Ripple (XRP) rallies 5% as Ripple gears for utility in institutional crypto products

Ripple (XRP) traders’ sentiment turned positive on Friday, as CEO Brad Garlinghouse highlighted the addition of XRP-Dollar reference rate and indices to the CME Group and CF Benchmarks. The CME Group is a leading derivatives marketplace, and CF Benchmarks is an FCA-regulated Benchmark administrator. The addition of XRP indices demonstrates how the asset is moving towards finding utility in institutional crypto products.

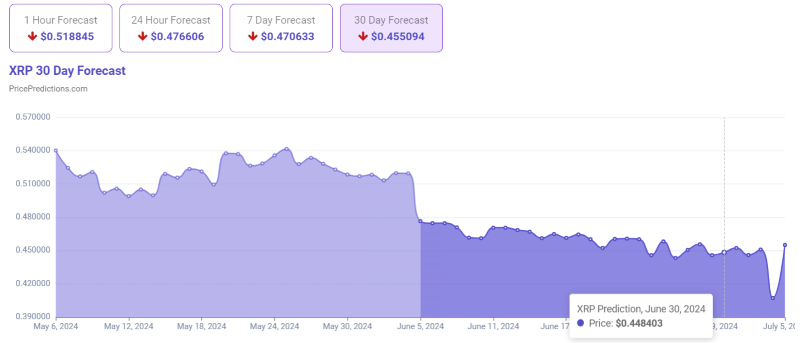

XRP trades at $0.4719 at the time of writing. The first step towards institutional crypto products is to have a trusted benchmark reference rate. It is encouraging to see CMEGroup and CFBenchmarks collaborate on this for an XRP index.

Ripple's Price Movement

Ripple is in an upward trend, extending gains by nearly 5% on Friday. As sentiment among XRP traders remains bullish, the altcoin could rally towards resistance at the psychological barrier of $0.50. Currently, XRP trades at $0.4719.

XRP price steadies above $0.56 ahead of deadline in SEC v. Ripple ...

Further up, XRP could rally towards $0.5205, representing nearly a 10% gain from the current level, as observed in the XRP/USDT daily chart. The Moving Average Convergence Divergence (MACD) indicator shows a positive momentum of the Ripple price trend.

If XRP corrects, the altcoin could collect liquidity in the Fair Value Gap (FVG) between $0.40 and $0.44. Further down, Ripple’s price could find support at the July 5 low of $0.3823.

Ripple's Legal Battles

According to a court ruling released on July 14, for institutional investors or over-the-counter sales, XRP is considered a security. However, for retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services, and other platforms, XRP is not classified as a security.

AI sets XRP price for June 30, 2024

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. The court ruling presents a partial win for both Ripple and the SEC, with implications for the broader crypto sector.

The SEC has intensified its enforcement actions towards the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating US Securities laws.

The court decision is a partial summary judgment and can be appealed once a final judgment is issued. The case is in a pretrial phase, allowing both Ripple and the SEC to settle the matter.