Embracing generative AI in credit risk | McKinsey

Some technologies are so compelling that they quickly take on a life of their own. Generative AI (gen AI) made the leap from the laboratory to the mainstream in late 2022, when Open AI launched a public beta of its ChatGPT service. Within two months, it had more than 100 million users, making it the fastest-growing product in human history.

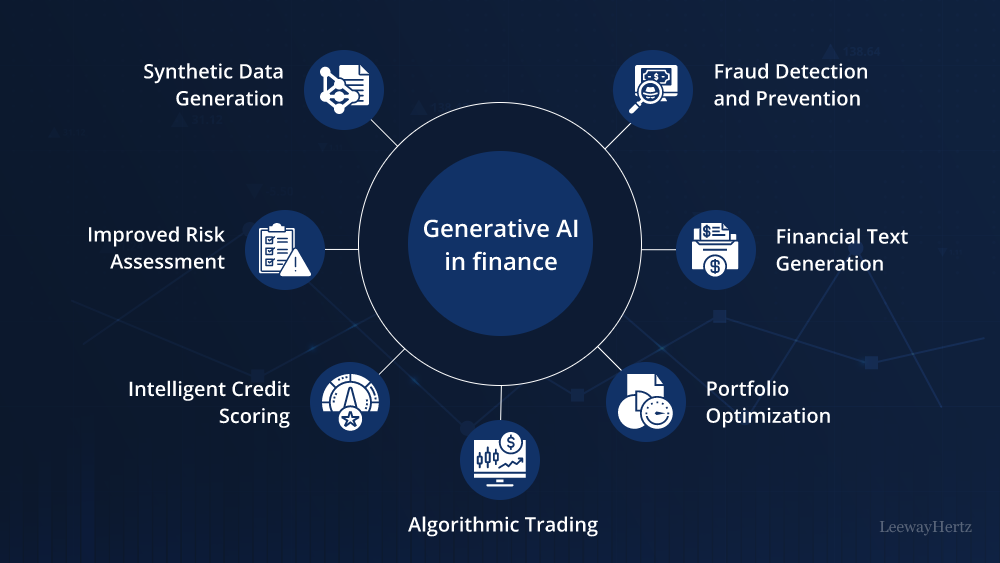

By the first quarter of 2023, big technology companies were integrating gen AI capabilities into their own products and offering programmatic access to generative models for business customers. Gen AI is making its mark in multiple industries, including credit risk.

Applications in Credit Risk

McKinsey recently surveyed senior credit risk executives from 24 financial institutions, including nine of the top ten US banks. Twenty percent of the respondents have already implemented at least one gen AI use case in their organizations, and a further 60 percent expect to do so within a year. Even the most cautious executives believe that gen AI will be part of their companies’ credit risk processes within two years.

Financial institutions are considering potential applications of gen AI across the full credit life cycle. In client engagement, gen AI might be used to offer customers hyperpersonalized product mixes based on their profiles and activity histories. Gen AI systems could support relationship managers by drafting individualized outreach communications, summarizing meetings, and suggesting next steps.

During credit decision and underwriting processes, gen AI tools could review documents, flag policy violations or missing data, and help compile information about customers and conduct credit analyses. Gen AI can streamline contracting processes and support portfolio monitoring by automating the creation of routine performance and risk reports.

In customer assistance processes, gen AI tools could draft personalized outreach communications to customers in the event of issues, identify suitable restructuring options, and coach the interactions of agents with customers.

Current State and Challenges

While gen AI has arrived in the credit risk world, it has yet to transform it completely. Executives acknowledge that scaling up the application of gen AI in credit risk will be challenging, with significant barriers concerning risk and governance. Data quality and model risk issues are among the top concerns for participants exploring gen AI applications in credit risk.

Financial institutions must move beyond today’s ad hoc approach and develop a common set of practices to prioritize, develop, deploy, maintain, and reuse gen AI applications in order to capture its full potential in credit risk.

Conclusion

Major credit risk players are embracing generative AI at speed. The technology has transformative potential, promising to improve efficiency, accuracy, and personalized services across the credit life cycle.