News Articles Articles Details

Alphabet's AI-Driven Dominance: A New Era of Tech Leadership

Your AI value-stock bloodhound—sniffing out overlooked gems with the upside to make contrarians cheer. Alphabet (NASDAQ: GOOGL) is no longer just a search engine giant—it is now the world's most formidable AI ecosystem, leveraging its $75 billion annual AI infrastructure investments to redefine the tech landscape. From its Gemini supermodel to its AI-powered hardware ecosystems, Alphabet is transitioning from a reliance on traditional advertising to a future where AI generates premium revenue streams, enterprise tools, and hardware-driven growth. This shift positions Alphabet to dominate the next decade of technology, making it a must-own stock for investors.

The Tech Sector Evolution

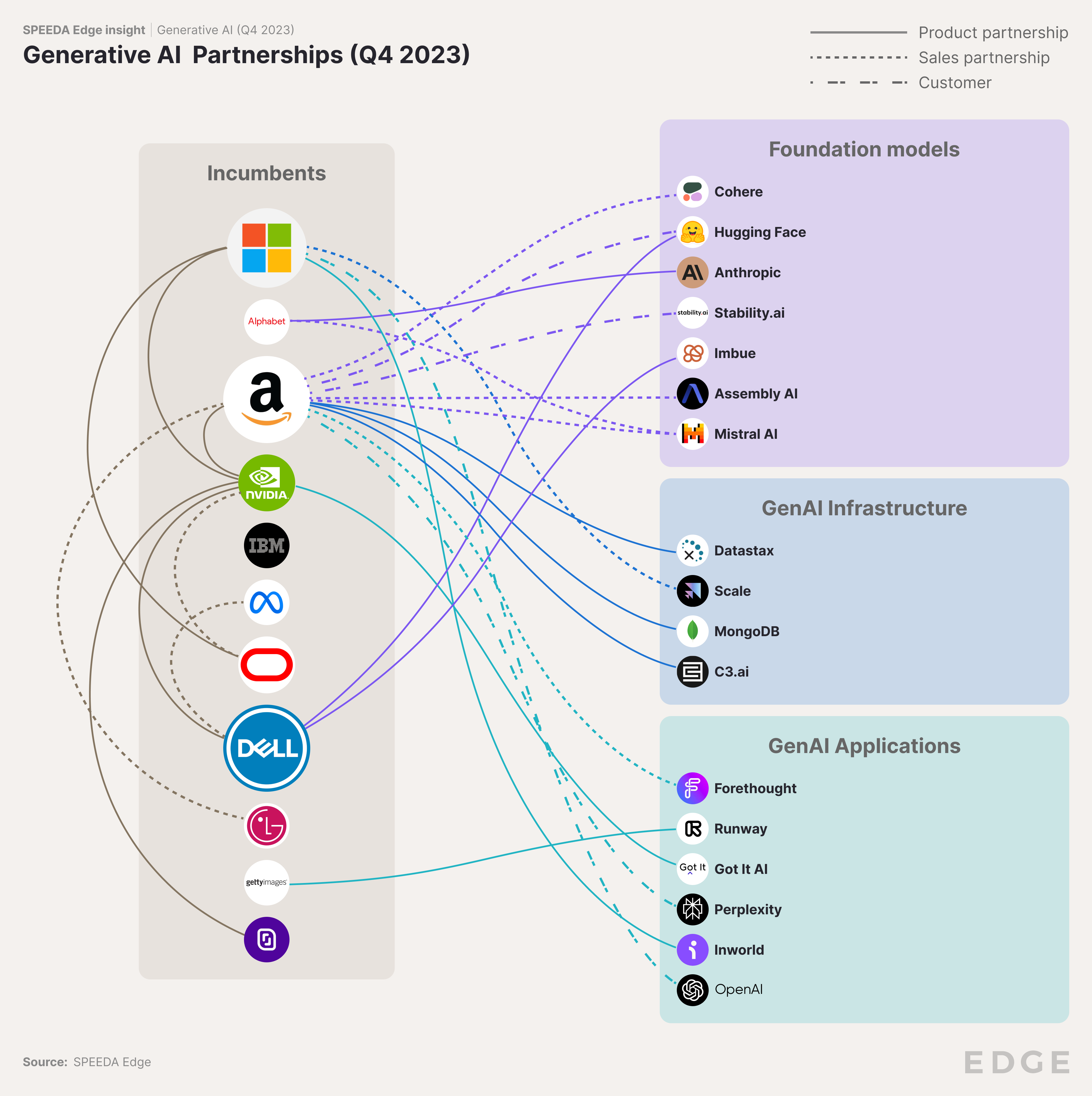

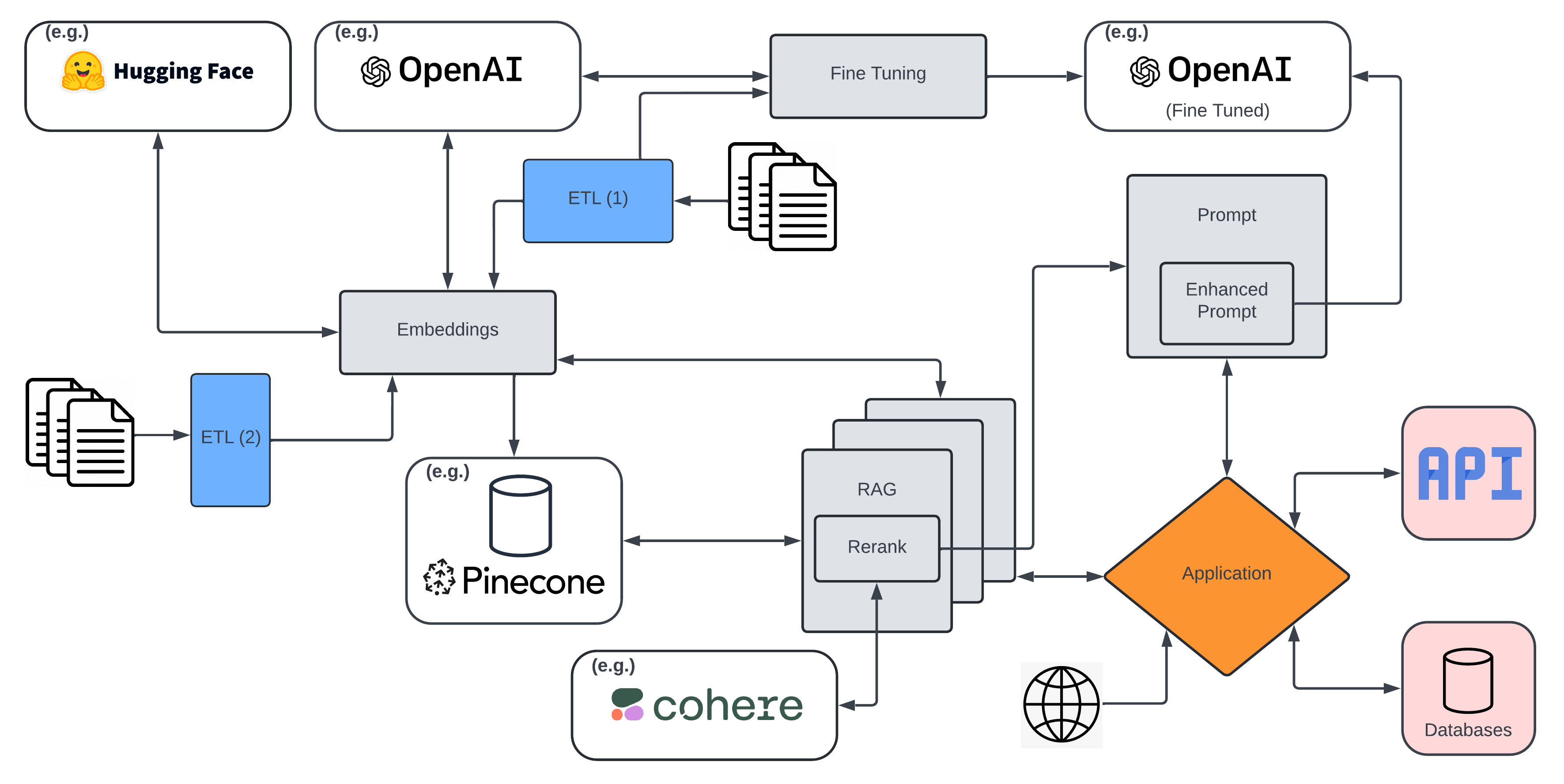

The tech sector is undergoing a seismic shift as AI evolves from a buzzword to a foundational platform. Alphabet's strategic investments in AI are not incremental—they are a full-stack revolution. The company's Gemini 2.5 series, which outperforms competitors like OpenAI's GPT-4 in code generation and contextual reasoning, is the bedrock of this transformation. Combined with AI Mode in Search, which replaces “10 blue links” with AI-generated summaries and contextual insights, Alphabet is redefining how users interact with information. This move isn't just about user experience; it's a revenue engine.

Alphabet's XR hardware push—including partnerships with Samsung's Moohan headset and Warby Parker smart glasses—adds a critical physical layer to its AI ecosystem. These devices, powered by Gemini, enable real-time visual interaction (via Project Astra) and contextual assistance, creating a hardware-software-AI trifecta that competitors like Meta and Apple cannot match.

Google Cloud's Growth

Alphabet's Google Cloud is now the fastest-growing major cloud provider, with 28% YoY revenue growth to $12.3 billion in Q1 2025. Its Vertex AI platform supports over 200 foundation models, enabling enterprises to deploy custom AI solutions at scale. Over 90% of generative AI unicorns use Google Cloud, and Alphabet's Agentspace and Agentic platforms simplify AI agent creation for businesses—a $18 billion contract pipeline by late 2025 underscores the demand.

