Hot ringgit trade gets another boost from foreign bond flows

The Malaysian ringgit’s rally is luring global funds to buy more local bonds, giving a further boost to the emerging market’s top-performing currency this quarter. Foreign investors poured 5.5 billion ringgit ($1.2 billion) into Malaysian bonds in July, the largest monthly inflow in a year, according to data from Bank Negara Malaysia.

Positive outlook for ringgit and local bonds

The recent surge in the currency has pushed total returns on ringgit notes to 5.9% this year, among the highest in emerging markets. Winson Phoon, head of fixed-income research at Maybank Securities in Singapore, stated, “Expectations of ringgit strength attracted foreign bond flows, probably on an FX-unhedged basis to position for FX gains, creating a positive feedback loop. The stars have aligned for the ringgit and local bonds.”

Bullish position on the ringgit

Investors are increasingly taking a bullish position on the ringgit in a sign of confidence in the country’s improving economic outlook. The Malaysian currency is up 4.8% against the dollar this quarter. Increased expectations for US interest rate cuts may further attract foreign flows to the domestic bond market.

Factors driving the rush to Malaysian debt securities

The rush to Malaysian debt securities is partly helped by light foreign positioning ahead of an expected Federal Reserve pivot. Global funds’ purchase of bonds over the past 12 months remains at 0.6 standard deviation below the five-year average.

Market projections and outlook

Maybank sees the 10-year Malaysian government yield falling to 3.5% by mid-2025 amid expectations the central bank will maintain the overnight policy rate at 3% through next year. This is supported by waning inflation risks and solid domestic growth prospects. Investors will be on watch for the timing and extent of an eventual cut in subsidies for the nation’s most widely used gasoline for further impact on consumer prices.

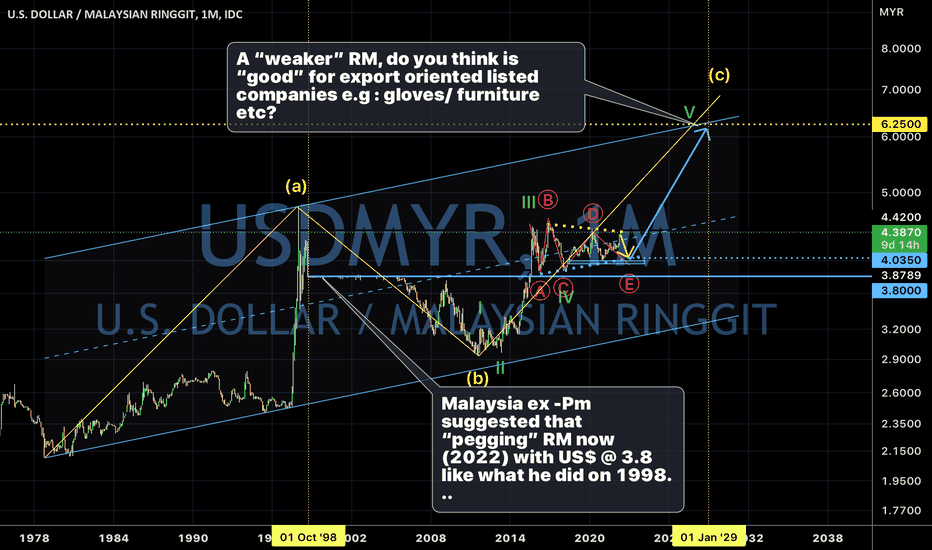

“We favour tactically positioning for dollar-ringgit to push below our fair value target of 4.30,” buoyed by an export recovery, unwinding of dollar longs, and room for further foreign bonds and stocks inflows, CIMB strategists including Michelle Chia wrote in a note on Monday.