Google, Microsoft and Meta's AI message to Wall Street: Stop fretting

Big Tech's message to investors on back-to-back earnings calls this week was to stop worrying about the billions being spent on AI, as everything is expected to turn out just fine.

The big picture:

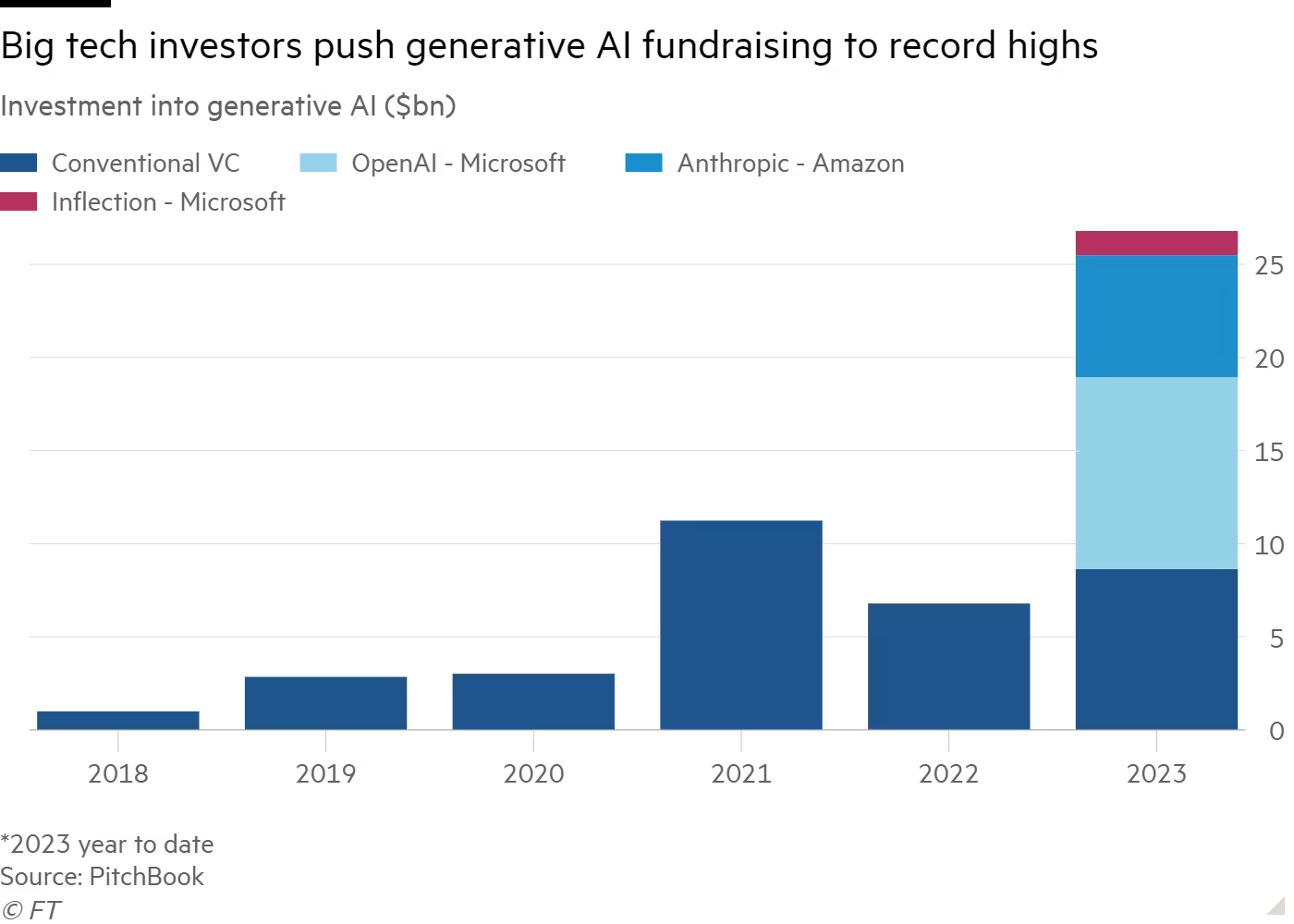

Over the past month, Wall Street has started to question the increasing cost of buying high-end chips and building data centers, and when these investments will begin to reflect in revenue and profit growth.

