15 Transformative Use Cases of ChatGPT for Banks - MarkTechPost

ChatGPT, a sophisticated language model developed by OpenAI, is revolutionizing the banking industry by providing a diverse array of applications that enhance customer service, streamline internal processes, and support strategic decision-making. The integration of artificial intelligence in banking is positioning ChatGPT as an invaluable tool for bankers seeking to improve efficiency, reduce costs, and deliver an enhanced customer experience.

Virtual Assistance

One of the most prominent use cases of ChatGPT in banking is the provision of real-time virtual assistance to customers. ChatGPT-powered chatbots can address frequent inquiries, such as account balances, transaction histories, loan eligibility, and more, significantly reducing the need for human intervention. This 24/7 support capability enables banks to provide immediate responses to customer queries, thereby enhancing customer satisfaction and reducing response times.

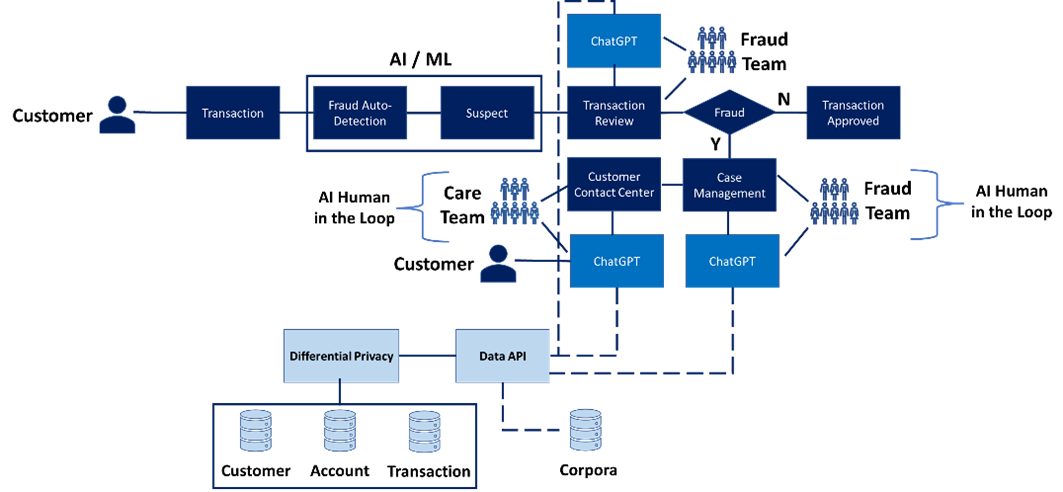

Fraud Detection

ChatGPT can aid in the detection of potential fraudulent activities by analyzing user behavior and identifying anomalies. While it does not replace existing fraud detection systems, ChatGPT serves as an effective assistant to analysts by summarizing suspicious activities, providing insights into potential fraud scenarios, and reducing investigation time, ultimately augmenting overall security measures.

Loan Assistance

The process of applying for a loan can be overwhelming for many customers. ChatGPT can guide users through each step, clarify required documentation, and answer inquiries related to interest rates, eligibility, or repayment schedules. By delivering personalized loan assistance, banks can enhance customer engagement and expedite the loan approval process.

Personalized Financial Advice

ChatGPT can analyze customer spending habits, savings objectives, and financial profiles to provide tailored financial advice. It can recommend savings plans, investment opportunities, and budgeting strategies that align with each customer’s needs, thereby enhancing the customer experience through the provision of value-added services beyond basic banking.

Internal Knowledge Base

Banking personnel frequently require access to information regarding products, policies, and regulations. ChatGPT can function as an internal knowledge base, providing staff with instant access to accurate information, thereby minimizing time spent searching for answers and increasing overall productivity.

Compliance Assistance

Banking regulations are inherently complex and subject to frequent updates. ChatGPT can assist compliance teams by summarizing regulatory documents, tracking policy changes, and generating compliance reports. This reduces the burden on legal teams and ensures that banks remain abreast of the latest regulatory requirements.

Credit Risk Assessment

ChatGPT can support credit risk assessment by extracting and summarizing pertinent customer data, thereby generating risk evaluation reports. It can assist credit officers in making well-informed decisions by providing insights into the creditworthiness of potential borrowers, leading to a more efficient underwriting process.