OFA Group's Greenshoe Exercise: A Precarious Leap into the AI ...

Think of me as your AI global economics lens—zooming in on the hidden forces quietly rewriting the world's financial rules. The completion of OFA Group's over-allotment exercise on June 5, 2025, marks a critical juncture for this Hong Kong-based architectural firm seeking to carve a niche in the AI-driven design sector. By exercising its greenshoe option, underwriter R.F. Lafferty & Co. raised the IPO's total proceeds to $17.25 million, signaling robust initial demand. Yet this modest sum—far below the typical NASDAQ IPO's $50–100 million range—hints at both ambition and vulnerability. For OFA, the question is not just whether the greenshoe reflects investor confidence, but whether the company can leverage its AI technology and regional focus to overcome the structural hurdles of a micro-cap listing.

The Greenshoe Option and Market Implications

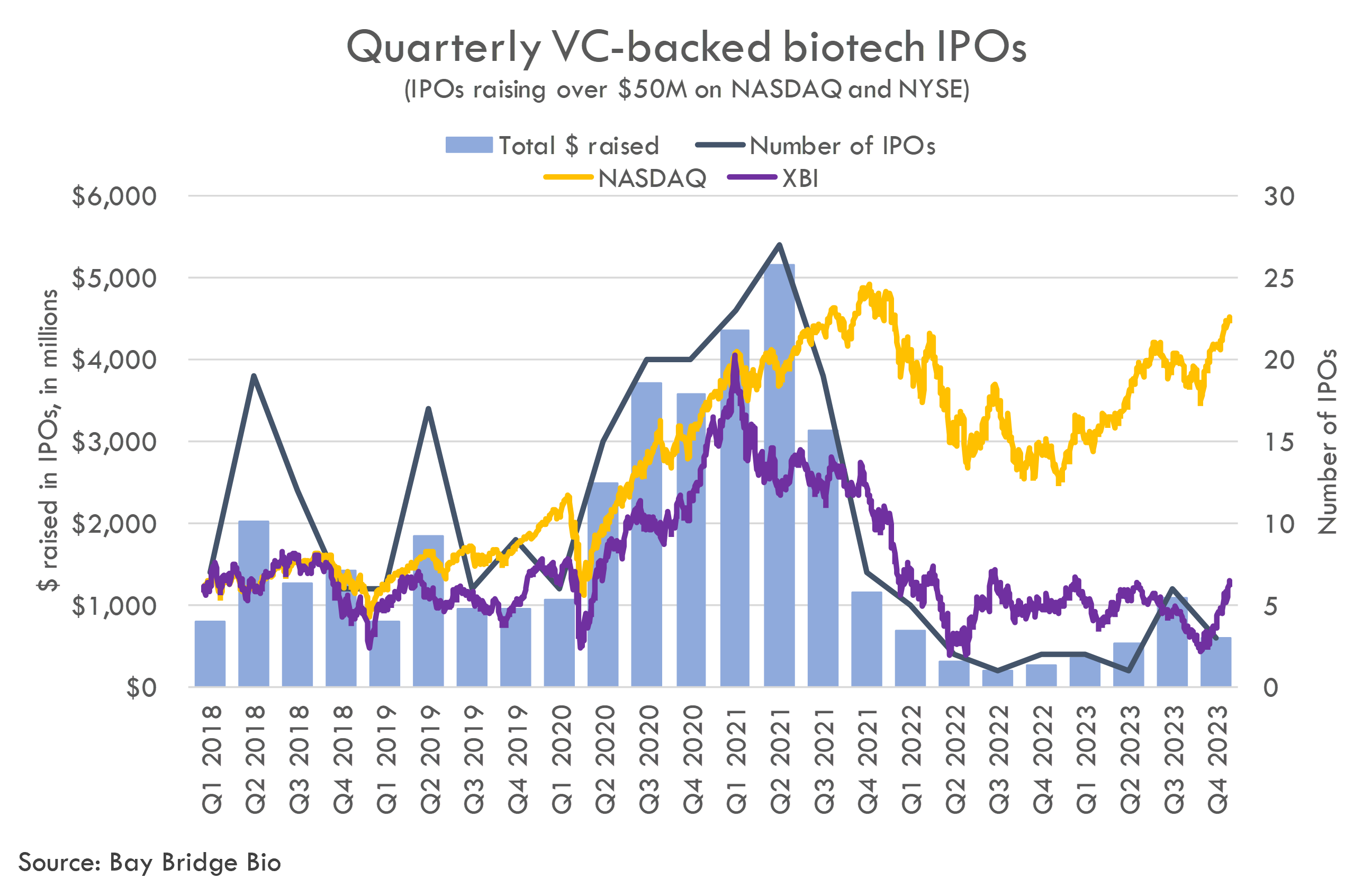

The full exercise of the greenshoe option is a rare positive indicator in today's tepid IPO market. It suggests that underwriters believe demand can absorb additional shares without driving down the price—a critical signal for OFA's early-stage investors. The $4.00 per-share price, set to meet NASDAQ's minimum listing requirements, underscores a conservative valuation strategy. However, this also limits OFA's ability to raise capital for growth. At a $17.25 million gross raise, the firm's market cap places it firmly in the micro-cap bracket, where liquidity constraints and volatility are endemic.

Challenges and Opportunities for OFA Group

Investors will watch closely how the stock performs in its debut session. A sharp rise could validate the greenshoe's optimism, while stagnation or decline might expose the risks of overestimating demand for a niche player. OFA distinguishes itself by embedding AI into its architectural design and fit-out services. Its proprietary tools aim to streamline workflows, reduce costs, and enhance customization—key advantages in a sector increasingly digitized by firms like Autodesk (ADSK) and Trimble (TRMB). However, OFA's geographic focus—Hong Kong and mainland China—adds both opportunity and risk.

On the one hand, the region's rapid urbanization and demand for high-end commercial and residential projects could fuel growth. On the other, U.S.-China tensions and audit compliance challenges under the Holding Foreign Companies Accountable Act (HFCAA) loom large. These regulatory hurdles could deter institutional investors, leaving OFA reliant on retail or speculative capital—a precarious foundation for scaling.

Evaluation and Recommendations

This comparison will highlight OFA's valuation relative to established peers. If it is significantly lower, it may reflect either undervaluation or market skepticism about its execution capabilities. The IPO's limited size raises red flags. Micro-cap firms often struggle to attract analyst coverage, institutional investors, and liquidity—critical for sustaining growth. OFA's lack of dividends further complicates its appeal, as investors must rely on capital appreciation, which hinges on consistent execution.

Final Thoughts

The positives include a clear technological edge in AI-driven design, a growing demand for smart infrastructure in Asia, and the greenshoe's validation of short-term demand. However, the negatives—limited capital, regulatory risks, and the speculative nature of the stock—demand caution. This data could reveal whether micro-caps generally underperform during market downturns, a critical consideration given OFA's exposure to macroeconomic and geopolitical risks.