David vs Goliath: Why this fund manager is shorting tech giants ...

Receive daily news in your inbox. FE fundinfo will use the details you have provided to send you the newsletters you have requested. You can unsubscribe at any time, please see our Privacy Policy.

Fidelity FAST Global manager Dmitry Solomakhin

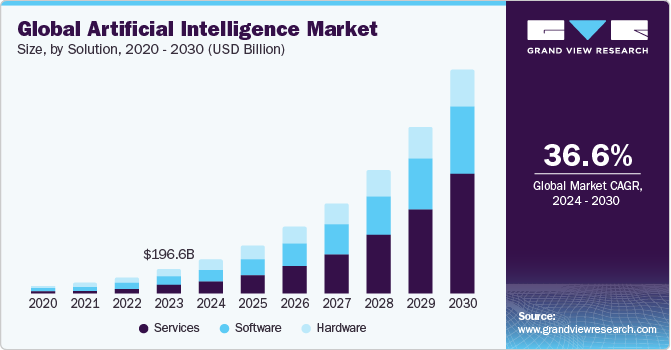

Fidelity FAST Global manager Dmitry Solomakhin is actively betting against some of the dominant US tech names. The ‘Magnificent Seven’ have been dominant in markets over the past 18 months as the artificial intelligence (AI) theme has boomed. But not all are convinced of its staying power. Dmitry Solomakhin, lead manager of Fidelity FAST Global, is actively shorting some of the biggest US tech names. These positions will undoubtedly have been painful for the fund, as Solomakhin told Trustnet earlier this month. Despite a top-quartile record over three, five and 10 years, the fund has dropped to the bottom 25% of its sector over one year – something he puts down to short positions in AI winners.

Why short these AI winners?

So why short these AI winners in the first place? Solomakhin said if investors take a step back, they may realize there is a gap between market expectations and reality, which makes the sector a “rich hunting ground” for short positions. "Hyperscalers are spending a lot of money. It started with Open AI and Microsoft and then Google joined the race because it felt threatened. Then others followed," he said.

Concerns and Predictions

Solomakhin understands the tech sector well, having been a technology fund manager between 2008 and 2013, so he has “seen a number of these cycles in the past”. The cycle of spending money early to develop technology, without worrying about its future monetization, is “the tech mould”, he said. Additionally, while there are some “obvious use cases” for the technology being produced at present, there is “nothing fundamentally new” about the products. "A lot of this stuff has been with us for 20 years. Yes, this might be a better product but it is not a new concept," said Solomakhin.

Short Positions and Future Outlook

Although Fidelity International does not publicly disclose its short positions, the fund’s factsheet lists two short positions in stocks worth 4.4% and 3.9% of the MSCI All Country World Index benchmark. Investors should not expect shorting tech to be an ongoing theme. Should valuations return to more “normal” levels, the fund will look very different. Indeed, Solomakhin noted that three years ago he was mainly shorting special purpose acquisition companies (SPACS) and ESG-related names.

© Trustnet Limited 2024. All Rights Reserved. Please read our Terms of Use / Disclaimer, Privacy Policy and Cookie Notice. Data supplied in conjunction with Refinitiv and London Stock Exchange Plc. This site uses cookies. Some of the cookies are essential for parts of the site to operate and have already been set. You may delete and block all cookies from this site, but if you do, parts of the site may not work. To find out more about cookies used on Trustnet and how you can manage them, see our Privacy and Cookie Policy. By clicking "I Agree" below, you acknowledge that you accept our Privacy Policy and Terms of Use. For more information Click here.