Unlocking the Full Potential of Asset Tokenization with Generative AI

Blockchain technology has paved the way for representing physical assets as digital tokens, revolutionizing the ownership and transfer of assets. Asset tokenization, the process of digitizing physical assets on a blockchain, has created new investment opportunities and streamlined existing ones. However, to truly realize the potential of asset tokenization, the integration of generative AI is crucial.

Generative AI combined with blockchain technology enhances the efficiency and security of the financial ecosystem. As these technologies continue to advance, we can anticipate a surge in adoption and innovation in asset tokenization, ushering in a new era of digital assets and investments.

The Process of Asset Tokenization

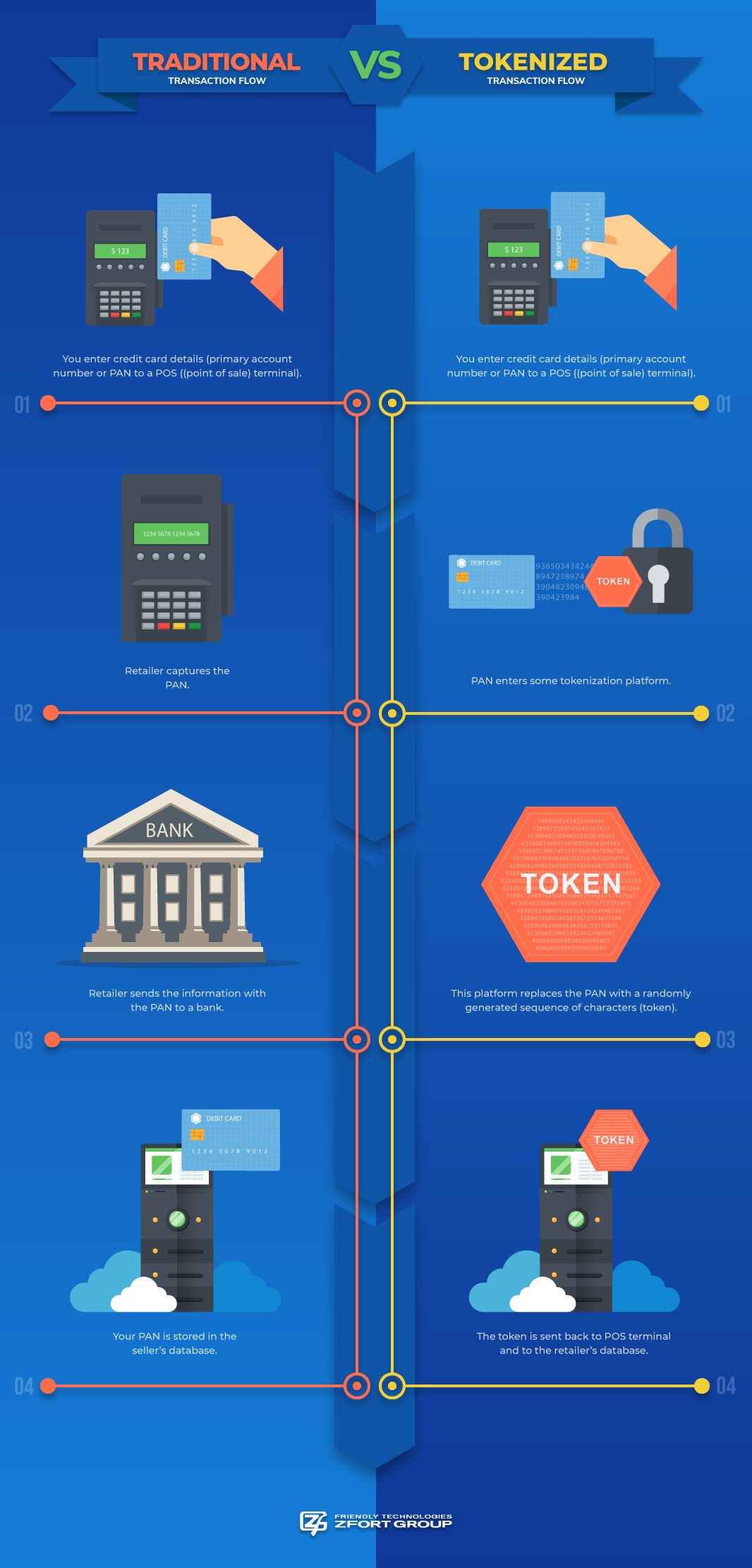

Traditionally, assets such as real estate, artwork, or intellectual property were represented by physical certificates or contracts, leading to inefficiencies and lack of liquidity. Asset tokenization disrupts this traditional system by creating digital representations of assets on a blockchain, enabling fractional ownership, transparency, and faster transactions.

Determine the asset to tokenize: Identify the asset suitable for tokenization, considering factors like divisibility, marketability, and regulatory requirements.

Value the asset: Engage valuation experts to determine the asset's worth accurately, ensuring investor confidence.

Evaluate compliance/regulatory mandates: Stay informed about the evolving legal landscape related to asset tokenization and seek professional advice for compliance.

Identify a tokenization agency: Partner with a reputable agency well-versed in blockchain technology and regulatory compliance to facilitate token creation and platform integration.

Identify the right marketplace: Choose a suitable marketplace for trading tokens based on reputation, liquidity, and regulatory compliance.

Tokenize the asset: Develop smart contracts to govern the ownership and transfer of the tokenized asset securely.

Benefits of Asset Tokenization

Asset tokenization offers numerous benefits, including fractional ownership, increased transparency, and faster transactions, revolutionizing the financial landscape. Leveraging blockchain and generative AI can enhance the efficiency, security, and personalization of asset tokenization, leading to innovative solutions in finance.

Open source tools play a significant role in accelerating the development of asset tokenization solutions, ensuring compatibility and interoperability. By embracing these technologies, organizations can unlock the full potential of asset tokenization and drive financial innovation.

Understanding the asset tokenization process and its benefits empowers organizations to participate in this transformative shift in finance. To succeed in tokenization, thorough research, due diligence, and collaboration with experts are paramount.