DeepSeek's AI disruption – what it means for Investors - Tim Davies ...

Large learning models (LLMs) are a type of AI program that can recognize and generate text. An LLM is essentially a computer program that uses machine learning, a practice that involves feeding a program an enormous volume of data that enables it to recognize and interpret human languages or other types of complex data without human intervention [i].

Current Use Cases

LLM's are currently being used in the following broad functions. Despite the fanfare surrounding AI disruption, the use cases for LLM models within business operations remain low, primarily due to their early-stage development. However, a shift by developers to create smaller, task-centric reasoning models is expected to rapidly expand their implementation over the next 5 years.

On 20th January 2025, a relatively unknown Chinese AI software developer called DeepSeek released their latest AI reasoning model called R1. It quickly became the most downloaded app on the Apple Store, after independent assessments of R1’s capabilities showed results like the much larger LLM models like Chat-GPT4. [ii]

Market Impact

Within a week of DeepSeek’s R1 launch, the US Nasdaq market fell by 3.5% on January 28th, while some of the world’s leading technology hardware companies, including Nvidia, Broadcom, SK Hynix, and ARM Holdings, fell by 10-20% in a single trading session. The selloff of technology hardware companies resulted from information contained in DeepSeek’s R1 model white paper, released on 20th January. In this report [iii], DeepSeek stated that R1 had revolutionary capabilities.

