Alphabet's Q1 earnings to highlight growth amid AI advances and regulatory challenges

Alphabet, Google’s parent company, is set to report its Q1 earnings with expected revenue growth of around 10%, driven by AI innovation, YouTube and Google Cloud gains, alongside challenges from increased regulatory scrutiny and competitive pressures.

Analysts' Expectations

Alphabet, the parent company of Google and YouTube, is poised to report its first-quarter earnings after market close on Thursday. Analysts have set expectations for the technology giant’s financial performance in a quarter marked by significant developments in artificial intelligence, regulatory challenges, and strategic business moves.

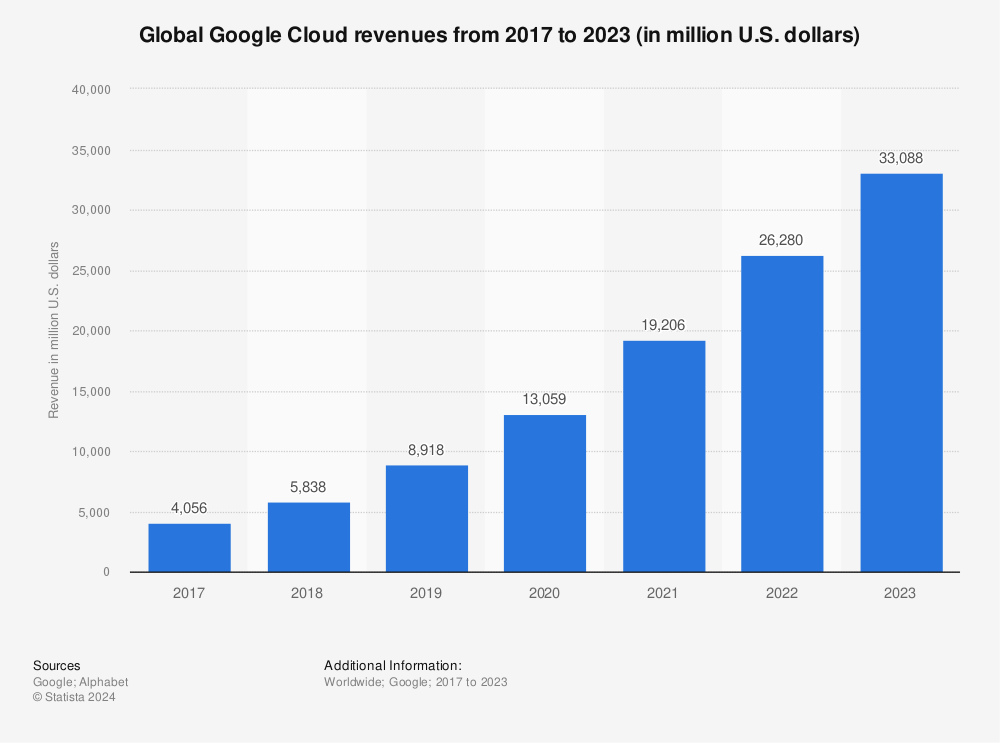

According to data aggregated by LSEG, Alphabet is forecasted to generate $89.2 billion in revenue for the quarter, representing approximately 10% year-over-year growth. Earnings per share are projected to be $2.02. Specific segments within the company also draw distinct analyst attention: YouTube’s advertising revenue is expected to reach $8.97 billion, while Google Cloud’s revenue is forecasted at $12.27 billion. The company’s traffic acquisition costs (TAC)—the expenses Google incurs to acquire traffic via partnerships—are anticipated to total $13.66 billion, as per figures reported by StreetAccount.

Challenges and Opportunities

Alphabet’s market valuation and investor sentiment have faced challenges recently, with its shares declining more than 17% so far in 2025. The company finds itself in the center of an increasingly competitive artificial intelligence (AI) landscape, where regulatory scrutiny and new entrants present competitive pressures.

Despite challenges, Alphabet has made significant advancements, including the launch of Gemini 2.5, described as its “most capable” AI model suite yet, and Waymo's expansion of robotaxi services in Austin, Texas, and Atlanta. In March, Alphabet also announced its largest-ever acquisition, agreeing to purchase cybersecurity firm Wiz for $32 billion to enhance Google Cloud's security solutions.

Legal and Regulatory Environment

However, Alphabet's growth trajectory remains challenged by ongoing regulatory and legal issues. A recent federal court ruling found Google holds illegal monopolies in online advertising markets, adding to previous antitrust setbacks. The company settled with its employee union in April, reversing a policy that prevented staff from discussing ongoing antitrust litigation.

Further legal challenges have emerged, with companies like Chegg filing lawsuits against Google. These legal battles, along with industry trends and product launches, will be reflected in Alphabet's first-quarter earnings report, providing insights into the company's strategic positioning amid innovation, competition, and regulation.

Source: Noah Wire Services