Facebook's global ad revenue expected to exceed $100bn

Since its revival in 2022, Facebook's advertising revenue has been on the rise, with APAC advertisers targeting Western consumers. This revival can be attributed to the fruits of AI innovation and a shift towards outcomes-based targeting.

Alex Brownsell, head of content at Warc Media, highlights the latest trends in Facebook's advertising revenue and user behavior in comparison to its parent company Meta. The platform is making significant strides in capturing a new Gen Z audience.

Insights on Facebook's Challenges and Opportunities

Warc Media's Platform Insights report provides evidence-based insights on the challenges and opportunities that Facebook presents for advertisers. The report covers essential data points related to investment, consumption, and performance on the platform.

While Meta does not disclose revenue by platform, Warc Media's forecasts indicate that Facebook's ad revenue in Q3 2024 increased by 13.2% year-on-year, slightly slower than Meta's overall growth of 19.0%.

Facebook is projected to earn $100.1 billion in advertising revenue in the current year, with expectations to surpass $112.8 billion by 2026. This milestone would make Facebook the second media brand, after Google in 2020, to exceed $100 billion in global ad revenue.

Shifts in the Social Ad Market

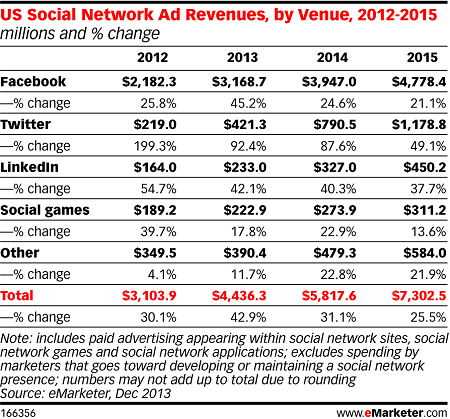

Despite its revenue growth, Facebook's share of the global social ad market is decreasing. In 2013, nearly 90% of social ad dollars were allocated to Facebook, but by 2025, this share is projected to drop to 38.2%. Platforms like Instagram and TikTok are rapidly gaining ground in this space.

Retailers are increasingly investing in AI and commerce on Facebook, with projected investments exceeding $20 billion in 2024. AI tools such as Advantage+ Shopping Campaign (ASC) have shown a 12% improvement in Return on Ad Spend (ROAS) over two years.

Global Advertising Trends

Asian brands are ramping up their advertising spend on Meta platforms, with a focus on targeting users in other regions. In the US, Facebook's ad spend is expected to reach $39.5 billion in 2024, marking an 11.6% year-on-year increase. Despite this growth, the pace is forecasted to slow in 2025 and 2026.

Instagram, on the other hand, is anticipated to achieve nearly 20% growth in the next two years. Facebook's advertising business remains significantly larger than the US OTT market and TikTok, capturing a significant share of US retailer spend.

Conclusion

Facebook continues to be a dominant force in the digital advertising landscape, attracting a vast global audience and offering robust advertising opportunities. With a strategic focus on AI innovation and outcome-driven campaigns, the platform is poised for continued growth in the coming years.