BMO Capital Hikes Alphabet's Price Target - Wall Street Pit

Alphabet Inc. (GOOG, GOOGL), the parent company of Google, saw its shares rise by $2.84 or 1.45% to $198.88 in early trading on Tuesday, following a positive upgrade from BMO Capital. The stock reached an intraday high of $202.29, reflecting strong market confidence. This increase comes after closing at $196 on Monday, with Alphabet showing a 5.04% gain year to date and a robust 36.20% growth over the past year.

Key Developments

BMO Capital’s decision to raise its price target from $217 to $230 while maintaining an ‘Outperform’ rating underscores their confidence in Alphabet’s future performance. This optimism is based on several key developments across Alphabet’s diverse business segments.

Enhancements in Search Revenue

The firm highlighted improvements in search revenue, attributing this to the enhanced Return on Ad Spend (ROAS) facilitated by Performance Max (PMax). This tool has evidently been effective in optimizing advertising spend for clients, thereby improving Alphabet’s search revenue stream.

Google Cloud Platform (GCP) Growth

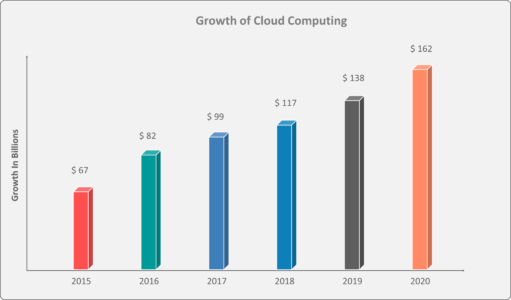

Google Cloud Platform (GCP) is witnessing growth due to middle-layer enhancements, particularly through the integration of Gemini and Vertex AI. These technologies are not only improving the platform’s capabilities but also expanding its Total Addressable Market (TAM) by handling more complex queries than before.

Positive Developments in YouTube

YouTube, another significant revenue driver for Alphabet, has also seen positive developments with the introduction of lower-funnel QR codes. These have been well-received by advertisers, offering a direct path to consumer engagement and conversion, which in turn positively impacts YouTube’s ad revenue.

Market Outlook

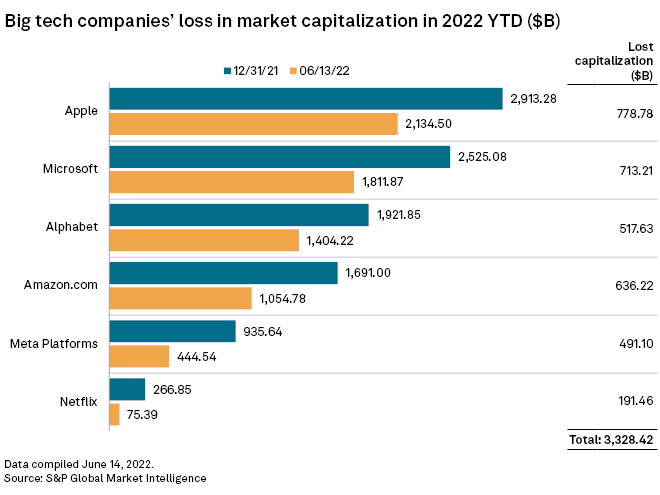

BMO Capital’s upward revision of its price target reflects an acknowledgment of these strategic moves and their anticipated impact on Alphabet’s financial performance. This upgrade and the subsequent rise in stock price also signal to investors that Alphabet is navigating the tech sector’s challenges with considerable agility and foresight.

As the market continues to reward companies that can demonstrate both innovation and profitability, Alphabet’s recent performance and the positive analyst sentiments suggest that the $2.41 trillion market cap name remains a formidable player in the tech industry, with considerable room for further growth.