AI Spending Dominated Big Tech Earnings. Why These 2 Stocks Got ...

One brief moment on Wednesday night summarized the current sentiment around Big Tech stocks. Microsoft had reported stellar earnings, and shares were higher in after-hours trading. Then, Chief Financial Officer Amy Hood said on the company’s earnings call that capital expenditures would continue to head higher. In a matter of minutes, shares were down 4%. That move encapsulates the general message from Big Tech earnings this past week. The large expenses related to artificial intelligence will continue, and investors remain skittish about it.

Microsoft's Success and Capital Expenditures

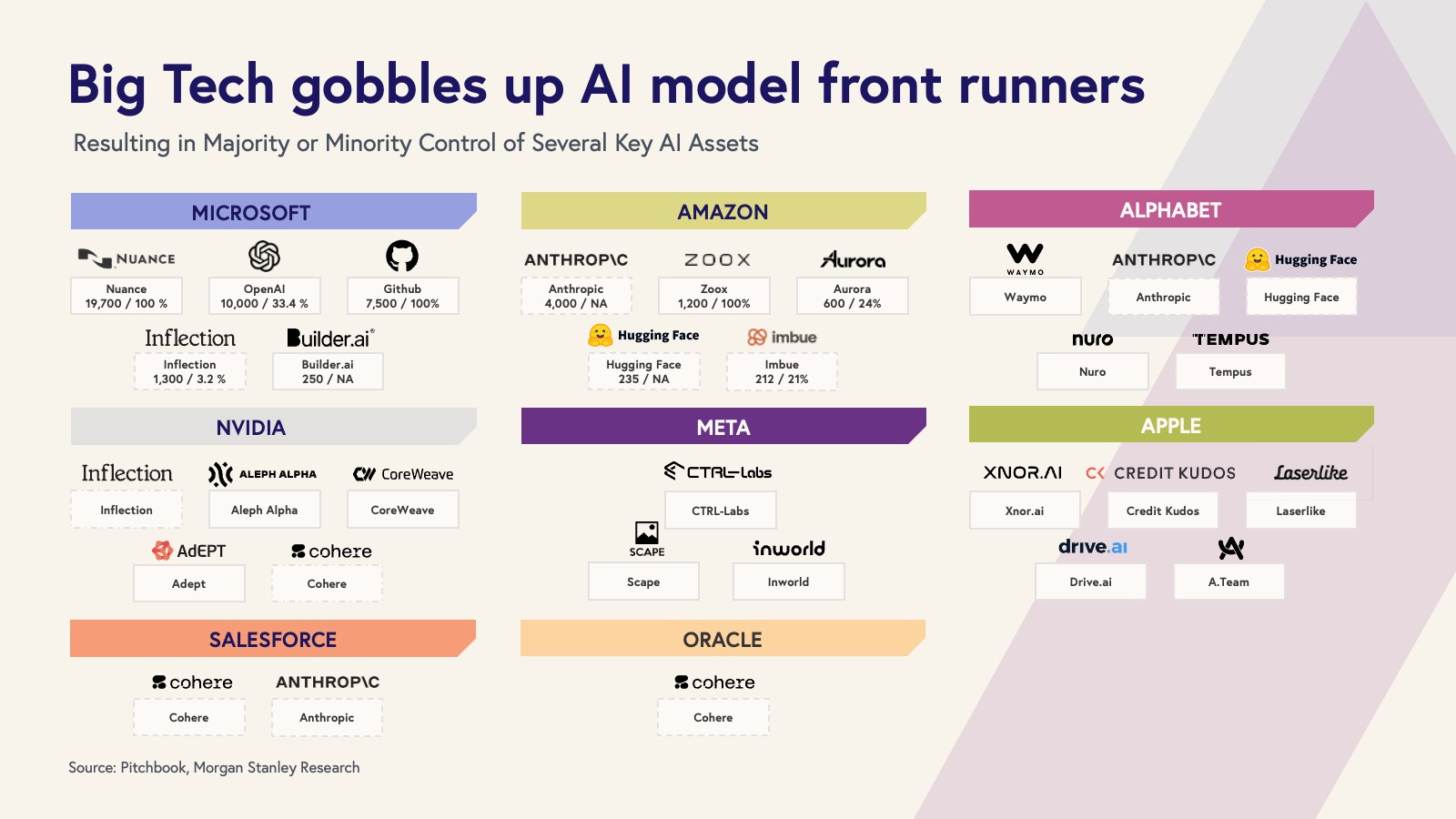

Microsoft, Alphabet, Meta Platforms, Amazon.com, and Apple all delivered impressive results in their latest quarter, with revenue beats across the board. However, the focus remains on the massive spending bills that they continue to rack up, especially in the realm of artificial intelligence.

Microsoft’s capital expenditures were $20 billion in its fiscal first quarter, up 79% on the year and 203% over two years. The spending is primarily for the AI buildout in its rentable cloud computing platform known as Azure. Despite the heavy spending, Microsoft remains optimistic, drawing parallels to its successful cloud transitions from over a decade ago.

Meta Platforms and AI Investments

Investors had a similar reaction to results from Meta Platforms, where the company sees no choice but to invest heavily in infrastructure and talent to accelerate its progress. Meta's AI initiatives, including the large-language model Llama and the Meta AI platform with 500 million monthly users, show promise but have yet to materialize into significant revenue.

Google, Amazon, and Continued Spending

Google parent Alphabet and Amazon.com also reported substantial capex increases with promises for more elevated spending next year. Google's focus on Google Cloud and the surprising strength in search advertising and YouTube led to a positive market reaction, while Amazon's growth in its ad business and AWS cloud segment boosted its stock price.

Apple's Unique Approach to AI

Apple has taken a different approach by staying out of the AI arms race and focusing on leveraging its large user base and unique ecosystem. The company's capex spending remains relatively flat, and it manages expenses by using its own chips and rented servers from other tech giants.

Challenges Beyond AI

While AI dominates the discussion, Big Tech companies face challenges in other segments as well. Microsoft's integration of Activision, Meta's losses in Reality Labs, Google's investments in Other Bets, Amazon's struggles with Alexa devices, and Apple's muted sales of Vision Pro highlight the varied landscape of tech investments.

Despite the heavy spending, these companies have robust balance sheets and cash flows. However, the investments do impact how much they can return to shareholders in the form of buybacks and dividends, highlighting the balance between innovation and shareholder returns in the Big Tech sector.