Vanguard's S&P 500 ETF Will Thrive After The AI Party Ends ...

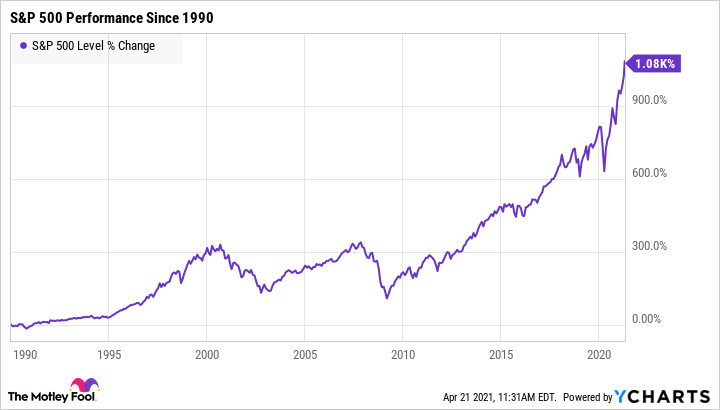

The Vanguard S&P 500 ETF (NYSEARCA:VOO) is a fundamental component of many investment portfolios, including my own. As an investor who acquired a substantial stake in VOO during the tumultuous period of the March 2020 market crash, I have reaped significant benefits. With a remarkable 70% growth in value and consistent dividend payouts, VOO has proven to be a reliable and profitable investment choice.

Investors looking for diversified exposure to the market often turn to index funds like VOO due to the unparalleled diversification they offer. Recreating a portfolio mirroring the S&P 500 index with individual stocks would incur substantial costs, especially with trading fees factored in. In contrast, VOO provides access to the entire index with a minimal management fee of 0.04%, making it a cost-effective and efficient investment vehicle.

The Influence of Generative AI on S&P 500

Over the past few years, the S&P 500 has reaped the rewards of increased investments in generative AI technologies. Despite fluctuations in the treasury yield, the S&P 500 exhibited resilience and growth attributed to the advancements in generative AI. Leading AI-centric companies like NVIDIA (NVDA), Alphabet (GOOG), and Microsoft (MSFT) experienced significant gains during this period, either through direct profits from AI operations or through investor expectations.

Investing in VOO presents a strategic opportunity to capitalize on the ongoing generative AI trend. As AI continues to shape various industries and drive economic growth, integrating VOO into a portfolio can be a prudent long-term investment decision.

Challenges and Opportunities in the AI Landscape

While the potential of AI to enhance productivity and drive economic expansion is evident, there are concerns regarding valuation levels and the commoditization of AI products. The current valuation of AI stocks, including NVIDIA, reflects high growth expectations, raising questions about sustainability and profitability.

Despite these challenges, the demand for generative AI solutions remains robust, indicating a lasting trend with profound implications for various sectors. VOO's diversified holdings, including significant weights in non-tech sectors like financials, healthcare, and consumer cyclicals, offer a balanced exposure to the market dynamics influenced by AI advancements.

Diversification Benefits Beyond Tech Stocks

VOO's allocation to non-tech sectors mitigates the risks associated with concentrated investments in AI-heavy portfolios. Financial institutions experiencing growth in investment banking operations, favorable conditions in the energy sector, and the promising outlook for utilities underscore the diversified opportunities within VOO's holdings.

By maintaining a diversified portfolio encompassing AI-driven sectors and traditional industries, investors can navigate the complexities of the evolving market landscape with confidence. VOO stands as a compelling investment choice for those seeking exposure to the AI revolution while prioritizing risk management and long-term stability.