Meta Platforms Stock Gets a Lift From Analysts After Strong Q1

Meta Platforms NASDAQ: META rewarded investors with another strong post-earnings gain on May 1. Shares rose over 4% after the release, and the company’s results extended its streak of beating expectations. Meta has now beaten Wall Street's sales estimates for 11 straight quarters. It also exceeded expectations for adjusted earnings per share (EPS) for the ninth quarter in a row. Overall, shares have gained by an average of more than 5% post-earnings over the last 10 quarters.

Analysts' Positive Outlook

However, a higher share price was far from the only good news investors received. According to forecasts tracked by MarketBeat, nearly 20 Wall Street analysts raised their price targets on the tech giant. To be fair, several individuals lowered their targets. Still, three times as many boosted them.

So, what is driving the majority of analysts to become more bullish on Meta, and exactly how much upside do they see?

Investment in AI

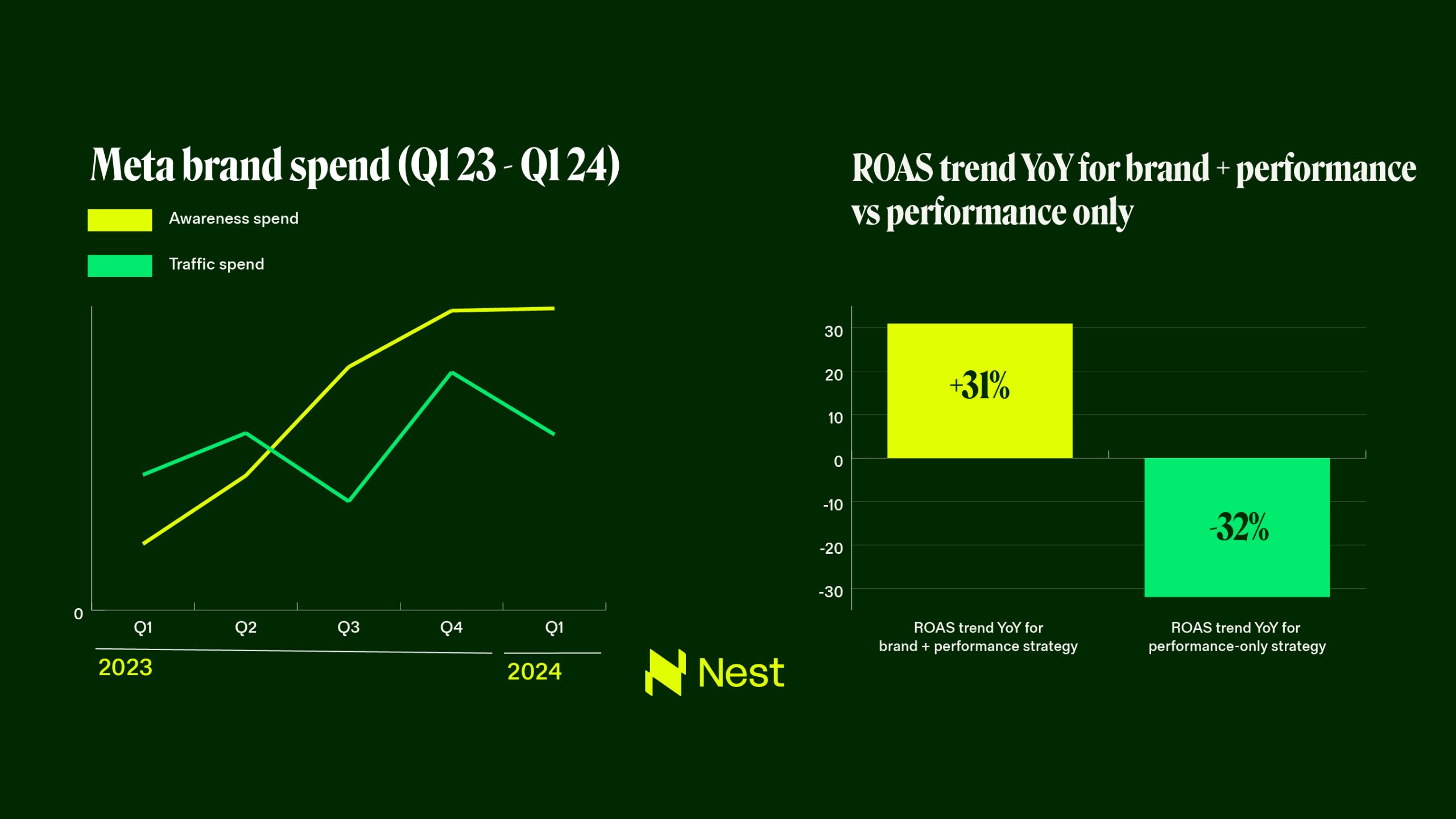

One major announcement coming from Meta was the company raising its capital expenditure (CapEx) guidance for 2025. Meta has been using CapEx spending to invest significantly in AI infrastructure that supports the growth of its business. Critics have targeted big tech companies for their tens of billions in CapEx spending on AI. However, Meta has been demonstrating extensive gains due to the implementation of AI in its advertising platform. Wall Street analysts are noticing this and showing support for Meta’s higher CapEx spending plans. The success of Meta’s AI initiatives is a key reason many are raising their price targets.

Analysts at JPMorgan Chase & Co. NYSE: JPM expressed confidence in this move. They highlighted the company’s “solid results and execution along its AI roadmap” and its “ambitious long-term goals” as justifications for the higher spending. Analysts at Stifel and Piper Sandler also emphasized the importance of Meta’s AI initiatives in driving future growth.

Increased Ad Demand

The fact that people are seeing more ads on Meta and that marketers are spending more on each ad provides evidence of Meta’s strong AI execution. From Q1 2023 to Q1 2025, the number of ad impressions on Meta’s apps is up by around 26%, indicating that marketers are buying a higher volume of ads. Comparing the same two periods, the price paid per ad is up around 17%. Meta’s AI investments have led to significantly more time spent on its apps. This is a key reason why marketers are willing to direct more ads to them while also paying a higher price.

Clarity in Business Strategy

Analysts at Citigroup NYSE: C highlighted Meta’s clear plan for growth opportunities through its AI strategy. This structured format of explaining the major growth opportunities has strengthened confidence in Meta’s continued growth trajectory. Providing clarity around their business allows investors to understand how well a company is executing. If a company executes well, this can lead to higher multiples. Because Meta is doing just that, adding clarity is a positive.

The rise in price targets for Meta comes down to the company delivering strong results with its AI strategy, bolstering investor confidence.

Analyst Price Target Updates

On average, Wall Street analyst price target updates tracked by MarketBeat after the May 1 earnings release indicate significant 12-month return potential in Meta shares. Compared to the stock’s May 8 closing price of just under $598 per share, these updates imply that shares could rise by over 18%.

Before you consider Meta Platforms, you'll want to hear this. MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

From mega-cap leaders to under-the-radar stocks, these blowout earnings winners are gaining serious momentum heading into 2025. Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools.

Featured By 345 N Reid Place, Suite 620, Sioux Falls, SD 57103

(844) 978-6257

© MarketBeat Media, LLC 2010-2025. All rights reserved. © 2025 Fair market value prices are updated every minute and are provided by Polygon.io. Other market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.

My Account -