Analytical META Stock Predictions for 2024, 2025-2030, and Beyond

Meta Platforms, Inc., formerly known as Facebook, stands as a prominent technology company celebrated for its groundbreaking advancements in social media and virtual reality. This article delves into a comprehensive examination of Meta's stock performance, future analytical forecasts spanning from 2024 to 2030, and the potential factors that could shape its future valuation.

The Journey So Far

Originally founded as Facebook in 2004 by Mark Zuckerberg and his college peers, Meta Platforms, Inc. swiftly evolved from a college networking platform to a global social media titan. The company's historic initial public offering (IPO) on May 18, 2012, marked a significant milestone, with an IPO price of $38 per share. Despite early volatility and challenges, Facebook demonstrated remarkable growth, especially in the mobile advertising sector.

From 2016 to 2019, Meta experienced consistent stock price growth, with peaks and troughs driven by various factors such as user expansion and ad revenue. The company's rebranding to Meta Platforms, Inc. in October 2021 signalled a strategic shift towards the metaverse and immersive digital experiences.

2024: A Pivotal Year

As we navigate through 2024, several key trends and developments are expected to influence Meta's trajectory. Global economic projections indicate potential support for increased consumer spending, aligning with Meta's revenue streams. The company's substantial investments in virtual and augmented reality technologies are deemed essential for future growth, despite initial financial losses in these ventures.

Advertising revenue remains a vital pillar for Meta, driven by innovations in ad targeting and analytics. With a strong focus on user engagement metrics and the sustained growth of its core platforms, Meta is poised to maintain its market position amidst regulatory scrutiny and competitive pressures.

Looking Ahead to 2025

Analysts foresee a bullish outlook for Meta in 2025, underpinned by investments in artificial intelligence (AI) and the metaverse. Revenue growth projections and advancements in AI-powered ad delivery signal a positive trajectory for the company. Despite regulatory challenges and market competition, Meta's strategic initiatives and technological investments are deemed crucial for navigating potential obstacles.

Mid-Year 2025 and Beyond

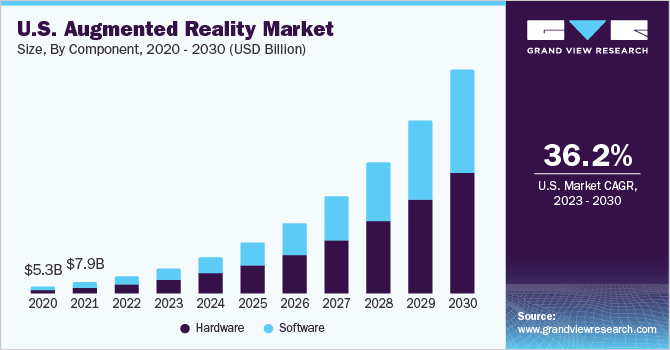

As we gaze towards the mid-year and beyond, Meta's foray into augmented reality (AR) and virtual reality (VR) landscapes presents significant growth opportunities. The company's long-term vision revolves around creating a fully immersive metaverse, powered by AI-driven innovations. By leveraging its vast user base and advertising capabilities, Meta aims to solidify its market standing amidst evolving market dynamics.

Analysts predict robust financial growth for Meta between 2026 and 2030, propelled by new revenue streams such as VR/AR hardware sales and digital commerce. Regulatory challenges and intense competition from tech rivals will continue to shape Meta's strategies, necessitating continuous innovation and compliance efforts.

Overall, Meta Platforms, Inc. is poised to navigate the evolving digital landscape, capitalising on technological advancements and user engagement to drive future growth and innovation.

To explore Meta’s price history and stock forecasts, visit FXOpen’s TickTrader platform.