US Market Preview | US Inflation Concerns; Nvidia Slashes Chip Prices; Google, Meta AI Investment

As of 7:32 am EDT, stock futures were slightly higher on Friday, following the worst session in more than a year for the Dow Jones Industrial Average. Futures tied to the 30-stock Dow Jones Industrial Average(DJI.US) were up by 41 points, or 0.1%. S&P 500 index(SPX.US) futures and NASDAQ(IXIC.US) 100 futures added 0.3% each.

Barclays Predicts Prolonged Strong US Dollar Sell-off This Month

According to Barclays analysts, Erick Martinez and Sheryl Dong, a model suggests a significant, widespread sell-off of the USA dollar against major currencies will persist until month-end. This trend is encouraged by weaker USA data which boosted stocks and bonds, potentially leading investors towards dollar sales. The sentiment index indicates high but potentially peaking bullish sentiment on the dollar, hinting at an amplified sell-off trend in the near future with minimal data expected next week.

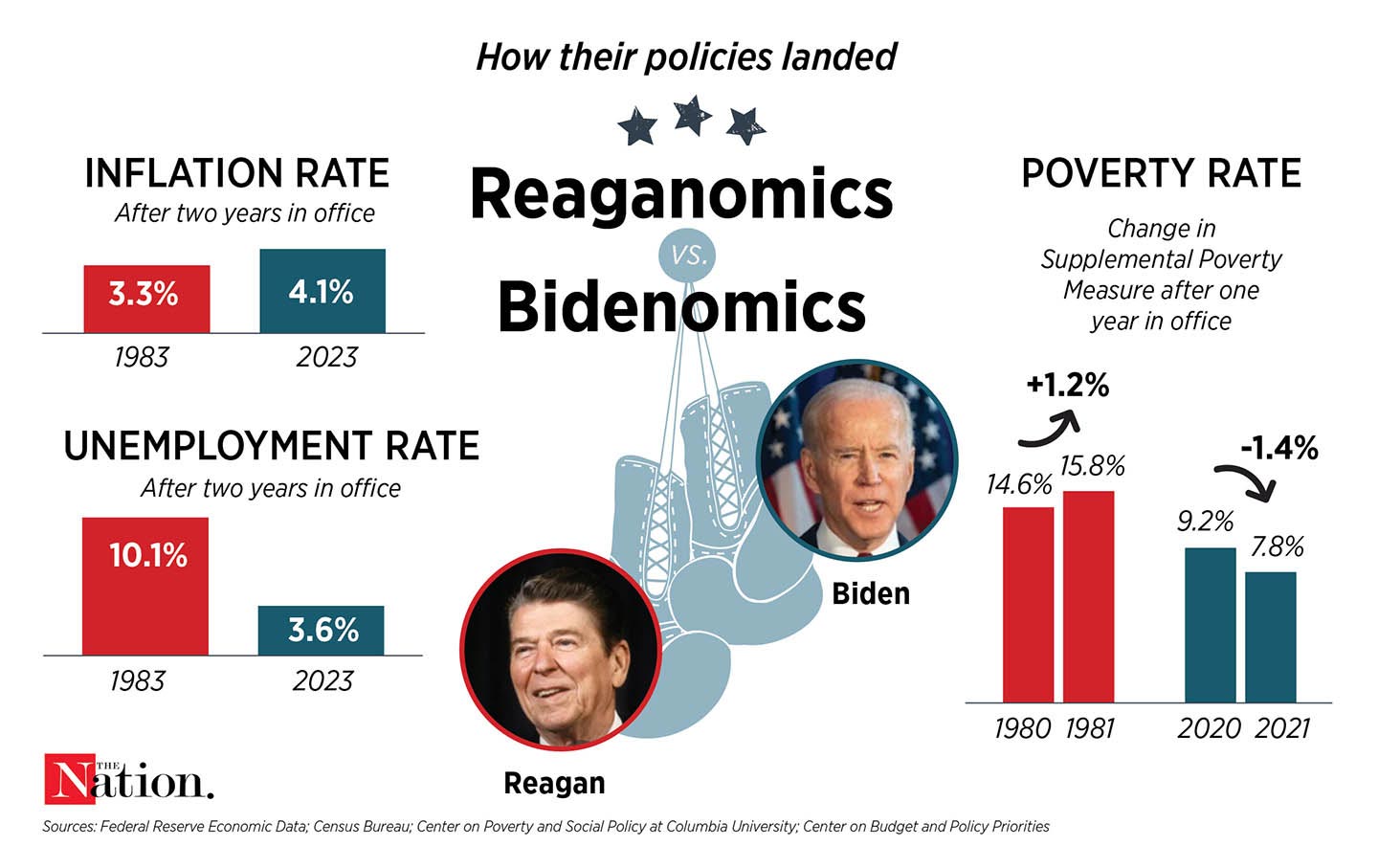

Yellen Cites Persistent Inflation Woes for USA Residents Ahead of Election

USA Treasury Secretary Janet Yellen has acknowledged that although wages have risen, the cost of necessities like housing remains high, causing distress for many Americans. With inflation up over 19% since President Biden's tenure began, polls indicate economic concerns are influencing voter sentiment ahead of the presidential election. Yellen defends Biden's efforts to tackle inflation, attributing the price surge to global factors and pandemic-related shortages despite a strong labor market and extensive fiscal stimulus.