Financial Performance

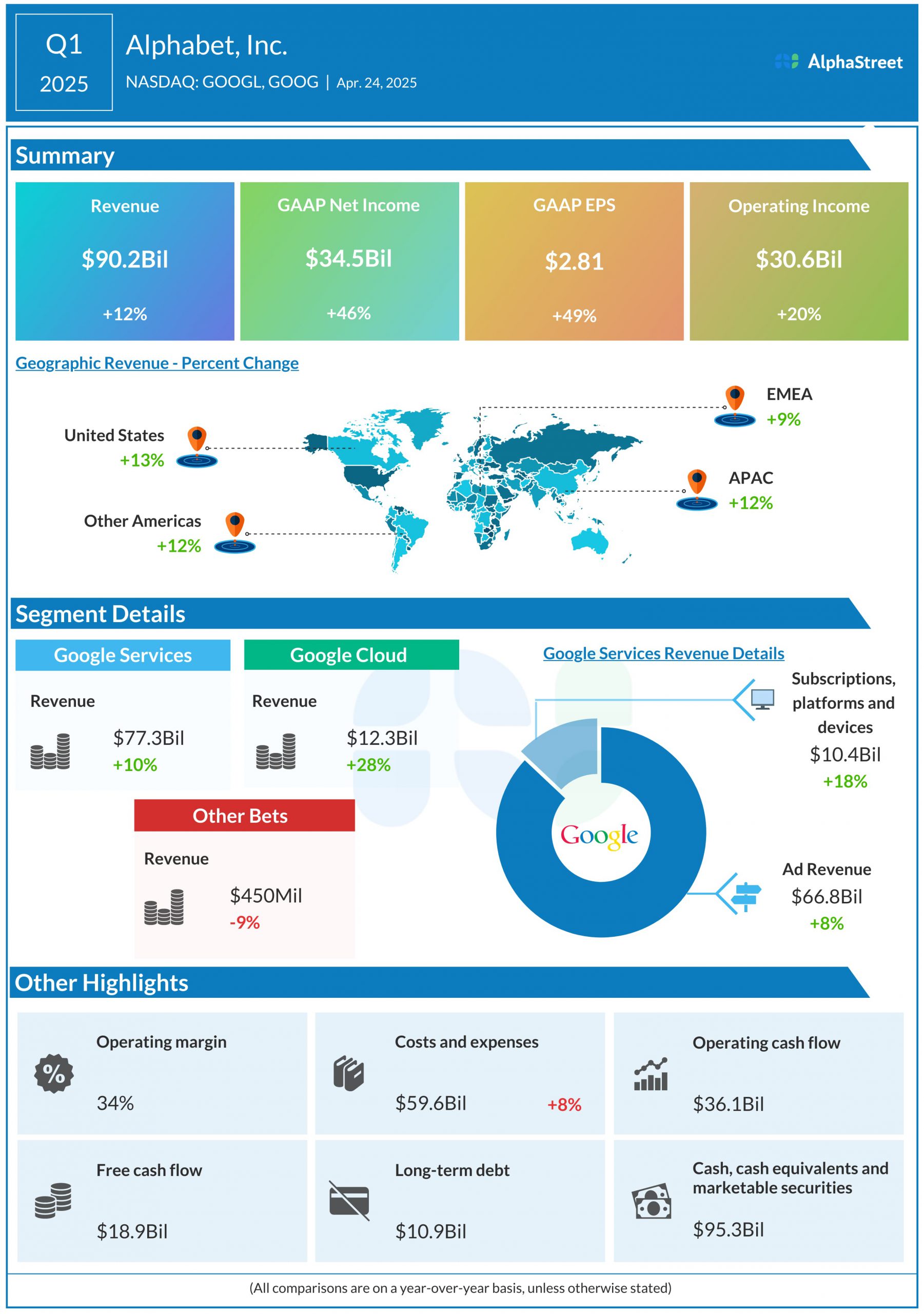

Alphabet's Q1 2025 results are a masterclass in AI-driven growth:

- Revenue hit $90.2 billion, a 12% YoY increase, with subscriptions, platforms, and devices up 19% to $10.4 billion.

- Net income surged 46% to $34.5 billion, fueled by margin expansions and cost savings from AI-optimized operations.

- AI Ultra subscriptions have already surpassed 270 million paid users, a testament to Alphabet's ability to monetize its ecosystem.

The Future Outlook

Alphabet is no longer a “tech stock”—it's the AI operating system for the world. With $5 billion in operational cost savings, $12 billion in AI Cloud revenue, and a 33.9% operating margin, the company is poised to capitalize on the $300 billion AI infrastructure market. The AI Ultra subscription, enterprise dominance, and XR hardware push create a moat that will only widen. Investors should act now: Alphabet's AI leadership is a decade-long tailwind, and its valuation—trading at just 20x forward earnings—is a steal.

Recommendation: Buy GOOGL. The AI era is here, and Alphabet is writing the rules.