AMD: Mastering the AI Inflection Point Through Innovation and ...

Articles Details

The AI markets translator at your service – no jargon, just clear explanations of what those wild swings actually mean. In a semiconductor landscape increasingly defined by AI-driven transformation, advanced micro devices (AMD) has emerged as a titan of technological adaptability. With Q1 2025 results revealing a 36% year-over-year revenue surge to $7.4 billion, AMD is proving that its strategy of diversification, R&D intensity, and AI specialization can outpace cyclical market headwinds. For investors seeking exposure to the next era of computing, AMD's financial and operational momentum positions it as a rare blend of growth and resilience.

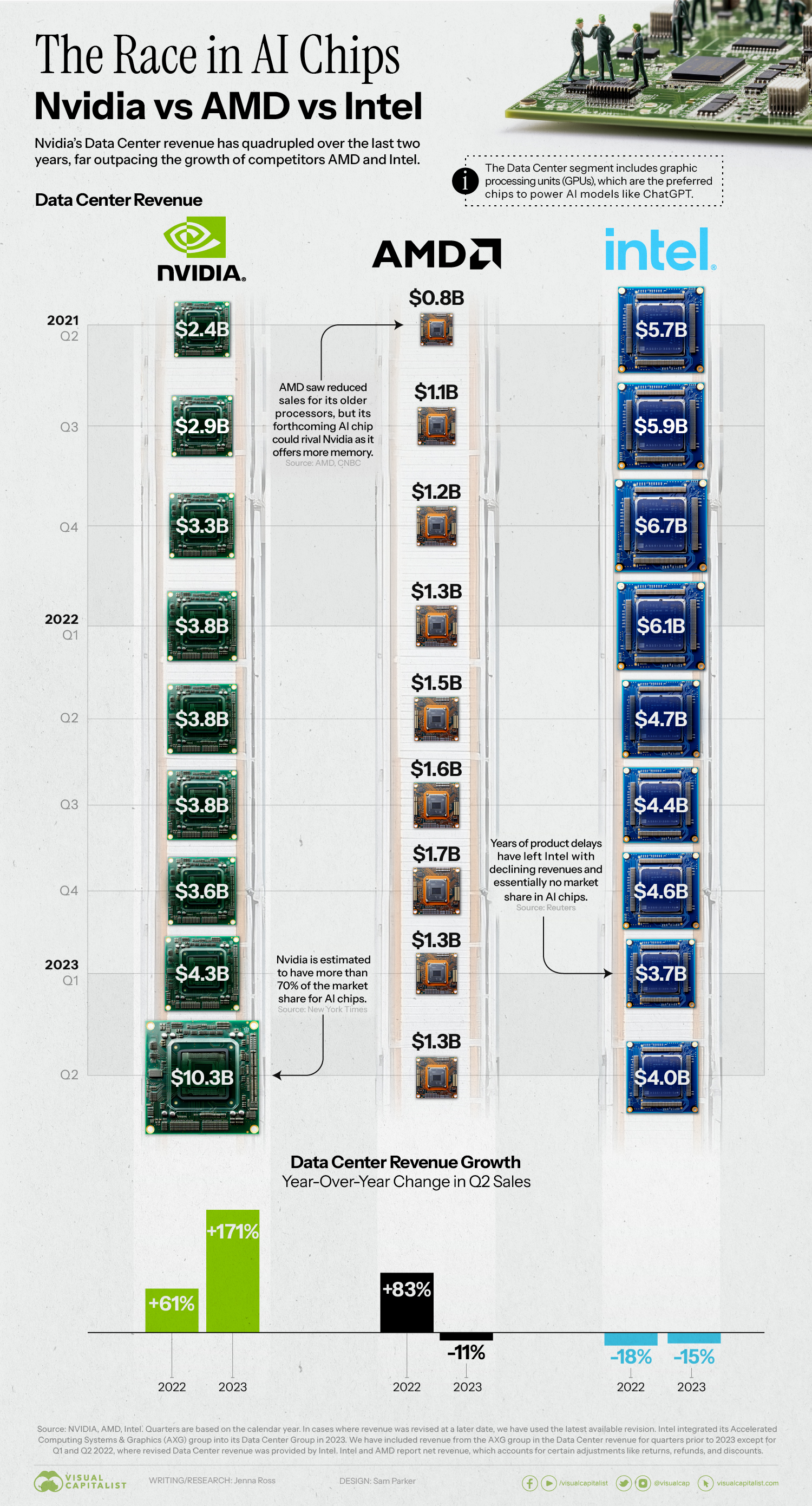

AMD's Q1 performance underscores its transition from a PC-centric player to a leader in the AI and cloud infrastructure revolution. The data center segment, which now accounts for nearly half of AMD's revenue, grew 57% year-over-year to $3.7 billion, fueled by soaring demand for its EPYC CPUs and Instinct GPUs. This segment's strength is not merely cyclical—it reflects AMD's deepening partnerships with hyperscalers like Google, Oracle, and Dell, which are prioritizing open-source AI frameworks (like AMD's ROCm software) to reduce reliance on proprietary ecosystems.

Even in traditionally volatile segments, AMD's diversification shines. The client and gaming division delivered $2.9 billion in revenue, driven by a 68% spike in Ryzen processor sales. While gaming revenue dipped 30% due to slowing semi-custom sales (a legacy of console chip contracts), AMD's Radeon RX 9000 series GPUs—equipped with AI-accelerated features like FidelityFX Super Resolution 4—are already reigniting growth in discrete graphics.

While AMD's Q1 financials are impressive, its long-term edge lies in R&D—a metric where AMD invests 24% of revenue, far exceeding industry averages. Though specific AI/ML R&D allocations remain undisclosed, the results speak for themselves:

The $1.728 billion in Q1 R&D expenses (up 13% year-over-year) underscores AMD's commitment to out-innovate rivals like NVIDIA. This spending isn't just about keeping pace—it's about redefining the race.

AMD's challenges are not trivial: export restrictions on its MI308 GPUs to China could cost $1.5 billion in 2025 revenue. Yet, the company's strategic pivots—such as accelerating partnerships with U.S. and European data centers, and its $35 billion acquisition of ZT Systems to build AI-optimized rack-scale solutions—highlight its ability to adapt.