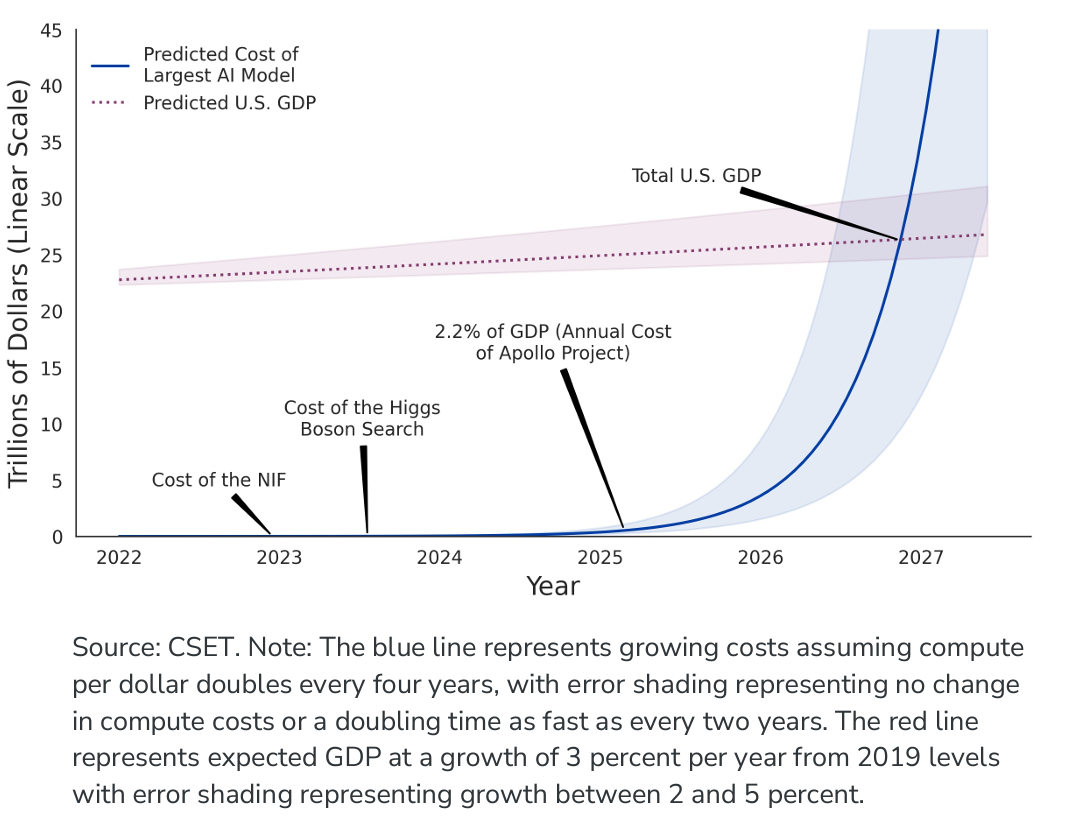

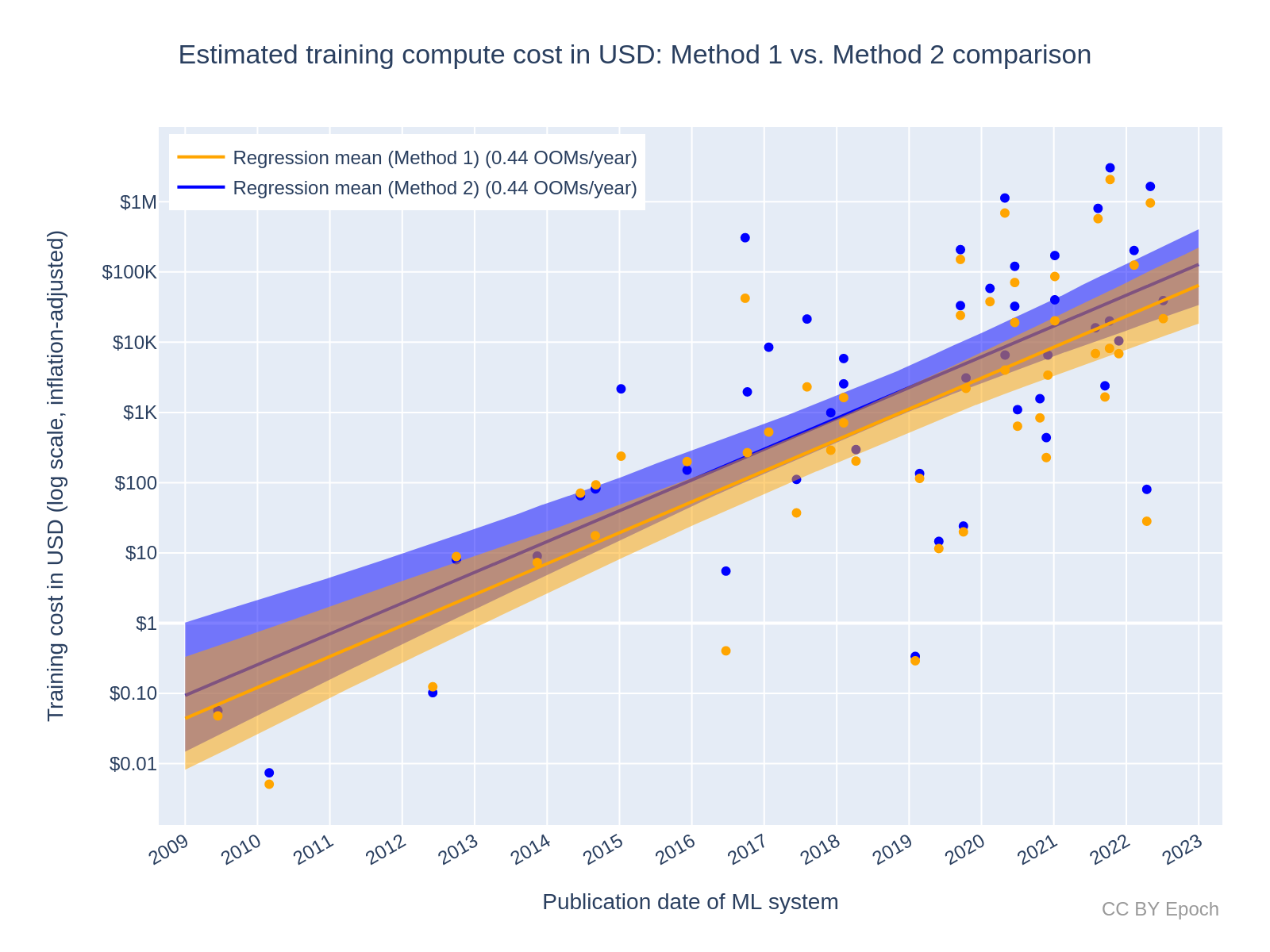

This white paper suggested that DeepSeek had reinvented AI training at a substantially lower cost, both in terms of computer hardware requirements and model development [iv][v].

Investment Insights

Did this mean that demand for specialized chips like NVIDIA GPUs would be substantially lower than current expectations? DeepSeek was started in 2021 by High-Flyer, a mainland Chinese hedge fund that was an early adopter of AI in its trading strategies. Over the past 4 years, High-Flyer has invested significantly in AI technologies.

Now that the dust has settled after the market collapse on January 28th, substantial evidence has emerged that raises serious doubts about the validity of DeepSeek’s claimed achievements.

If we consider performance, DeepSeek’s R1 achieving comparable reasoning outcomes as the much larger OpenAI model (GPT-4 and o-1) is most likely a function of the rapid improvements being achieved with newer AI reasoning algorithms undergoing model training.

The world of AI is challenging for most investors to understand, given its rapid pace and early stage of development. Market leadership remains unknown, evidenced by the enormous stock market reaction to new, much smaller competitors like DeepSeek that may challenge the larger US tech giants operating in the space.

Future Outlook

All of this suggests that investors could consider exposure to the leading technology hardware supply chain companies, given the likely direction of future demand growth. While DeepSeek’s launch caused a market selloff, the recovery in most technology share prices back towards previous highs suggests its impact will be muted on long-term demand.

At Carrara, we are closely monitoring the evolving landscape of artificial intelligence and its implications for global markets. If you would like to discuss how our thematic investment approach is considering developments in AI technologies, or if you are interested in learning more about our strategies in this sector, please don’t hesitate to contact us for further information.