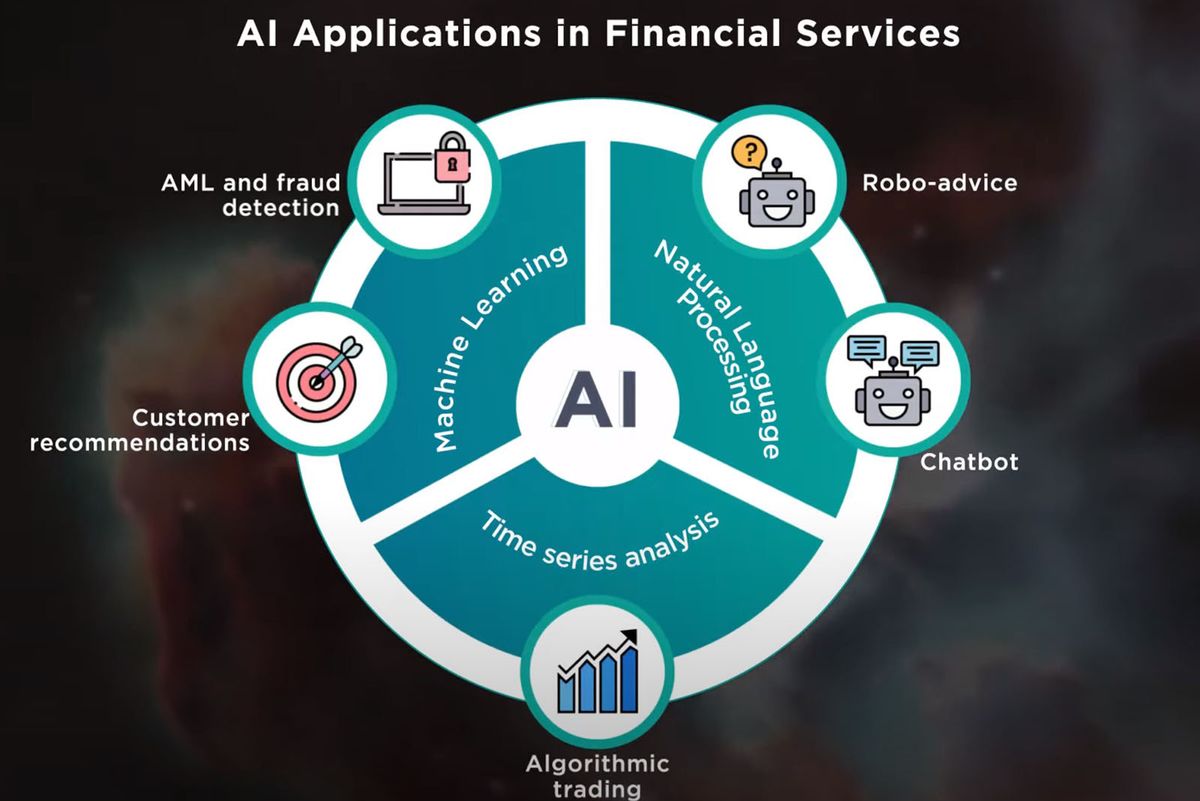

Artificial intelligence (AI) is becoming an increasingly important technology for the banking industry. When used to power internal operations and customer-facing applications, it can assist banks in improving customer service, fraud detection, and financial and investment management. Financial services companies, such as banks, have embraced digital transformation initiatives in order to stay ahead of technological trends, increase their competitive advantage, and provide valuable services and better customer experiences. The advent of AI technologies has increased the importance of digital transformation, which has the potential to remake the industry and determine which companies thrive.

Role of AI in Fraud Detection

Historically, incumbent financial service firms have struggled to innovate. A McKinsey study discovered that huge banks were 40% less productive than digital natives. Many growing banking firms are pioneering artificial intelligence use cases, emphasizing the need for incumbent banks to catch up and innovate. Natural language processing (NLP) has long been used by investment banks to parse massive volumes of data that they either generate internally or obtain from third parties. They employ NLP to analyze data sets in order to make more educated decisions about critical investments and wealth management.

Bank fraud takes numerous forms, ranging from obtaining consumers' account numbers to creating false accounts and incurring costs. AI can detect several types of bank fraud, reducing the impact of unscrupulous actors. Banking relies on several document-based identity checks to prevent fraud — pay stubs, tax statements, and utility bills, for example. With so many paper and digital documents, this creates many opportunities for fraudsters to use forged or fake documents to open accounts and qualify for loans.

Identity theft is a widespread problem in which fraudsters pose as someone else in order to obtain money, products, and services in their name without repaying the bill. AI can detect identity theft by analyzing large quantities of data in real time and identifying patterns. This proactive method allows banks to detect and prevent fraudulent transactions before they happen.

Challenges and Risks

Introducing AI into banking is not without risks and challenges. According to the IBM Institute for Business Value 2024 Global Outlook for Banking and Financial Markets survey, more than 60% of banking CEOs are concerned about new AI vulnerabilities. Generative AI models require training on current data sets to be effective. Banks are increasingly engaging in environmental, social, and governance (ESG) activities to demonstrate openness and accountability for their decisions.

Banks continue to prioritize AI investment in order to stay competitive and provide clients with increasingly sophisticated tools for managing their money and investments. Customers continue to prioritize banks that can offer personalized AI applications that help them gain visibility on their financial opportunities.

Future Outlook

In the future, banks will advertise their use of AI and how they can deploy advancements faster than competitors. AI will help banks transition to new operating models, embrace digitization and smart automation, and achieve continued profitability in a new era of commercial and retail banking.