ChatGPT-4o builds an ideal $1,000 crypto portfolio for the first half of 2025

As Bitcoin (BTC) briefly surged past the $100,000 mark on December 5 before retreating to $94,000, the cryptocurrency market has been gripped by intense volatility. This intense volatility was mirrored by major altcoins like Ethereum (ETH) and XRP, which saw significant declines, contributing to a staggering $881 million in market-wide liquidations. Despite the turbulence, Bitcoin has managed to regain its footing, trading at approximately $99,607 at press time, reflecting renewed investor confidence.

Strategically Curated Portfolio

Amid this backdrop, ChatGPT-4o, OpenAI’s advanced AI model, has designed a $1,000 cryptocurrency portfolio tailored for the first half of 2025. This portfolio is strategically curated to balance growth potential and risk management, offering traders and investors a clear path through the ever-changing crypto landscape.

ChatGPT recommends allocating the majority of the portfolio to blue-chip cryptocurrencies like Bitcoin and Ethereum to ensure a strong foundation. These assets have a proven track record of stability and market dominance, making them essential for reducing overall portfolio risk.

High-Potential Altcoins

The AI model picked Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) as high-potential altcoins, allocating 25% of the portfolio to these assets. According to ChatGPT, these altcoins address critical blockchain challenges such as scalability, interoperability, and transaction efficiency, positioning them as key players in the future of decentralized technologies.

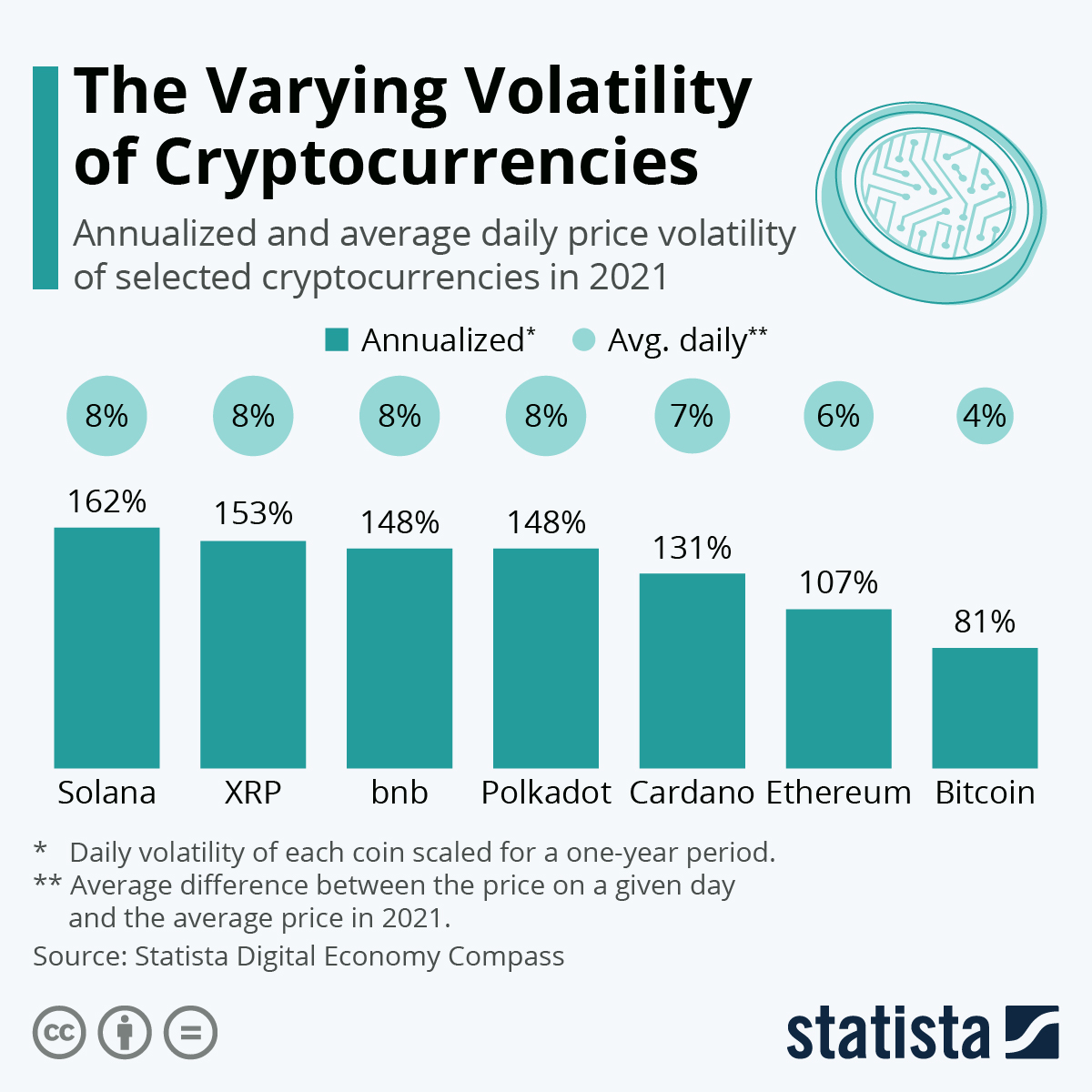

ChatGPT-4o provides insights into the varying volatility of cryptocurrencies, helping investors make informed decisions. Check out the chart below for more details.

Utility-Driven Tokens

The final allocation focuses on utility-driven tokens that derive value from adoption and practical use cases rather than speculation. These tokens add an extra layer of resilience to the portfolio. In this context, the AI model picks Chainlink (LINK) and Filecoin (FIL) as essential utility-driven tokens.

Navigating Volatility

As the cryptocurrency market continues to evolve, this $1,000 portfolio provides traders and investors with a roadmap for navigating both volatility and opportunity in the first half of 2025. Anchored by blue-chip assets, strengthened by innovative altcoins, and reinforced by utility-driven tokens, this portfolio equips investors to seize opportunities in the expanding digital asset space while effectively managing risks.

Featured image via Shutterstock

Risk Disclosure

RISK WARNING: Cryptocurrencies are high-risk investments, and you should not expect to be protected if something goes wrong. Don’t invest unless you’re prepared to lose all the money you invest. By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more about cryptocurrency risks. Click here to learn more.

Copyright © 2024 Finbold.com. All rights reserved. Use of this site constitutes acceptance of our Terms of Service. Finbold is a news and information website.