Bitcoin Price Prediction Ahead of June's FOMC Meeting

Bitcoin (BTC) has been trading in a tight range since February, currently at $69,370, with cryptocurrency traders eagerly awaiting the Federal Open Market Committee (FOMC) meeting on June 12 to set the Federal Reserve’s interest rate target. Historically, the FOMC meetings and interest rate decisions have significantly impacted Bitcoin‘s price.

ChatGPT-4o BTC Price Prediction

Finbold provided technical analysis and finance market projections context to ChatGPT-4o for a BTC price prediction ahead of June 12. Within this context, OpenAI's flagship artificial intelligence (AI) model predicts Bitcoin will trade between $68,000 and $73,000. However, a rate cut or hints of an upcoming cut could propel BTC above its range. ChatGPT-4o forecast places the leading cryptocurrency between $73,000 and $75,000 or beyond in this unlikely economic scenario.

Bitcoin's Trading Range

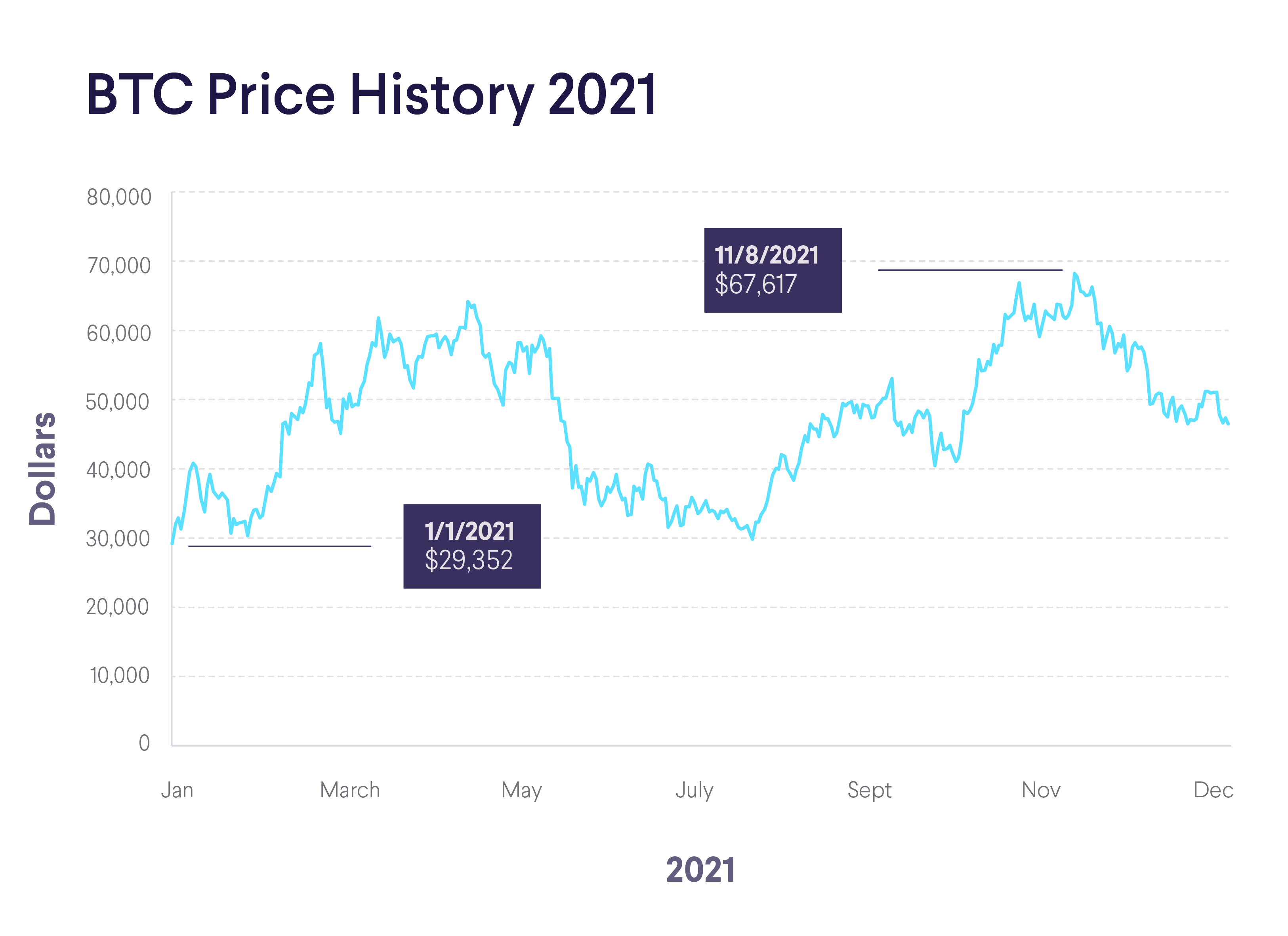

Notably, Bitcoin has been trading in a well-defined range since late February, from $60,000 to $72,000. These prices mark key support and resistance levels for Bitcoin traders and investors. During this time, BTC has made two brief deviations—of two days each—from the price range. One in mid-March made an all-time high at $73,805, and the other in early May flash-crashed to $56,590.