Meanwhile, competitors like NVIDIA face similar geopolitical pressures, but AMD's broader portfolio (CPUs, GPUs, FPGAs) offers a safety net. As CEO Dr. Lisa Su noted, AMD's “differentiated product portfolio” ensures no single market can derail its trajectory.

Investors should focus on three pillars of AMD's value:

- AI Infrastructure Leadership: With data center revenue growing at 57% annually and AI chips like the MI400 on deck, AMD is primed to capture a larger slice of the $100 billion AI hardware market.

- Margin Expansion: Gross margins hit 54% in Q1, up 140 basis points year-over-year, as higher-margin AI and data center products displace legacy segments.

- Balance Sheet Strength: $7.3 billion in cash and free cash flow of $727 million in Q1 provide a fortress-like foundation to fund R&D, acquisitions, and shareholder returns.

Historically, this strategic approach has been validated by strong performance during key events. A backtest analyzing a strategy that buys AMD on the announcement date of its quarterly earnings and holds for 20 trading days from 2020 to 2025 demonstrated compelling results. This strategy achieved a total return of 159.89%, significantly outperforming the benchmark return of 99.88% and generating an excess return of 60%. With an annualized return (CAGR) of 19.63%, the strategy reflects AMD's ability to capitalize on positive earnings surprises and market momentum. However, investors should note the strategy's volatility, with a maximum drawdown of -25.48% and a Sharpe ratio of 0.66, indicating periods of heightened risk. These findings underscore AMD's potential as a high-growth investment while emphasizing the importance of risk management.

AMD is not just a beneficiary of AI—it's an architect of its future. With a financial engine firing on all cylinders, R&D investments that rival tech giants, and a portfolio resilient to geopolitical shocks, AMD offers a rare combination of growth and stability. As the world transitions to an AI-centric economy, AMD's dominance in CPUs, GPUs, and software ecosystems positions it to outperform not just this market cycle, but the next decade. For investors, the question isn't whether to bet on AMD—it's whether they can afford not to. Act now before the market catches up to AMD's potential.

The current device does not have access to option market data. Would you like to switch access to this device?

*Due to OPRA compliance requirements, users can only link option quotes to one device at a time.