Meta Platforms Stock: Explaining The Growth Algorithm And Future Prospects

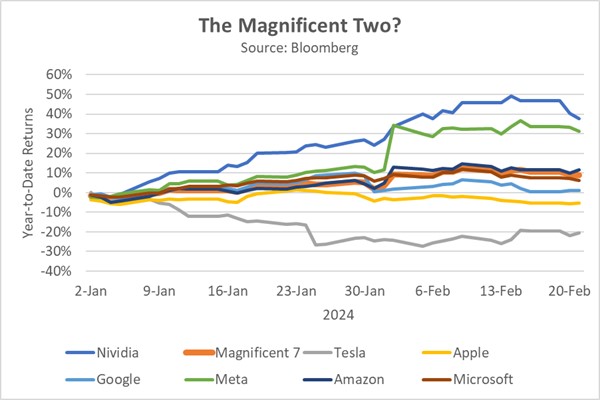

Meta (NASDAQ: META) has experienced a remarkable journey, with its shares surging nearly 5x from their 2022 trough. This growth has been fueled by a relentless commitment to efficiency, the tremendous success of Reels, and the establishment of best-in-class ad targeting capabilities in a post-ATT world.

Understanding Meta's Growth Algorithm

As Reels monetization reaches neutrality and competition stiffens, investors are once again examining Meta's trajectory. It is crucial to delve into Meta's intricate growth algorithm to comprehend why the company holds a promising future.

Following Apple's iOS update in April 2021, which introduced the App-Tracking-Transparency (ATT) framework, Meta was compelled to adapt to a probabilistic model for measuring return on ad spend. This transition required substantial investments in machine-learning algorithms, bolstering Meta's competitive position alongside Google in the digital advertising landscape.

With a superior advertising offering, Meta leads the industry in monetizing popular features such as Stories and Reels. Despite initial concerns about the impact of new features on monetization, Meta consistently optimizes user experience before integrating ads gradually.

Future Growth Prospects

Looking ahead, Meta's growth hinges on various factors, including sustained user growth, increased ad load, improved price per ad, new products like Threads and Meta AI, expanding digital advertising budgets, and the growth of WhatsApp Business. Despite undervaluation in current market assessments, Meta's growth potential remains substantial.

Consensus estimates for Meta's revenue growth in 2025 appear conservative, considering the company's innovative capabilities and wide moat. The current valuation, at 22 times CY25 earnings, presents an attractive opportunity for investors, with significant upside potential projected.

Meta's commitment to efficiency gains, enhanced engagement, and advancements in advertising capabilities position the company for sustained mid-teens growth. Even in a scenario where expenses escalate, Meta's long-term prospects remain compelling.

Therefore, reaffirming a Buy rating for Meta seems prudent, given the company's strong growth trajectory and undervalued market position.