Students Turn to ChatGPT for Study Help and Chegg Stock Declines

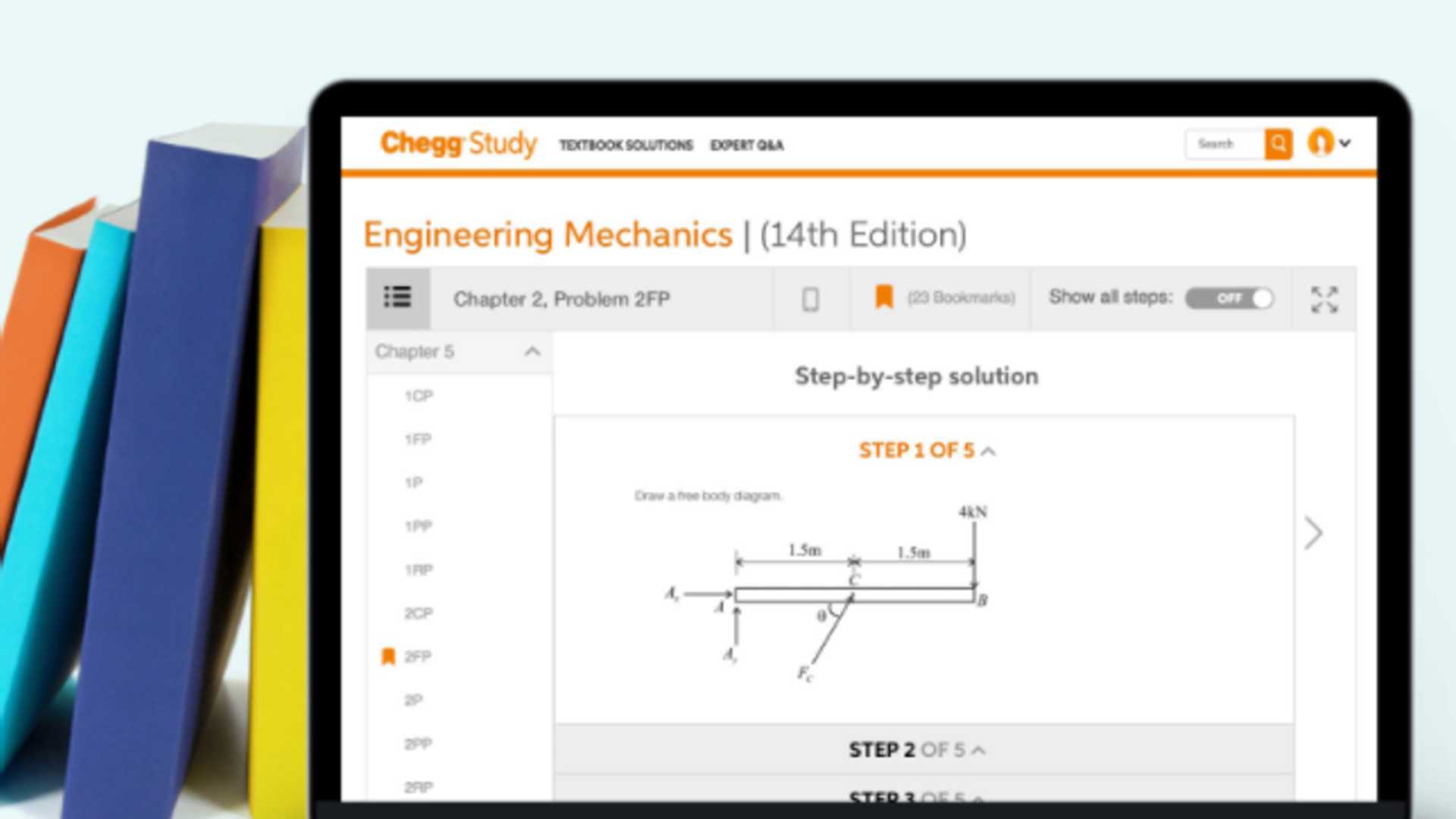

Online education company, Chegg Inc., reported a surprising forecast for an unexpected decline in revenue as more students have turned to ChatGPT for study help. The company's stock has plunged 37.5% in after-hours trading and is predicted to hit its lowest price since 2017. Chegg's Q1 earnings showed positive results with adjusted earnings of 27 cents a share, beating the average expectations of 25 cents a share on sales of $185.2 million, according to FactSet.

However, the Q2 guidance provided by Chegg executives was a surprise, with a projected decline in revenue sequentially, stating a range of $175 million to $178 million. This is lower than analysts' expected $193.6 million. Chegg's CEO, Dan Rosensweig, pointed at the growth of ChatGPT, an AI chatbot which has significantly influenced student's new customer growth rate.

Chegg has disclosed that its core subscriber count has declined by 5% in the quarter, down to 5.1 million, more significant than what analysts were expecting. Moreover, for Q2, executives predict subscription revenue of $159 million to $162 million, while analysts were expecting $176 million.

Despite the negative impacts brought upon by ChatGPT, Rosensweig emphasized the company's aggressive utilization and incorporation of AI into Chegg services, citing the recent introduction of CheggMate in cooperation with OpenAI. CheggMate will harness the power of ChatGPT, paired with the company's proprietary data and subject matter experts.

Chegg's stock has declined 28.9% in the past year, while the S&P 500 index has gained 0.9%.