Meta Earnings: Reports Illustrate Tech Giant's Financial Growth

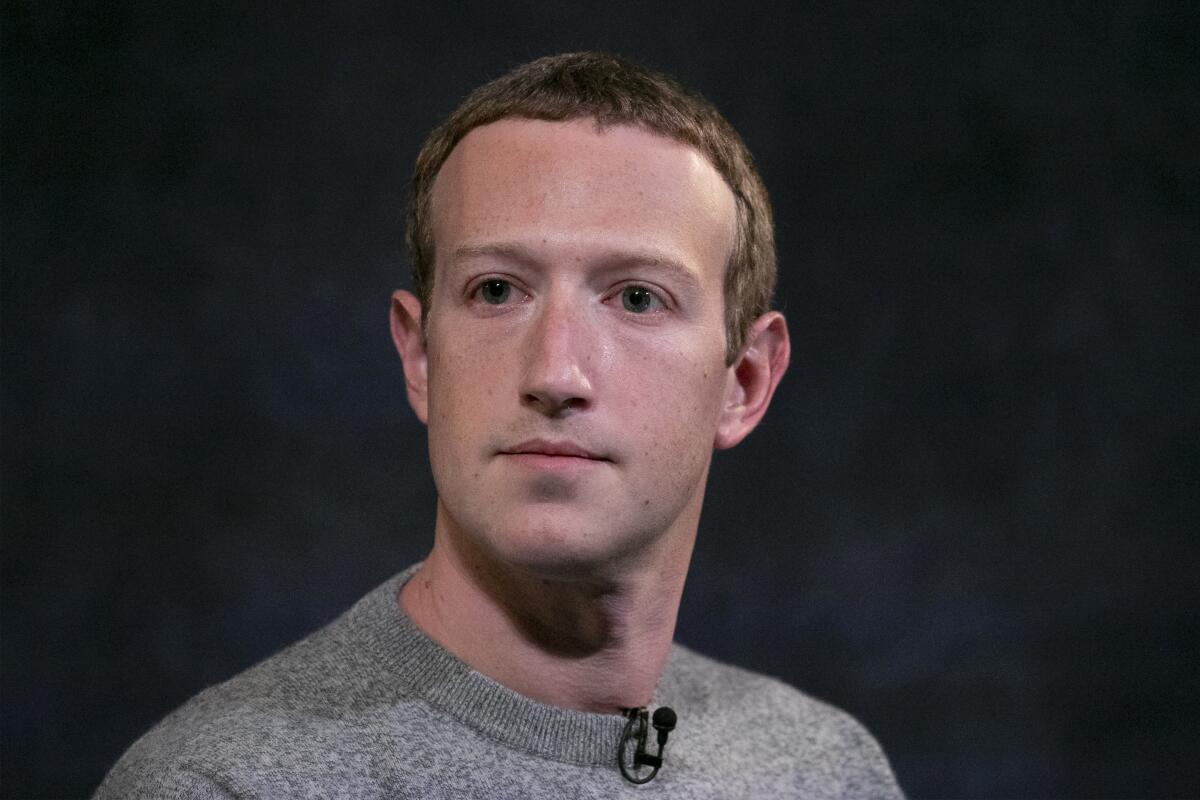

Meta Platforms, the Silicon Valley parent company of social media sites Facebook, Instagram, and Threads, the messaging app WhatsApp, and more, releases its earnings quarterly. CEO and chairman Mark Zuckerberg plays a leading role on these calls to report Meta's status to its shareholders. Meta's next earnings report is scheduled for April 30, 2025, after the market close. Here's a breakdown of Meta's recent earnings.

4th Quarter Results

Meta reported its fourth-quarter earnings on January 29 after the closing bell. The social media company crushed Wall Street's expectations. Meta tried to reassure investors about how much it's spending on artificial intelligence and about possible competition from Chinese AI company DeepSeek. The Facebook parent reported revenue for the period of $48.39 billion, beating the consensus analyst estimate of $46.98 billion.

