Best balanced advantage funds or dynamic asset allocation funds to ...

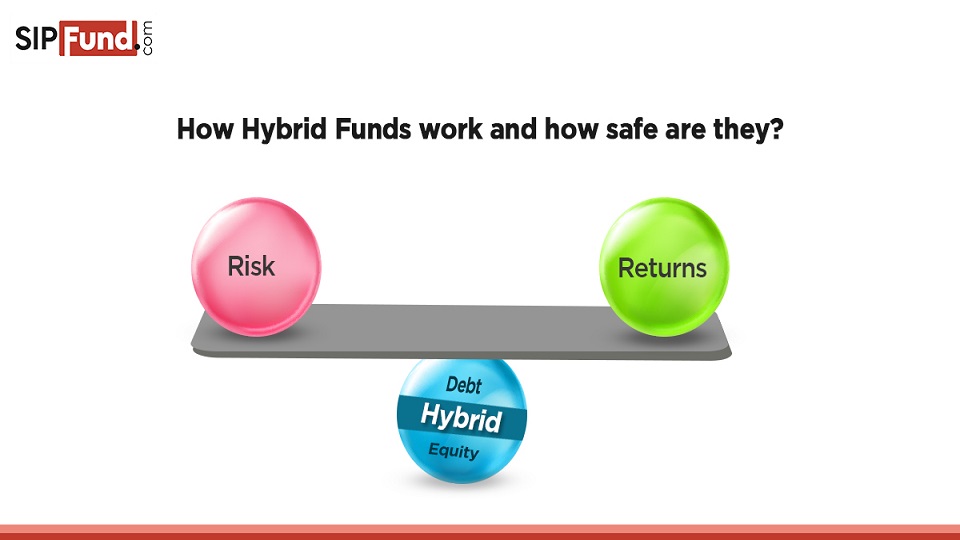

When it comes to investing in mutual funds, balanced advantage funds or dynamic asset allocation funds are popular choices among investors. These types of funds offer a mix of equity and debt instruments, providing a balanced approach to investment.

Top Tax Saving Mutual Funds

If you are looking to save on taxes while investing, consider exploring the top tax saving mutual funds. These funds offer tax benefits under Section 80C of the Income Tax Act, making them a popular choice among investors.

Better Than Fixed Deposits

Compared to traditional fixed deposits, balanced advantage funds and dynamic asset allocation funds have the potential to offer higher returns over the long term. They also provide diversification benefits, reducing overall portfolio risk.

Low Cost High Return Funds

Investors looking for low-cost investment options with the potential for high returns may find balanced advantage funds and dynamic asset allocation funds attractive. These funds typically have lower expense ratios compared to actively managed funds.

Best Hybrid Funds

Hybrid funds, which include balanced advantage funds, offer a mix of equity and debt investments. This hybrid approach can help investors achieve diversification while potentially benefiting from both asset classes' performance.

Best Large Cap Funds

For investors seeking exposure to large-cap stocks, balanced advantage funds can be a good option. These funds typically invest a significant portion of their assets in well-established companies with a track record of stable performance.

SIP’s starting Rs. 500

Systematic Investment Plans (SIPs) starting from Rs. 500 are a convenient way for investors to regularly invest in balanced advantage funds or dynamic asset allocation funds. SIPs help in rupee-cost averaging and can potentially reduce the impact of market volatility.

Top Performing Mid Caps

Investors looking to tap into the growth potential of mid-cap stocks can consider investing in balanced advantage funds that have exposure to these segments of the market. Mid-cap stocks have the potential for high growth but also come with higher risk.

Promising Multi Cap Funds

Multi-cap funds, which invest across companies of different market capitalizations, can offer a well-rounded portfolio. Balanced advantage funds with a multi-cap approach provide investors with the flexibility to navigate various market conditions.

Top Rated Funds

When selecting balanced advantage funds or dynamic asset allocation funds, it is essential to consider factors such as fund performance, risk profile, and expense ratio. Top-rated funds are evaluated based on these criteria to help investors make informed decisions.

Top Performing Index Funds

Index funds are another popular investment option for investors seeking diversified exposure to the market. While balanced advantage funds may not replicate a specific index, they follow a disciplined approach to asset allocation based on market conditions.

Stock Radar: 120% in a year!

Keeping track of market trends and stock performance is crucial for investors. Balanced advantage funds with a keen focus on market analysis and stock selection can capitalize on trends and opportunities, potentially delivering impressive returns.

Stay informed about Mutual Fund News, Breaking News, Budget 2024 Events, and Latest News Updates on The Economic Times. Subscribe to The Economic Times Prime and read the ET ePaper online for the latest financial news and insights.