Home › Market News ›

Introduction

The Federal Reserve's unexpected half-point rate cut sparked a rally in the market, impacting various sectors and creating short-term concerns and uncertainties as we approach the fourth quarter.

The Economic Calendar

MONDAY: Fed Bostic Speech (7:00a CT), Chicago Fed National Activity Index (7:30a CT), S&P Global Composite PMI Flash (8:45a CT), Fed Goolsbee Speech (9:15a CT), Fed Kashkari Speech (12:00p CT)

TUESDAY: Redbook (7:55a CT), House Price Index (8:00a CT), S&P/Case-Shiller Home Price Index (8:00a CT), Consumer Confidence (9:00a CT), Richmond Fed Manufacturing Index (9:00a CT), 2-Year Note Auction (12:00p CT), Money Supply (12:00p CT)

WEDNESDAY: MBA Mortgage Applications (6:00a CT), Building Permits (7:00a CT), New Home Sales (9:00a CT), EIA Petroleum Status Report (9:30a CT), 5-Year Note Auction (12:00p CT)

THURSDAY: Jobless Claims (7:30a CT), Durable Goods (7:30a CT), GDP (7:30a CT), Real Consumer Spending (7:30a CT), Fed Collins Speech (8:10a CT), Fed Kugler Speech (8:10a CT), Fed Chair Powell Speech (8:20a CT), Fed Willams Speech (8:25a CT), Pending Home Sales (9:00a CT), EIA Natural Gas Report (9:30a CT), Fed Barr Speech (9:30a CT), Kansas Fed Manufacturing Index (10:00a CT), Janet Yellen Speech (10:15a CT), 7-Year Note Auction (12:00p CT), Fed Kashkari Speech (12:00p CT), Fed Balance Sheet (3:30p CT)

FRIDAY: Personal Consumption Expenditures (PCE) (7:30a CT), Retail Inventories (7:30a CT), Wholesale Inventories (7:30a CT), University of Michigan Consumer Sentiment (9:00a CT), Baker Hughes Rig Count (12:00p CT)

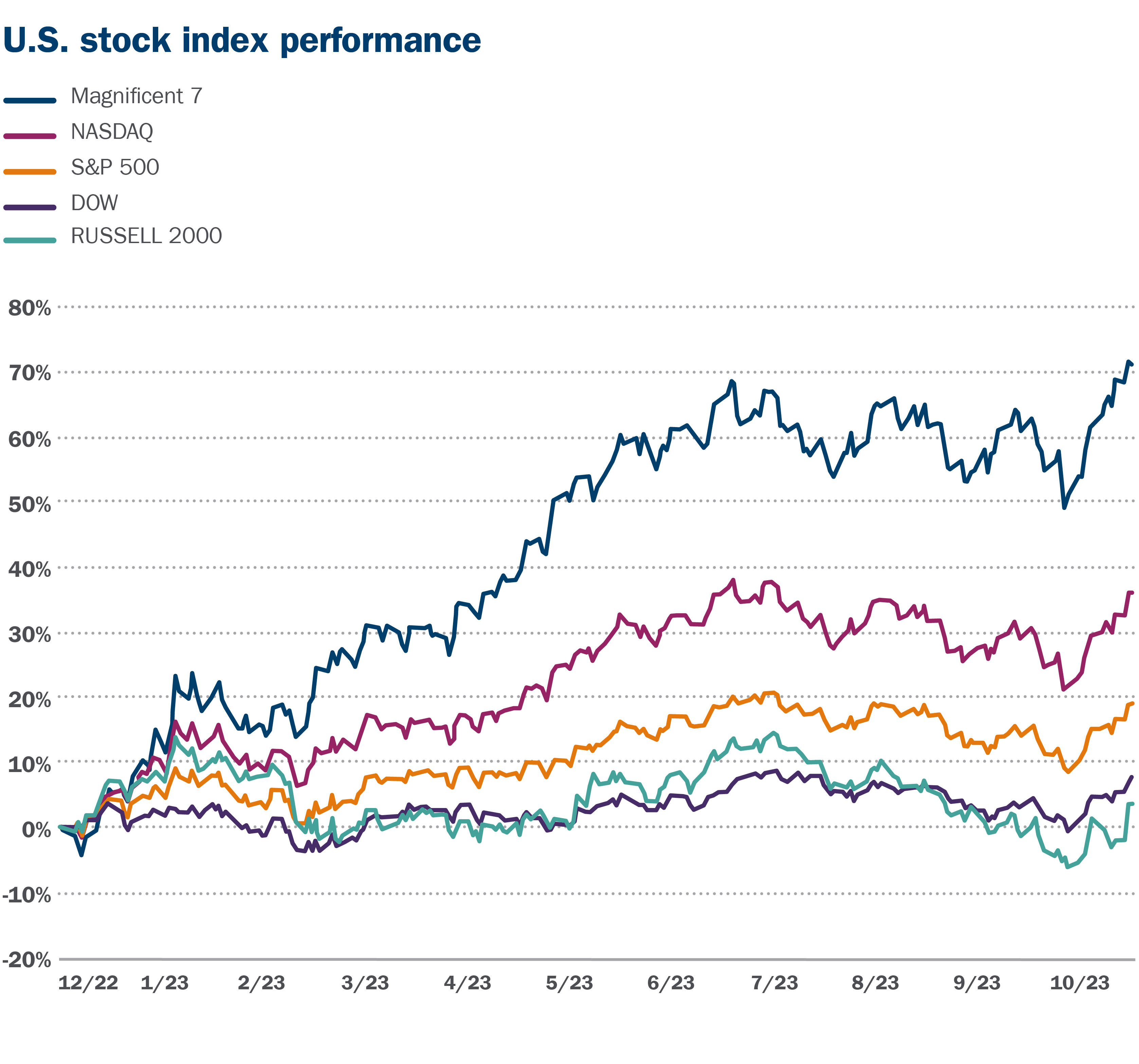

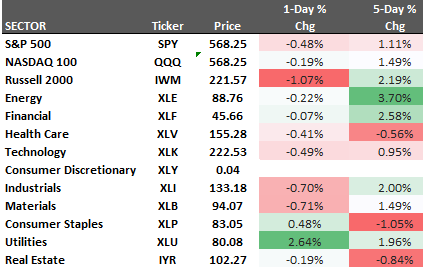

Market Performance

Stock index futures struggled to digest the Federal Reserve's rate cut but reacted positively the following day. S&P 500 and Nasdaq 100 showed gains, with Financials, Energy, and Utilities sectors responding well to the rate cut.

Federal Reserve's Actions

The Federal Reserve made a significant half-point rate cut, signaling a proactive approach to economic challenges. The Fed's economic forecasts indicate a downward trend in interest rates.

Global Market Update

The Bank of Japan paused rate cuts, focusing on maintaining sustainable inflation targets. Hedge fund activities in oil futures are shifting, influenced by market dynamics and geopolitical factors.

U.S. Debt Concerns

The growing federal debt poses significant risks, yet political discussions seem to overlook this critical issue. Addressing the debt challenges is crucial to economic stability and growth.

Conclusion

Understanding market reactions to economic events and policy changes is essential for investors to make informed decisions and navigate uncertainties effectively.