Nvidia 'Bracing for Worst' as It Reportedly Cuts Prices of Flagship AI Chips in China Amid Huawei Competition

The price of NVIDIA Corporation(NVDA.US)’s H20 chip, designed specifically for the Chinese market, has been reduced due to an oversupply, Reuters reported on Friday, citing sources familiar with the matter. The H20 chip is now being sold at a discount of over 10% compared to Huawei’s Ascend 910B, the most powerful AI chip from a Chinese company.

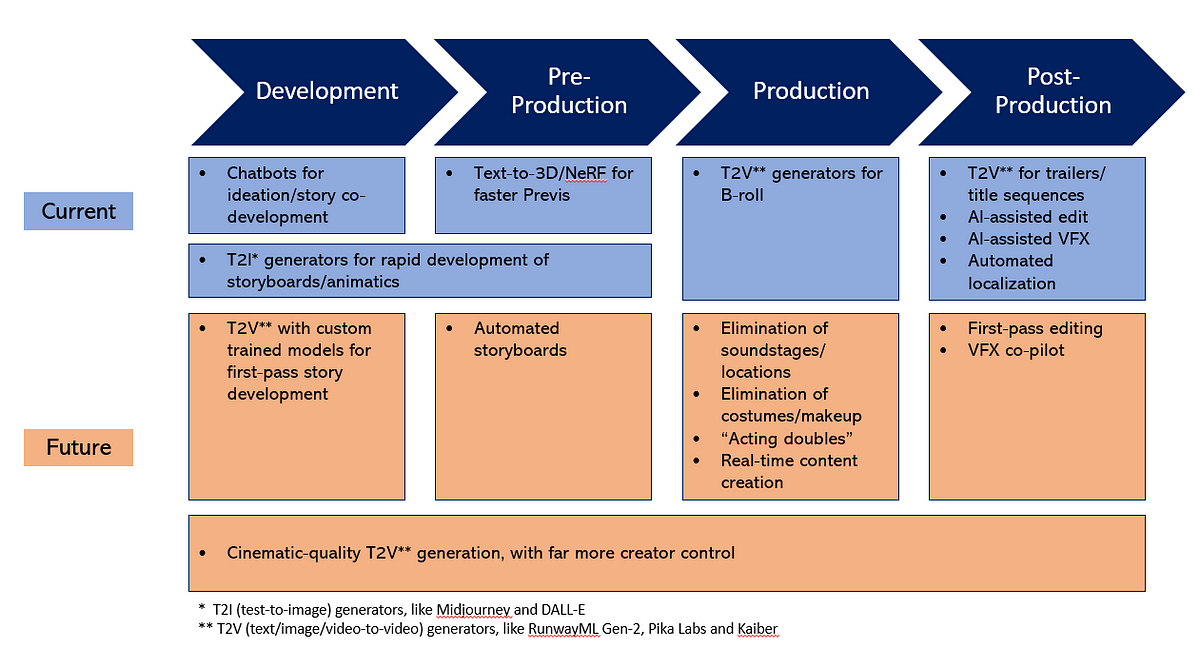

Google, Meta Offer Millions for AI-Hollywood Collaborations

Tech giants Alphabet Inc. Class C(GOOG.US) and Meta Platforms(META.US) are reportedly investing tens of millions to integrate AI technology that creates realistic scenes into the film industry, with Hollywood showing both interest in cost-cutting and concern over content control. Key players like News Corporation Class A(NWSA.US) have embraced long-term partnerships with OpenAI, while others like Warner Bros. are cautiously open to licensing content. The rise of AI tools in production has initiated industry conversations about regulation amidst fears of potential job losses.

Wedbush Raises Apple Price Target on AI-Driven iPhone 16 'Supercycle' Expectations Ahead of WWDC

Wedbush analyst Dan Ives has revised the price target for Apple Inc.(AAPL.US) from $250 to $275. The adjustment is to account for the anticipated iPhone 16 supercycle, driven by AI technology. This could potentially add $30 to $40 per share to the stock.