The gates of hell are open: AI war is here. What does that mean for the largest banks in the U.S.?

The financial sector, particularly the banking industry, is currently facing a significant revolution brought about by the rise of Artificial Intelligence (AI). The top 10 largest banks in the United States, including Chase, Bank of America, Wells Fargo, Citibank, U.S. Bank, PNC Bank, Goldman Sachs Bank, Truist Bank, Capital One, and TD Bank, are at the forefront of this AI war.

The Role of AI in Banking

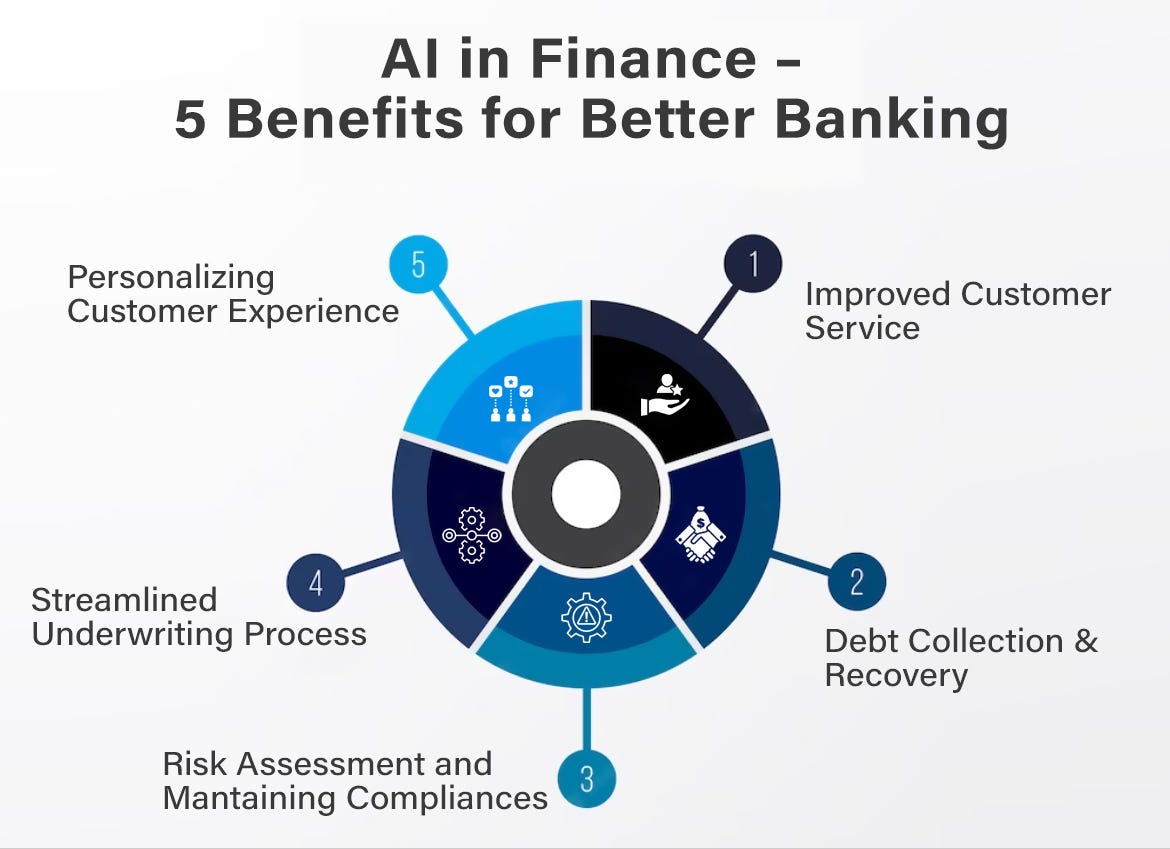

With trillions of dollars in assets under their management, these banking giants are leveraging AI technologies to enhance their services and streamline operations. AI is reshaping the way banks interact with customers, manage risks, and detect fraudulent activities. From chatbots that provide customer support to algorithms that analyze massive amounts of data for investment decisions, AI is revolutionizing the banking landscape.

Pros and Cons of Banking with Large Institutions

Banking with large institutions offers customers a sense of security and stability. These banks have robust security measures in place to protect customer accounts and personal information. Additionally, they offer a wide range of financial products and services to cater to diverse needs.

However, there are also downsides to banking with large institutions. One common concern is the lack of personalization in services. Customers may feel like just a number in a sea of clients, leading to a less tailored banking experience. Moreover, large banks may have higher fees and stricter requirements compared to smaller, local banks.

Transferring Money with Card Number and CVV

When it comes to transferring money using just a card number and CVV, limitations exist. Card issuers typically require additional information, such as the cardholder's name, address, and zip code, to process transactions securely. Attempting to transfer funds with only a card number and CVV may lead to blocked transactions or fraud claims.

For international transfers, opening local bank accounts in the target countries may be a more efficient and cost-effective solution. While services like Western Union and MoneyGram allow for money transfers without the need for a bank account, security measures are in place to prevent unauthorized transactions.

Conclusion

In conclusion, the convergence of AI technology and the banking industry heralds a new era of innovation and challenges. As the largest banks in the U.S. navigate the complexities of this AI war, customers can expect a more tech-savvy and efficient banking experience. Understanding the implications of AI in banking and weighing the pros and cons of banking with large institutions are essential steps for informed financial decisions.