European Central Bank cuts interest rates to support growth as ...

Live coverage of business, economics and financial news as ECB cuts main interest rate by 0.25 percentage points in effort to support European economies. It was a flash reading on the Eurozone economy, so we don’t have the details on what the drivers were. But it’s clear that it was a weak end to 2024.

The European Central Bank might be able to spur a bit of economic growth in the eurozone with looser monetary policy. Charlie Cornes, senior economist at the Centre for Economics and Business Research, a consultancy, said:

Challenges Faced by the Eurozone

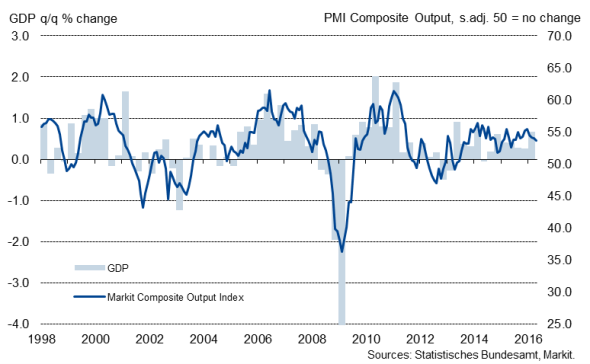

This marks a weak end to last year, following positive growth in the first three quarters of 2024. As a result, first estimates suggest that the currency bloc as a whole grew by 0.7% in 2024. Declining activity in Germany – the Eurozone’s largest economy – has weighed on the bloc’s growth, with German GDP contracting by 0.2% on the quarter. This suggests Germany has now seen annual declines in activity for two consecutive years.

In 2025, further loosening of monetary conditions is expected to provide a modest uptick in activity for both Germany and the Eurozone, with growth expected to amount to 0.3% and 1.0% respectively.

Legal Issues and Environmental Concerns

The decision to greenlight a giant new oilfield off Shetland has been ruled unlawful by the courts in a major win for environmental campaigners. The proposed Rosebank development – the UK’s biggest untapped oilfield, due to be developed by Norwegian oil company Equinor – had been given the go-ahead in 2023 under the previous government.

But on Thursday the court of session in Edinburgh sided with campaigners and climate experts in ruling that the original decisions to permit Rosebank and a second, smaller, gas field called Jackdaw were unlawful, as they had not taken into account the carbon emissions created by burning any oil and gas produced. British oil company Shell is due to develop Jackdaw.

Impact on Germany's Economy

The eurozone economy did not grow in the final three months of 2024, adding weight to the argument that the European Central Bank will ease interest rates further this year. Eurozone GDP growth came in at 0% quarter-on-quarter for the fourth quarter of 2024, according to the European Commission.

Germany has now gone two consecutive years with a shrinking economy. The only reason that it has not been called a “recession” so far is that by convention that word applies to two consecutive quarters of contraction. As the below quarterly GDP chart from Trading Economics shows, the country has narrowly avoided that fate over the last nine quarters.

Market Gyrations and Technological Advances

One of the driving forces of market gyrations this week has been concerns over the emergence of DeepSeek, a Chinese artificial intelligence company that appears to have blown rivals out of the water with an AI model that used a fraction of the resources of others.

Germany’s Dax stock market index is also in on the party with a new record high, while Spain’s Ibex benchmark is at its highest since 2008, before the Eurozone crisis crunched its economy for a decade.

Spain’s stock market has risen strongly in the last couple of years, as the country has become the surprise leader of the European economy – with a growth rate far outstripping the EU’s largest economy, Germany.

The biggest gainer on the FTSE 100 is telecoms company Airtel Africa. Its share price rose 7.2% after it reported a 20% increase in revenues for the first nine months.