Alphabet (GOOGL) Stock Price, News & Analysis

Alphabet Inc. is the parent company of a host of technology services that include the iconic Google search engine and all the associated apps that go with it. The company is the G in the FAANG stock acronym and a blue-chip operator of Internet infrastructure. Founded on September 4, 1998 by Larry Page and Sergey Brin while the two were Ph.D. students at Stanford, the original product was a tool for searching the rapidly growing Internet that revolutionized the budding Search Engine industry. Since its founding, Google has become the world’s premier and leading search engine commanding an estimated 86% of the search market in 2021.

The company abruptly changed its name and operating structure in 2015 making it a parent company with Google as a subsidiary. This provided some protection against anti-trust lawsuits, improved accounting, and allowed the company to expand into areas outside of search.

Segments and Headquarters

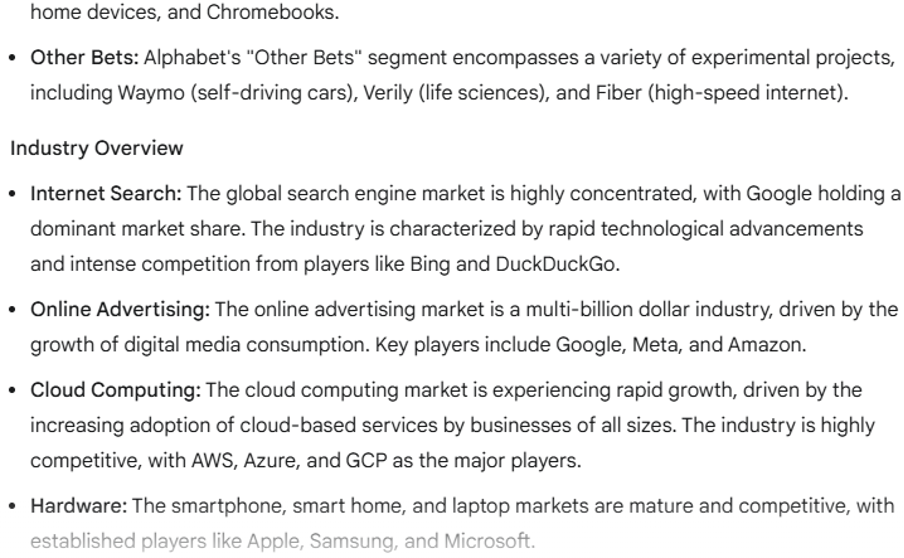

Alphabet provides various products and platforms globally, where it is permitted, and operates in three broad segments - Google Services, Google Cloud, and Other Bets. The company is headquartered in Mountain View, California, within a sprawling complex of modernized buildings called the Googleplex, prominently located within the San Francisco Bay Area. Employees working in the Googleplex are afforded free transportation on the company’s shuttle bus system as well as other ground-breaking perks.

Google Services and Google Cloud

The Google Services segment is the core of the business, built around the Google Search Engine and offering products and services to both businesses and consumers. The Google Cloud segment offers cloud-based infrastructure, operating platforms, and other services for business, as well as a suite of cloud-based products of its own.

Other Bets and Investment

The Other Bets segment is Alphabet’s venture capital arm, investing in technologies of all kinds and at all stages of development. Projects under the Other Bets umbrella include Waymo and Verily. Waymo focuses on self-driving vehicles and related technologies, while Verily is focused on the healthcare sector.

Financial Performance and Ratings

Alphabet scored higher than 89% of companies evaluated by MarketBeat, ranking 95th out of 663 stocks in the computer and technology sector. The company has a consensus rating of Moderate Buy, based on 26 buy ratings and 10 hold ratings. Earnings for Alphabet are expected to grow by 14.94% in the coming year.

The P/E ratio of Alphabet is 18.58, trading at a less expensive ratio than the market average. Alphabet also has a PEG Ratio of 1.06 and a P/B Ratio of 6.25. The company has a dividend yield of 0.48% and a dividend payout ratio of 9.36%.

Stock Performance and Recent Events

Alphabet's stock was trading at $189.30 at the start of the year. Since then, GOOGL stock has decreased by 12.0% and is now trading at $166.64. Alphabet Inc. (NASDAQ:GOOGL) posted its quarterly earnings data on Thursday, April 24th.

Google and Apple, The Beginning

Top institutional shareholders of Alphabet include Vanguard Group Inc. (4.20%), Price T Rowe Associates Inc. MD (0.73%), Northern Trust Corp (0.56%), and Wellington Management Group LLP (0.46%). Insiders that own company stock include Sundar Pichai, Ruth Porat, Prabhakar Raghavan, Kavitark Ram Shriram, Philipp Schindler, John Kent Walker, Frances Arnold, Amie Thuener O'toole, John L Hennessy, Ann Mather, 2019 Gp LLC Gv, and 2017 Gp LLC Gv.

Shares of GOOGL stock can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include Charles Schwab, E*TRADE, Fidelity, and Vanguard Brokerage Services.

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion-dollar tech company.

© 2025 Fair market value prices are updated every minute and are provided by Polygon.io. Other market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.