Meta forecasts higher AI spending and weaker revenue | Y100 ...

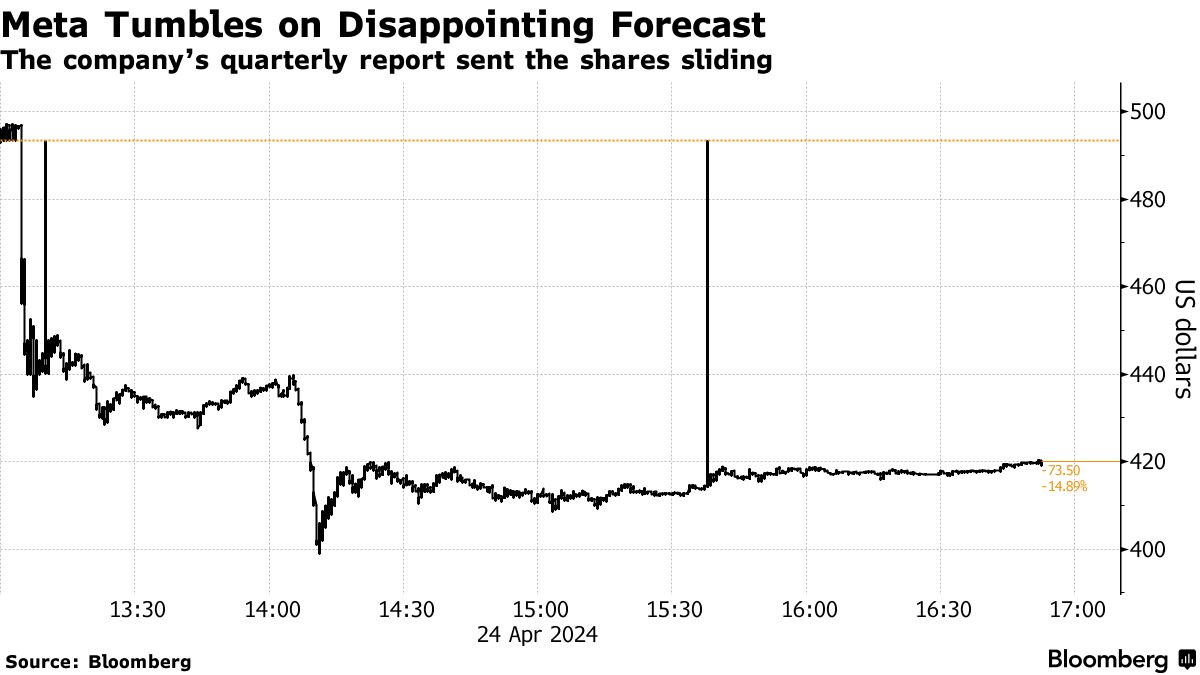

Meta Platforms, the parent company of Facebook and Instagram, shared its latest financial forecasts which left investors disappointed. The company predicted higher expenses and lower revenue than expected, causing its shares to plummet by 13% in extended trading. This resulted in a loss of $160 billion in market value for the tech giant.

According to Meta, they anticipate their revenue for April-June to be between $36.5 billion and $39 billion, with a midpoint of $37.8 billion. This projection fell short of analysts' expectations of $38.3 billion. The company attributed the increase in expenses to investments in new AI technologies and the necessary computing infrastructure to support them. Consequently, Meta revised its 2024 capital expenditure forecast to a range of $30 billion-$40 billion, up from the previous estimate of $35 billion to $37 billion. The total expense forecast was also adjusted to $96 billion-$99 billion, from $94 billion to $99 billion.

Impact on Stock Market

Following the announcement, Meta's shares took a hit while other tech giants like Alphabet and Snap also saw declines in their stock prices. This move reflected a shift in investor confidence as Meta navigates the AI landscape and invests heavily in new technologies.

The positive momentum Meta had experienced in previous quarters, particularly in artificial intelligence initiatives, seemed to be dampened by the latest forecasts. Despite solid performances and innovations in AI-powered products, the company is facing pressure to maintain its core advertising business while exploring new avenues for growth.

AI Investments and User Growth

Meta has been focusing on enhancing its ad-buying tools with AI capabilities and introducing short video formats to drive revenue. Additionally, the company has rolled out AI features like chat assistants to increase user engagement across its platforms. The recent promotion of Meta AI assistant signals the company's commitment to leveraging AI to improve user experience and drive adoption.

In a bid to sustain its competitive edge, Meta continues to innovate and adapt to evolving market dynamics. With regulatory challenges impacting competitors like TikTok, Meta is well-positioned to capitalize on emerging opportunities.

Despite the challenges, Meta reported a steady growth in daily active people (DAP) across its platforms, indicating a sustained user base. The company remains focused on meeting user expectations and delivering value through its suite of apps.

For more information, you can read the full article here.