Alphabet Stock Rated 'Buy' as Google Leads AI Market with Gemini 2.5

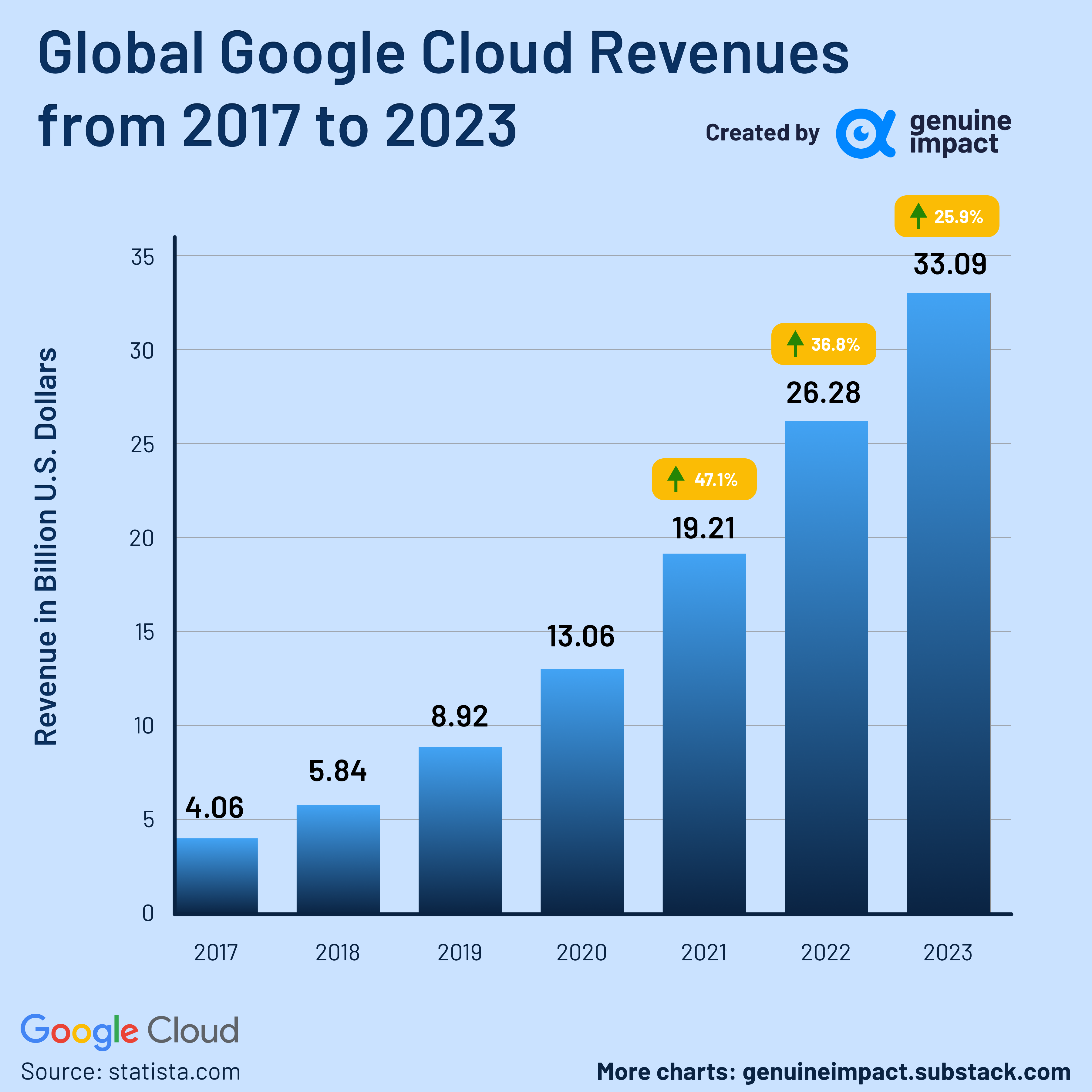

Alphabet Inc. (GOOG, GOOGL) reported 12% revenue growth during Q1 2025 as Google Cloud revenue grew 28% to $12.3 billion and Search earned $50.7 billion. YouTube continued its growth pattern during the year as the platform experienced a 20% increase in Shorts and podcasts viewer numbers.

Polymarket betting data indicates that Google’s Gemini 2.5 AI model holds the number one position among all available models. The model functions as a core system for Search platforms, YouTube, and Google Cloud to handle billions of user interactions while solidifying Google’s position as an applied AI leader.

Alphabet's Financial Strength

Alphabet’s financial strength and growth prospects received a significant boost through a 5% dividend increase and a $70 billion stock repurchase program. Alphabet stock performs worse than the general market since April 25 with a decrease of 0.5% while S&P 500 showed a 6.5% increase. The forward PEG ratio of Alphabet shows more than 10% improvement from sector averages according to analysts.

Market-Leading AI Technologies

Alphabet demonstrates market-leading AI technologies alongside substantial revenue expansion and discounted valuation which analysts identify as a prime long-term investment opportunity during the AI megacycle.

Some of the links in this article are affiliate links. Please keep in mind that all comments are moderated according to our comment policy.

![Google Statistic By Revenue and Facts [2025]](https://www.coolest-gadgets.com/wp-content/uploads/2024/06/PxHc6-distribution-of-worldwide-mobile-app-revenues-in-the-google-play-store-from-2019-to-2025-by-category-1024x906.png)

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.