Meta AI spending plans cause share price slump

Shares in Meta - the owner of Facebook, WhatsApp, and Instagram - experienced a sharp decline after the company revealed higher than expected spending on artificial intelligence (AI). Despite the tech giant reporting strong earnings figures, its shares dropped by more than 15% in after-hours trading in New York.

Increased AI Investment

Meta's CEO, Mark Zuckerberg, mentioned that it would take some time for the substantial AI investment to translate into increased revenues. The company also highlighted the growth of its X rival, Threads, which now boasts over 150 million monthly active users, putting pressure on competing platforms.

According to Mike Proulx from analysts Forrester, "Threads is well on its way to beating X by becoming the Twitter alternative users and advertisers are longing for."

Furthermore, Meta has been enhancing its ad-buying products with AI tools to drive earnings growth. The firm has been incorporating more AI features into its social media platforms, such as chat assistants, with plans to spend between $35bn and $40bn in 2024 on AI, up from the previous estimate of $30-$37bn.

Market Reaction

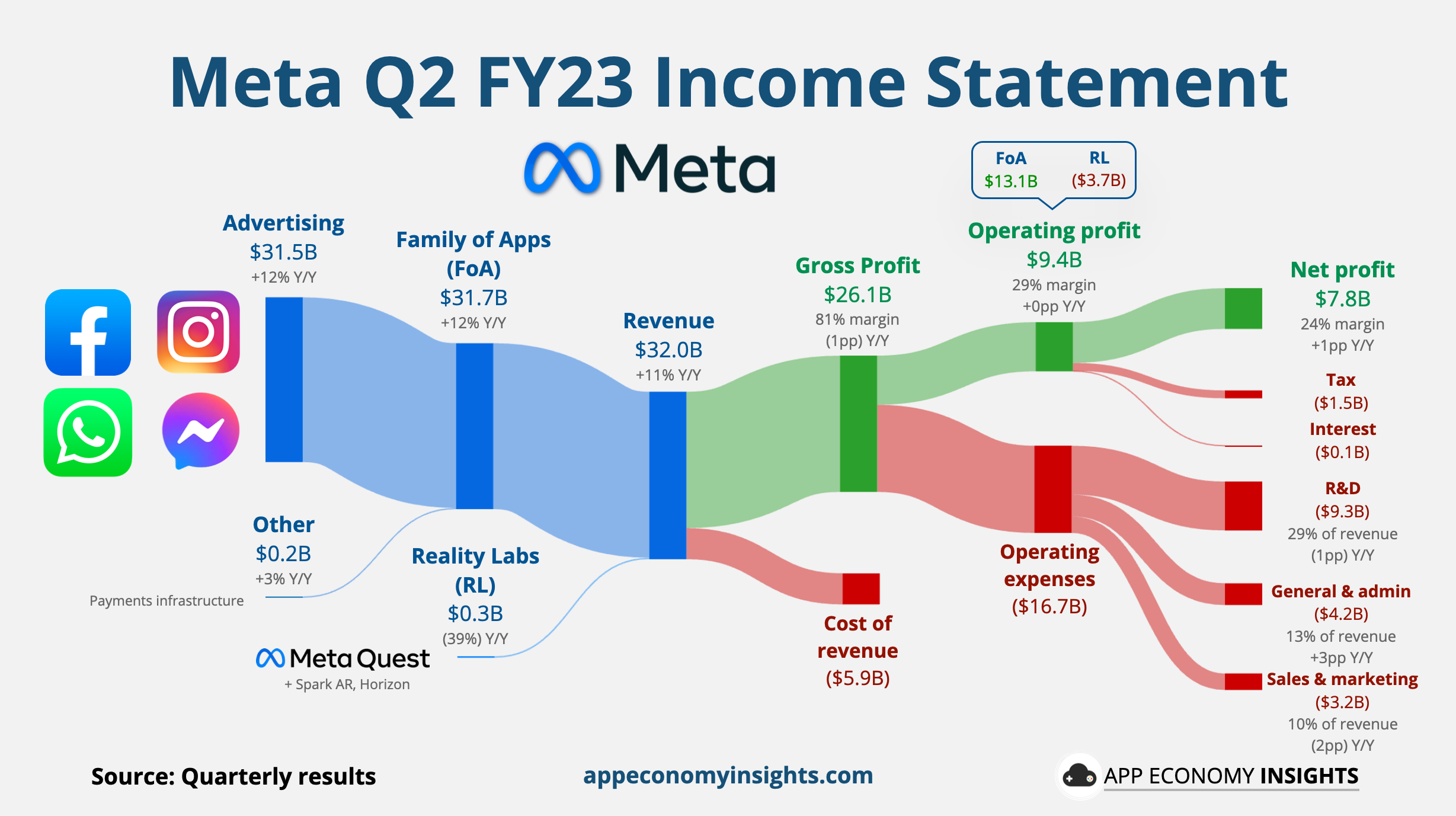

Despite the positive news on earnings, investors seemed more concerned about the increased spending on AI. First-quarter revenue saw a 27% increase to $36.46bn, slightly surpassing analysts' expectations.

Sophie Lund-Yates from Hargreaves Lansdown pointed out that Meta's significant investment in AI has been successful in engaging users on its platforms, leading advertisers to allocate more resources during a period of digital advertising uncertainty.

Despite beating estimates and doubling its Q1 net income to $12.37 billion, Meta's shares faced a 16% decline in after-hours trading, reflecting Wall Street's apprehension towards the company's AI investment strategy.

She also emphasized that with over 50 countries holding elections this year, the uncertainty could unsettle advertisers. Looking ahead, regulatory challenges remain a significant risk for Meta, following previous fines and criticisms.

Expert Analysis

Experts believe that Meta's intensified focus on AI technology could present monetizable opportunities, although concerns linger about its impact on the core digital advertising business. Elevation Partners Co-Founder, Roger McNamee, shared his perspective on the challenges of generative AI adoption within the tech industry.

For more insights on the latest market trends and expert analysis, you can click here.

Conclusion

Meta's ambitious plans to integrate AI across its products have impacted its financial outlook and share prices. The company's strategic shift towards AI technology raises both opportunities and challenges, as it navigates the evolving landscape of digital advertising and user engagement.