Nvidia: Make Hay While The Sun Shines

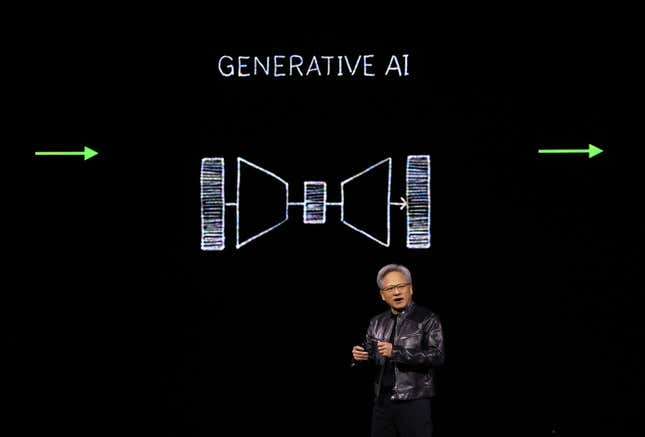

Nvidia Corporation (NASDAQ:NVDA) currently holds a dominant position in the AI semiconductor market by providing powerful GPUs for Generative AI applications. The company's GPUs are widely used in various applications, including Open AI and cloud hyperscalers. Nvidia's all-encompassing AI platform equips corporations with the necessary hardware, software, and networking to become AI-ready with minimal friction.

Challenges and Competition

Despite its current stronghold, Nvidia faces challenges that could impact its long-term market share. The company's premium pricing strategy and reliance on proprietary software, such as CUDA for GPU programming, may present hurdles as competitors like AMD and Intel enhance their offerings. A consortium of tech giants is also working on open-source solutions that could pose a threat to Nvidia's market position.

Advanced Micro Device’s (AMD) AI processors and Intel Corporation’s new chips offer competitive alternatives at lower price points. Additionally, companies like Intel, Qualcomm, Alphabet, Amazon, and Meta Platforms are collaborating on open-source code to optimize GPU performance across various hardware platforms. This collective effort aims to level the playing field in the AI semiconductor industry.

Market Outlook

Despite the intensifying competition, the overall demand for AI processing power is projected to surge, benefiting major chip companies in the industry. Nvidia's first mover advantage may diminish over time as competitors strategically position themselves to gain market share and reduce Nvidia's pricing power.

Financial Performance and Projection

Nvidia's financial results for FY24 showcased substantial growth, driven by strong sales in the data center and networking segment. The company's GPUs, particularly effective in training large language models like Chat-GPT, attracted high demand, leading to impressive margins and earnings. However, the evolving landscape of AI hardware, the emergence of rival platforms, and shifting focus towards AI inference could impact Nvidia's future revenue growth and profitability.

Investment Analysis and Price Target

An investment analysis has initiated a Sell Rating for NVDA with a $70/share Price Target based on a 10-year Discounted Cash Flow ("DCF") model. The valuation considers lower revenue and earnings growth projections as Nvidia's competitive position weakens against industry rivals. While Nvidia may continue to deliver strong earnings in the near term, long-term market dynamics suggest a potential decline in market share and pricing power.

In conclusion, the AI semiconductor market is evolving rapidly, with increasing competition and technological advancements reshaping the industry landscape. Investors are advised to consider the changing dynamics and potential market shifts as they evaluate their investment strategies in the semiconductor sector.