Market Expectations

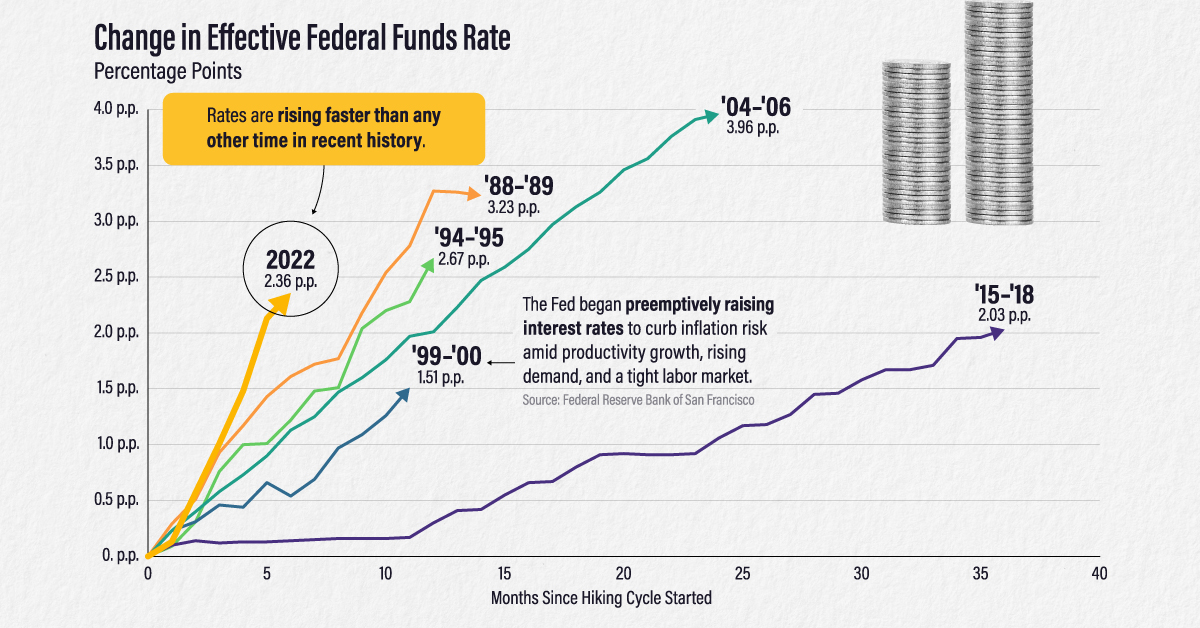

Recently, the deemed “digital gold” has kept a tighter range between $66,000 and $72,000. A prominent cryptocurrency trader believes these are ideal and high-risk entry points for BTC speculators, respectively. Interestingly, 97.8% of the finance market expects interest rates to remain uncut at 525-550 basis points (bps). On May 9, expectations were slightly less bearish, with 8.4% expecting a cut to 500-525 bps.

Economic Scenario Analysis

Furthermore, historical data evidences how the economic scenario changed in the last four months when Bitcoin entered its current range. In February, only 1.45% of the market expected June’s interest rates to remain at 525-550 bps. In April, the expectation ratio was 42% to 56% for 525-550 bps and 500-525 bps, respectively, and 2% for 475-500 bps for June’s FOMC meeting. Therefore, Bitcoin ranging could have had a direct influence from unchanged interest rate decisions from previous FOMC meetings.

Volatility Ahead of FOMC Meeting

In this context, June’s target could continue to have a major impact on BTC’s movements. Investors and traders must be cautious this week, as analysts expect high volatility ahead of the Federal Reserve meeting.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.