By the numbers:

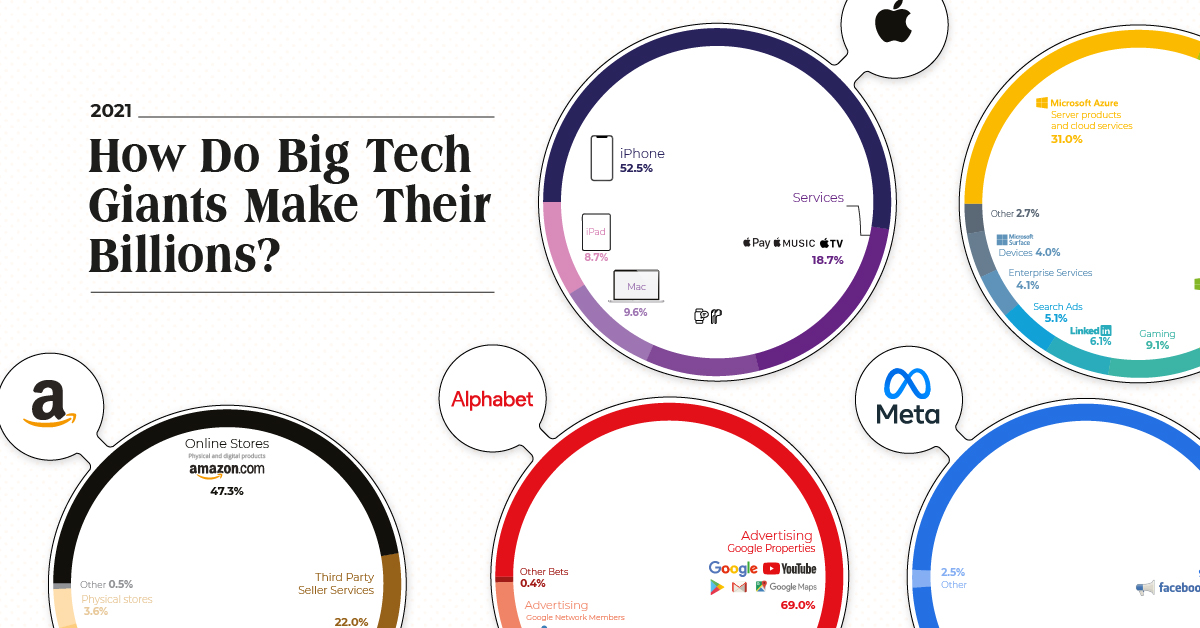

These companies continue to experience growth and remain incredibly profitable, establishing a strong financial foundation for their ambitious endeavors. Tech giants like Apple and Amazon, although not directly engaged in the race to build the most exceptional foundation model, are also making significant investments in AI.

It's important to note that these numbers are for a single quarter; when multiplied by four, it provides a rough annual overview.

Follow the money: With industries generating profits at this magnitude, shareholders may push for increased dividend payouts. While tech firms have traditionally avoided dividends, some, such as Apple, have started to embrace them.

Between the lines:

Wall Street has already assigned massive valuations to these companies based on their present operations and future potential. The CEOs have moved swiftly to reassure investors that the best is yet to come and that their companies are well-prepared to shape the future. Addressing concerns about allocating substantial funds into "capex" (capital expenditures) for AI infrastructure, Microsoft CEO Satya Nadella mentioned the importance of tuning into customer demand signals.

The bottom line:

"When you go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting for us here," stated Google CEO Sundar Pichai during discussions with analysts last week.