ChatGPT and Generative AI in Insurance: Reality, Hype, What's Next ...

ChatGPT, a conversational AI model created by OpenAI, has taken the technology world by storm in 2023, capturing the attention of leaders in the insurance industry. But where exactly will generative AI have the greatest impact in the insurance sector, and what are its most and least promising use cases?

Generative AI is predicted to revolutionize various types of insurance, with property and casualty insurance expected to experience the most transformation, followed by health insurance. However, life insurance is expected to be the sector least impacted by generative AI, particularly in the short term.

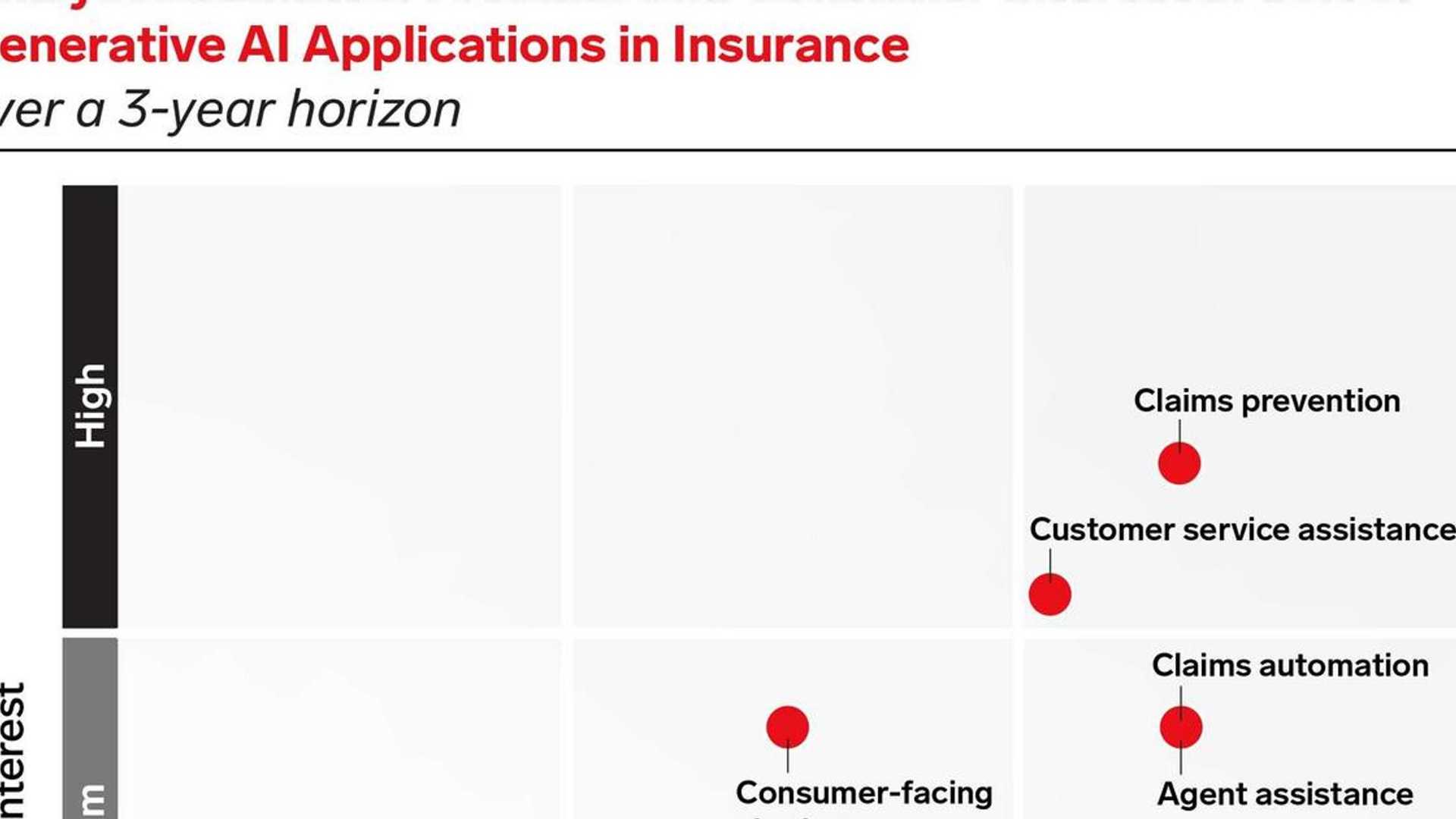

Over the next three years, there will be numerous promising use cases for generative AI within insurance. The most valuable and viable use cases include personalized marketing campaigns, employee-facing chatbots, claims prevention and automation, product development, fraud detection, and customer-facing chatbots. However, generative AI is currently not suitable for underwriting and compliance purposes.

Although the rise of generative AI has been sudden, it will take time for insurance providers to fully embrace its power and potential. Our full report goes into detail about the future of generative AI and provides actionable steps for insurers to prepare for its ascent. To purchase the report, click here and use the code CHATGPT100 for a $100 discount.