Intuit introduces new AI tools to expedite app development By ...

Intuit Inc. (NASDAQ: INTU), a leader in financial technology platforms like TurboTax and QuickBooks, has announced significant updates to its Generative AI Operating System (GenOS). These updates are designed to enhance the development process for its product teams and improve the financial solutions offered to its nearly 100 million customers.

GenOS AI Workbench

The GenOS AI Workbench is a new addition to GenOS, providing a dedicated environment for application development. It streamlines the development cycle from ideation to deployment and includes built-in governance and safety features. One of the tools introduced is the LLM Leaderboard, assisting developers in selecting the best large language models (LLMs) for specific applications. Additionally, the Prompt Management and Evaluation Service helps with prompt creation and assessment, while Prompt Flow Traceability optimizes response times and accuracy.

Improved Components

Existing components like GenStudio, GenRuntime, and GenUX have also seen enhancements. GenStudio now offers a wider selection of LLMs from various providers. GenRuntime can now handle more complex business workflows, and GenUX provides an expanded set of user experience components.

Rapid Deployment

These advancements have enabled rapid deployment of new capabilities, such as Intuit Assist for TurboTax, which has boosted tax filing confidence for millions of users this tax season.

Commitment to Responsible AI

Intuit prioritizes responsible AI and data stewardship, adhering to privacy and security standards and participating in the U.S. Artificial Intelligence Safety Institute Consortium.

Industry Recognition

The latest GenOS release from Intuit has set a benchmark in the industry for developing sophisticated fintech applications, as noted by experts like Hamit Hamutcu, Senior Advisor at the Institute for Experiential AI at Northeastern University.

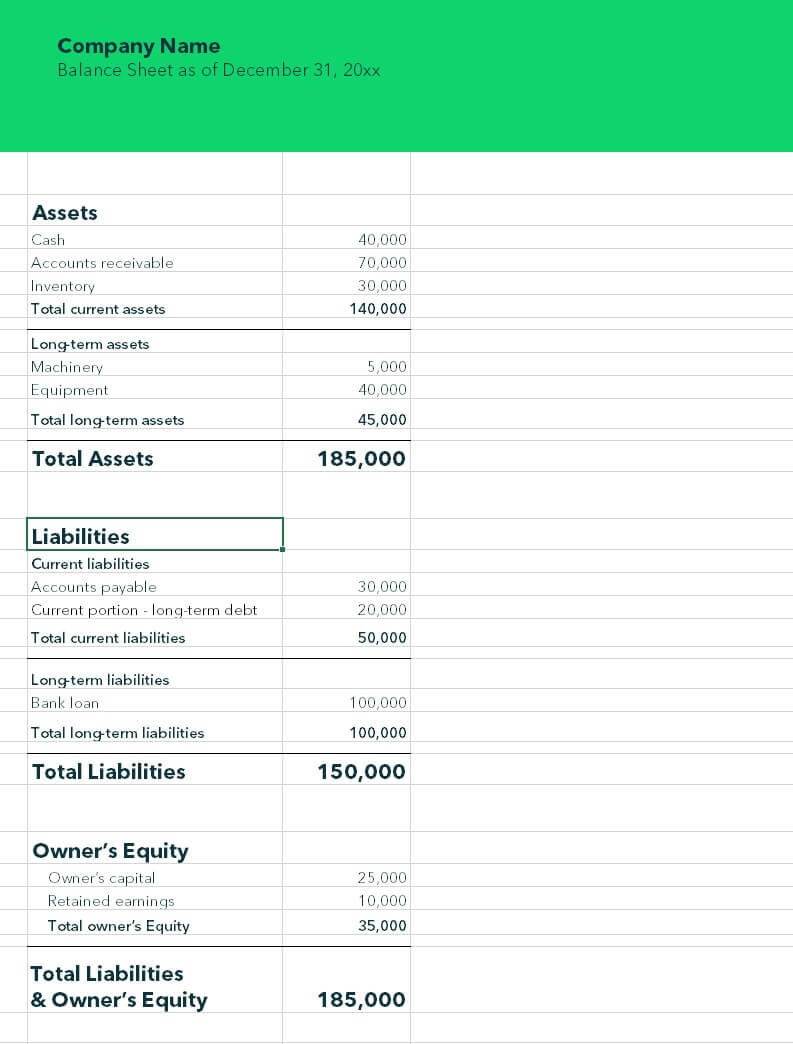

Financial Performance

Intuit reported a 13% revenue growth for the fourth quarter and fiscal year 2024, with a projected 12% to 13% growth for fiscal year 2025. Despite changes in the desktop ecosystem impacting revenue, Intuit maintains strong cash and investment reserves, with $4.1 billion reported at the end of Q4.

Market Position

With a market capitalization of $174.66 billion, Intuit is a significant player in the financial technology sector. The company's gross profit margin of 79.62% showcases its efficient cost management, while its consistent dividend payments and recent dividend growth appeal to investors seeking stable income streams.

Investor Insights

For investors interested in a detailed analysis of Intuit's financial health and prospects, InvestingPro offers additional insights and tips. These resources can provide a comprehensive understanding of the company's valuation, industry standing, and expected profitability.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

For more information on InvestingPro tips, visit InvestingPro and https://www.investing.com/pro/INTU.