Does META's Expanding AI Prowess Make the Stock Worth Buying?

Meta Platforms (META) has been utilizing artificial intelligence (AI) and machine learning to enhance the effectiveness of its social media platforms, which include WhatsApp, Instagram, Facebook, and Threads.

The rapid adoption of Generative AI (GenAI) is revolutionizing conversational messaging platforms like WhatsApp by enabling conversational commerce, such as ride-hailing and grocery purchases. META is integrating AI tools into WhatsApp to make businesses more customer-centric.

The rapid adoption of Generative AI (GenAI) is revolutionizing conversational messaging platforms like WhatsApp by enabling conversational commerce, such as ride-hailing and grocery purchases. META is integrating AI tools into WhatsApp to make businesses more customer-centric.

Transforming Customer Experience with AI

The incorporation of AI tools will empower businesses to assist customers in discovering new products. META is training AI to help businesses quickly address the most common inquiries they receive from customers on WhatsApp. This AI integration will also aid businesses in creating advertisements on Facebook and Instagram.

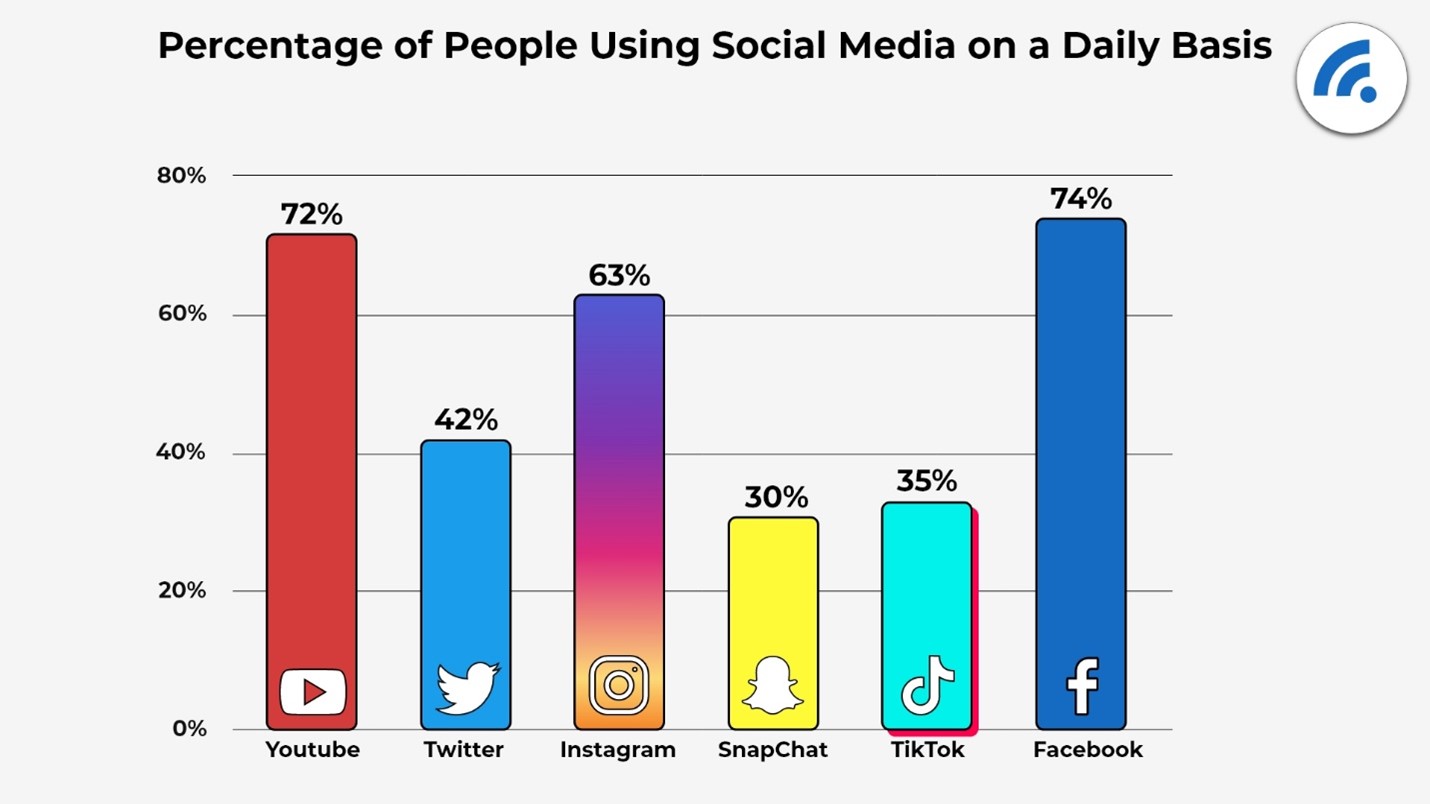

META Platforms is harnessing AI to enhance the appeal of Facebook among young adults, a demographic that gravitates towards Alphabet's (GOOGL) YouTube and Snap's (SNAP) Snapchat.

Social Media Landscape

According to Statista, platforms like Snapchat, TikTok, and Instagram are the most widely used social media platforms among 18-29-year-old users. A Pew Research study from 2023 revealed that YouTube was the most popular social media platform among U.S. teenagers, followed by TikTok, Snapchat, and Instagram.

According to Statista, platforms like Snapchat, TikTok, and Instagram are the most widely used social media platforms among 18-29-year-old users. A Pew Research study from 2023 revealed that YouTube was the most popular social media platform among U.S. teenagers, followed by TikTok, Snapchat, and Instagram.

Despite regulatory challenges, META Platforms' shares have outperformed both Alphabet and Snap, with a 39.5% return year-to-date.

AI Innovation and Development

META is continuously advancing its AI capabilities with initiatives like Meta Llama, which offers Facebook users more interactive and personalized experiences. Approximately 30% of the content on Facebook's feed is delivered through META Platforms' AI recommendation system.

The company is actively developing various AI services, including Meta AI, creator AI, and business AI, alongside internal coding and development AIs. META AI is currently powered by its latest model, Llama 3.

The company is actively developing various AI services, including Meta AI, creator AI, and business AI, alongside internal coding and development AIs. META AI is currently powered by its latest model, Llama 3.

Future Prospects and Concerns

While META Platforms' focus on AI bodes well for its long-term prospects, increased investments in AI infrastructure development are expected to impact top-line growth and margins in the near term. The company anticipates significant investments in developing more advanced AI models and services in the coming years.

However, regulatory hurdles and privacy concerns pose challenges for META's future. The company's recent changes to its European privacy policy and potential antitrust issues related to AI usage have raised scrutiny.

Financial Outlook and Valuation

Full-year 2024 expenses for META Platforms are projected to increase due to higher infrastructure and legal costs. The company's capital expenditures are also expected to rise to fuel AI research and product development efforts.

The Zacks Consensus Estimate for 2024 indicates growth in both revenues and earnings for META Platforms. However, the company's current valuation at a forward 12-month P/E of 7.46X raises valuation concerns compared to industry benchmarks.

Investors are advised to wait for a better entry point considering META Platforms' current Zacks Rank #3 (Hold).

For more details, you can access the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.