While its first-quarter sales forecast came in below estimates, investors seemed more concerned about other matters. During Meta's earnings conference call, Zuckerberg fielded questions from analysts on the company's recent content moderation changes, its big spending plans for 2025, TikTok, and more. He teased Llama 4 news and said he was "optimistic" about "progress and innovation" under Donald Trump's government.

Zuckerberg also responded to a question about DeepSeek, saying it was important to have a domestic firm set the standard on open-source AI "for our own national advantage."

3rd Quarter Results

Meta reported its third-quarter earnings on October 30, 2024, after the market close. The company made it clear it would not be slowing down on its spending while building out its AI infrastructure this year — and expects those costs to increase in 2025. "We had a good quarter driven by AI progress across our apps and business," Zuckerberg said. "We also have strong momentum with Meta AI, Llama adoption, and AI-powered glasses."

The company's revenue for the quarter was $40.59 billion, ahead of the expected $40.25 billion. Earnings per share were in at $6.06, above the expected $5.25. In its core business of advertising, Meta said its average price per ad had increased 11% year over year. However, the company missed expectations for user growth. It said daily active users grew 5% year over year to 3.29 billion.

2nd Quarter Results

Meta reported second-quarter earnings on July 31, 2024, after the market close, and it was another win for Zuckerberg. The Facebook parent's revenue and earnings-per-share beat consensus analyst estimates, driven by better-than-expected advertising sales.

Like other tech giants, Meta has been heavily investing in generative AI with little to show for it so far, but Zuckerberg defended its spending plans in the earnings call. Zuckerberg also said in the earnings release that the company's chatbot, Meta AI, is on pace to become the most widely used in the world by the end of 2024.

1st Quarter Results

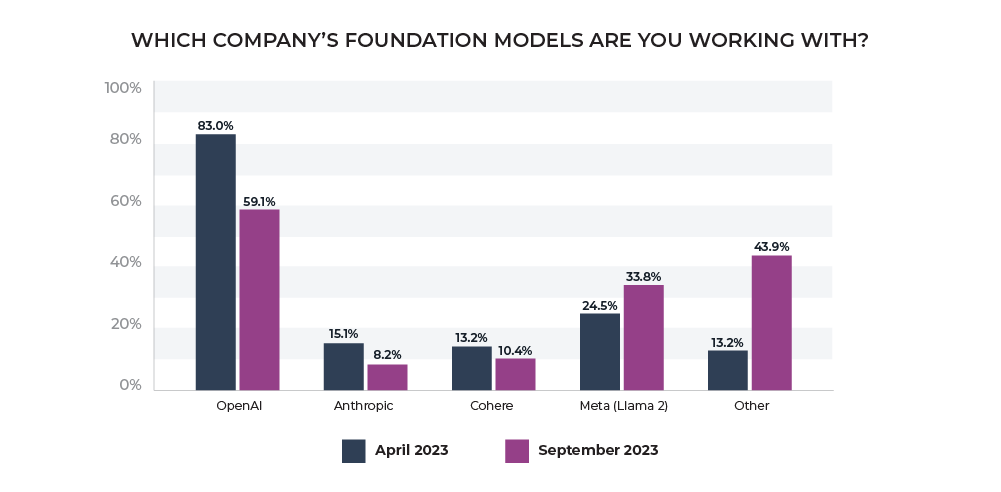

Meta's earnings are a chance for investors to hear from Zuckerberg himself. The founder and CEO tends to sprinkle in interesting snippets during earnings calls and has a front-row seat to the growing AI boom. Meta has shifted its focus recently from the Metaverse to AI-based large language models.

Meta's AI offering, Llama, is unique in that it is open-sourced, similar to China's DeepSeek. The company has also talked up the adoption of AI technologies into its ad network, which has shown solid results so far. An ongoing anti-trust lawsuit from the government has recently weighed on Meta.

If Meta proves unsuccessful in fighting the anti-trust lawsuit, it could lead to a break up of some aspects of its business.