Analyst Says Meta Platforms (META) Has 'Plenty of Levers' to Capture Share Gains

Recently, Cantor Fitzgerald stated that Meta Platforms Inc (NASDAQ:META) has "plenty of levers" to capture share gains. The firm included the stock in its top picks list and assigned an Overweight rating. Cantor Fitzgerald is optimistic about the potential of AI deployment in delivering incremental engagement, monetization, and revenue growth over the next 2–3 years.

Wall Street Analysts' Attention on Meta Platforms Inc (NASDAQ:META)

Meta Platforms Inc (NASDAQ:META) continues to attract attention from Wall Street analysts due to its explosive AI potential. D.A. Davidson analysts initiated coverage on Meta Platforms Inc (NASDAQ:META) with a "buy" rating, highlighting it as a top pick among mega-cap stocks. According to the analysts, Meta is well-positioned to lead in open source for two key tech platforms: AI Foundation Compute and Spatial Compute.

The analysts at D.A. Davidson pointed out that while previous tech innovations were driven by startups, the scale and capital required for AI and Spatial computing indicate that only mega-cap companies can dominate in these areas. Unlike companies like Alphabet, Apple, Amazon, and Microsoft, which focus on closed platforms, Meta Platforms Inc (NASDAQ:META) leads the open-source side. They commended Meta's open-sourcing of AI tools such as Llama, PyTorch, and FAISS, which have positioned the company as a leader in AI foundational model compute.

Furthermore, D.A. Davidson highlighted Meta Platforms Inc's (NASDAQ:META) advancements in AI, which have already enhanced ad delivery and returns, making it easier to justify its AI investments and open-source strategy. On the Spatial computing front, the analysts noted Meta Platforms Inc's (NASDAQ:META) significant investment in Reality Labs, strengthening its position as the open-source counterpart to Apple's closed ecosystem. They also praised CEO Mark Zuckerberg's leadership in navigating challenges.

Analyst Price Target and Quarterly Results

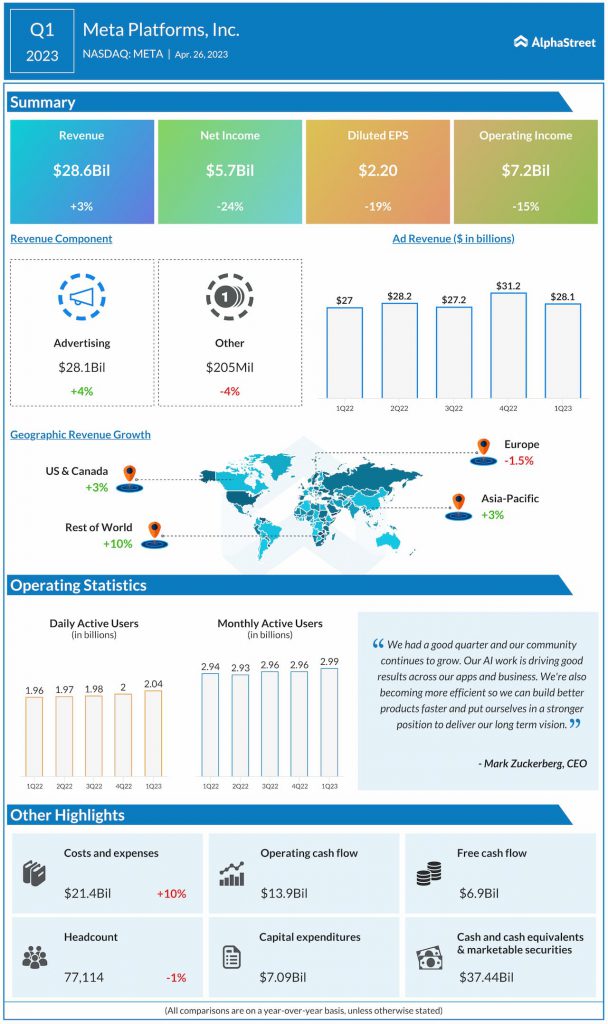

D.A. Davidson set a price target of $600 for Meta Platforms Inc (NASDAQ:META). The company surpassed analyst estimates for its latest quarterly results, indicating that the significant AI spending it has undertaken is expected to yield more results in the future.

Despite initial market reluctance towards Meta Platforms Inc's (NASDAQ:META) massive AI spending, the company aims to utilize AI to enhance engagement and language models like Llama 3, improving user interactions and monetization among its 3.2 billion daily active users.

Given Meta Platforms Inc's (NASDAQ:META) current trajectory, with a free cash flow margin of around 30% and on track to report $50 billion in free cash flow this year, the stock is trading at approximately 26 times this year's free cash flow. If this trajectory continues, Meta Platforms Inc (NASDAQ:META) could potentially achieve $58 billion in free cash flow next year, trading at 21 times next year's free cash flow. With $35 billion in net cash, a strong user base, and a key position in the consumer-facing AI industry, Meta Platforms Inc (NASDAQ:META) appears to be a solid long-term investment.

Mar Vista Focus Strategy's Perspective on Meta Platforms Inc (NASDAQ:META)

Mar Vista Focus strategy discussed Meta Platforms, Inc. (NASDAQ:META) in its Q2 2024 investor letter, noting the company's strategic shift towards operational efficiency, effective monetization of Reels, and a robust AI development program. The focus on AI is seen as a prudent capital allocation strategy with the potential to unlock substantial monetization opportunities and enhance user engagement.

Overall, while Meta Platforms Inc (NASDAQ:META) ranks 3rd on Insider Monkey's list of 10 Trending AI Stocks to Watch in September, the potential of AI stocks to deliver higher returns within a shorter timeframe remains significant. For investors seeking promising AI stocks trading at less than 5 times their earnings, exploring the cheapest AI stock could present an attractive opportunity.