HG Infra stock gave 56% return in one year; should you invest ...

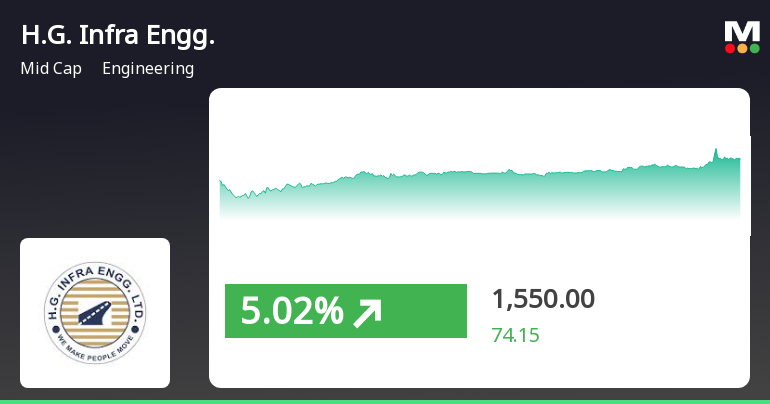

Investing in stocks can be a lucrative way to grow your wealth over time. One such stock that has shown impressive growth is HG Infra Engineering Limited. Over the past year, HG Infra stock has provided investors with a remarkable 56% return on their investment.

Why Consider Investing in HG Infra Stock?

There are several factors that have contributed to the strong performance of HG Infra stock. The company has a solid track record of delivering projects in the infrastructure sector. With a focus on quality and timely execution, HG Infra has successfully completed various projects across the country.

Furthermore, the government's increased focus on infrastructure development has created a favorable environment for companies like HG Infra. As the demand for infrastructure projects continues to grow, HG Infra is well-positioned to benefit from these opportunities.

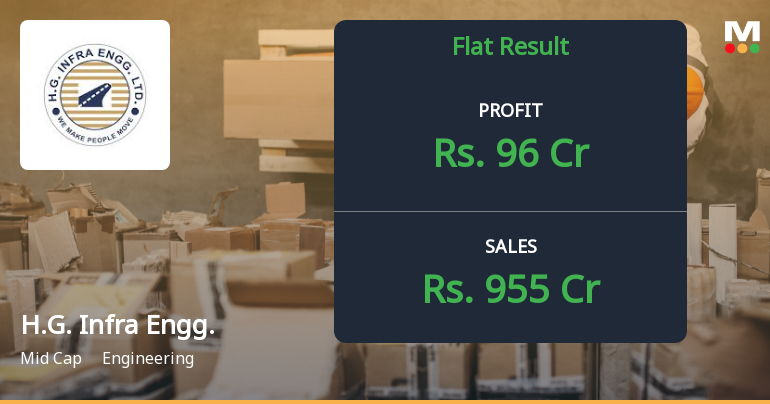

Additionally, HG Infra's strong financial performance and healthy balance sheet have instilled confidence in investors. The company's revenue and profits have been on an upward trajectory, reflecting its growth potential.

Should You Invest in HG Infra Stock?

While HG Infra stock has performed well in the past year, it's essential to conduct thorough research and analysis before making any investment decisions. Consider factors such as your investment goals, risk tolerance, and investment horizon before investing in HG Infra stock or any other stock.

It's also advisable to consult with a financial advisor who can provide personalized guidance based on your financial situation and investment objectives.

Ultimately, investing in stocks carries inherent risks, and it's crucial to diversify your investment portfolio to mitigate these risks. While HG Infra stock has shown impressive growth, it's essential to approach investing with caution and make informed decisions.

Remember, past performance is not indicative of future results, and investing in the stock market involves risk. Conduct thorough research, seek expert advice, and make well-informed decisions to optimize your investment strategy.