Notable analyst calls this week: Meta, AMD and Intel among top picks

The S&P500 closed in the red after a week of earnings reports. Intel's weak guidance worried analysts, while Meta Platforms received positive reviews. CrowdStrike faced scrutiny over a global IT outage, and PayPal's turnaround plan impressed. AMD's financial report led to a stock surge, but analysts remain cautious. Bank of Montreal was downgraded, while Nvidia was added to Morgan Stanley's top picks list.

Intel’s weak guidance worries Wall Street analysts

Raymond James downgraded Intel (INTC) to Market Perform from Outperform and said it expected the third quarter outlook to be weak but were surprised by the magnitude, especially on margins. J.P. Morgan, which kept its Underweight rating and cut PT to $26 from $35, said operational execution will be even more important as Intel targets to become a global leader in the semiconductor foundry market. BofA materially reduced its Intel's forecasts after a weak second quarter, while New Street Research downgraded it to Neutral with a $27 price target.

Wall Street bullish on Meta after strong results and outlook

Meta Platforms (META) received PT hikes after the Facebook-parent issued strong result and forecast on Wednesday, leading to the stock rise over 4% in extended trading. Citi is "incrementally positive" on shares of Meta, given engagement & monetization gains and expanding margins, while Morgan Stanley saw progress on longer-term engagement initiatives including WhatsApp, Meta AI, and Threads and observed healthy trends, particularly from young adults on Facebook. “META continues to execute at arguably the best pace of any company in digital advertising, with little revenue deceleration despite facing very tough comps in 2H24,” noted Barclays. J.P. Morgan also thinks Meta is showing signs of progress across key areas of its broader AI strategy.

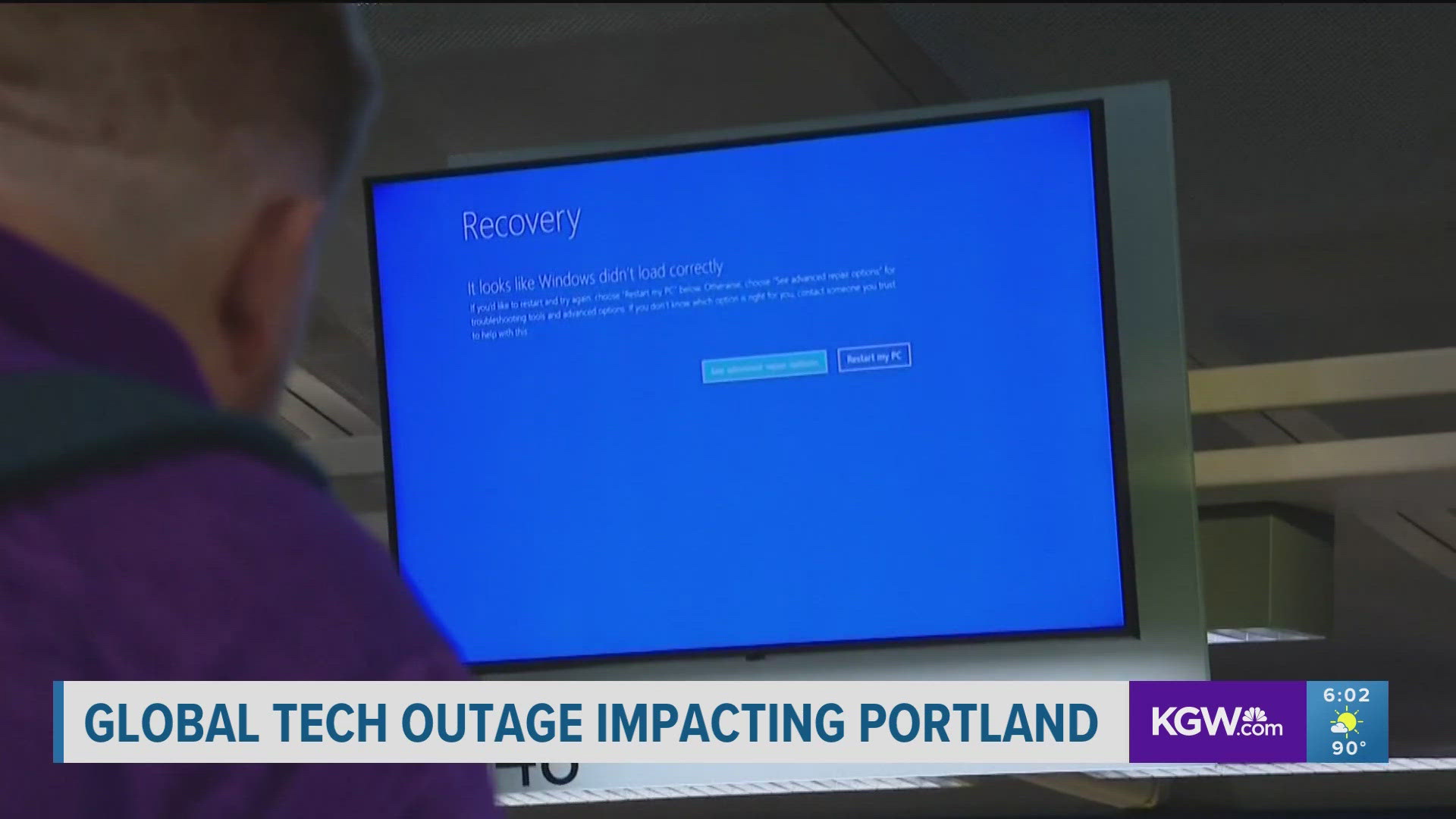

Analysts keeps CrowdStrike in focus after global outage

CrowdStrike was in the spotlight again after reports of Delta hiring law firm to sue the company and Microsoft over the recent global IT outage, leading to Jefferies slash PT for the cybersecurity company to $300 from $400. “While our checks have indicated little churn (some new business impact expected), we're reducing our ARR est. by 1% in FY25 & FY26,” said analyst Joseph Gallo. Needham analyst Alex Henderson and his team have cut their revenue, ARR, and EPS Estimates for CrowdStrike but thinks the damage to CrowdStrike's reputation will fade over the next year.

Argus positive on PayPal’s turnaround plan after Q2 results

Argus upgraded PayPal Holdings (PYPL) to Buy from Hold following the payment tech company's strong Q2 earnings, with Argus analyst Stephen Biggar noting that efforts to re-ignite growth are proceeding faster than originally expected. "We view the company as making steady progress on its turnaround plan, which includes a new CEO and CFO, improved online checkout experiences, and revived growth from Venmo," Biggar wrote.

AMD surges after financial report; analysts not convinced on long-term prospects

Advanced Micro Devices (AMD) posted a better-than-expected Q2 report, leading to the stock surge over 7% during early trading on Wednesday. However, analysts were not convinced. Oppenheimer said it remains cautious toward AMD's ability to deliver a profitable long-term business model as the second horse in the secularly declining PC market, while Truist, which maintained its Hold rating and lowered PT to $156 from $162, said its long-term concern on AMD remains. “We see AMD's position in AI as likely confined versus Nvidia's solutions, and we expect the X86 market will slowly come under pressure from new CPU competitors,” said Truist analyst William Stein. KeyBanc said it is concerned that any moderate downtick to expectations could add substantial risk to the stock based on valuation levels well above peers.

Bank of Montreal

Bank of Montreal (BMO) was downgraded by Royal Bank of Canada to Sector Perform from Outperform. The firm also lowered EPS estimates after digging into BMO's credit results. Meanwhile, Nvidia (NVDA) was re-added by Morgan Stanley to its top picks list after the recent sell-off.