Meta Platforms Inc. (META): A Good Fast Money Stock To Buy ...

Our #1 AI Stock Pick is on a steep discount - 29$ instead of 99$! Click here to access exclusive investment research and ad free browsing!Our #1 AI Stock Pick is on a steep discount - 29$ instead of 99$! Click here to access exclusive research!

Meta Platforms Inc. (NASDAQ:META) and Fast Money Stocks

We recently compiled a list of the 7 Best Fast Money Stocks To Buy According To Hedge Funds. In this article, we are going to take a look at where Meta Platforms Inc. (NASDAQ:META) stands against the other fast money stocks.

Insights on Current Financial Situation

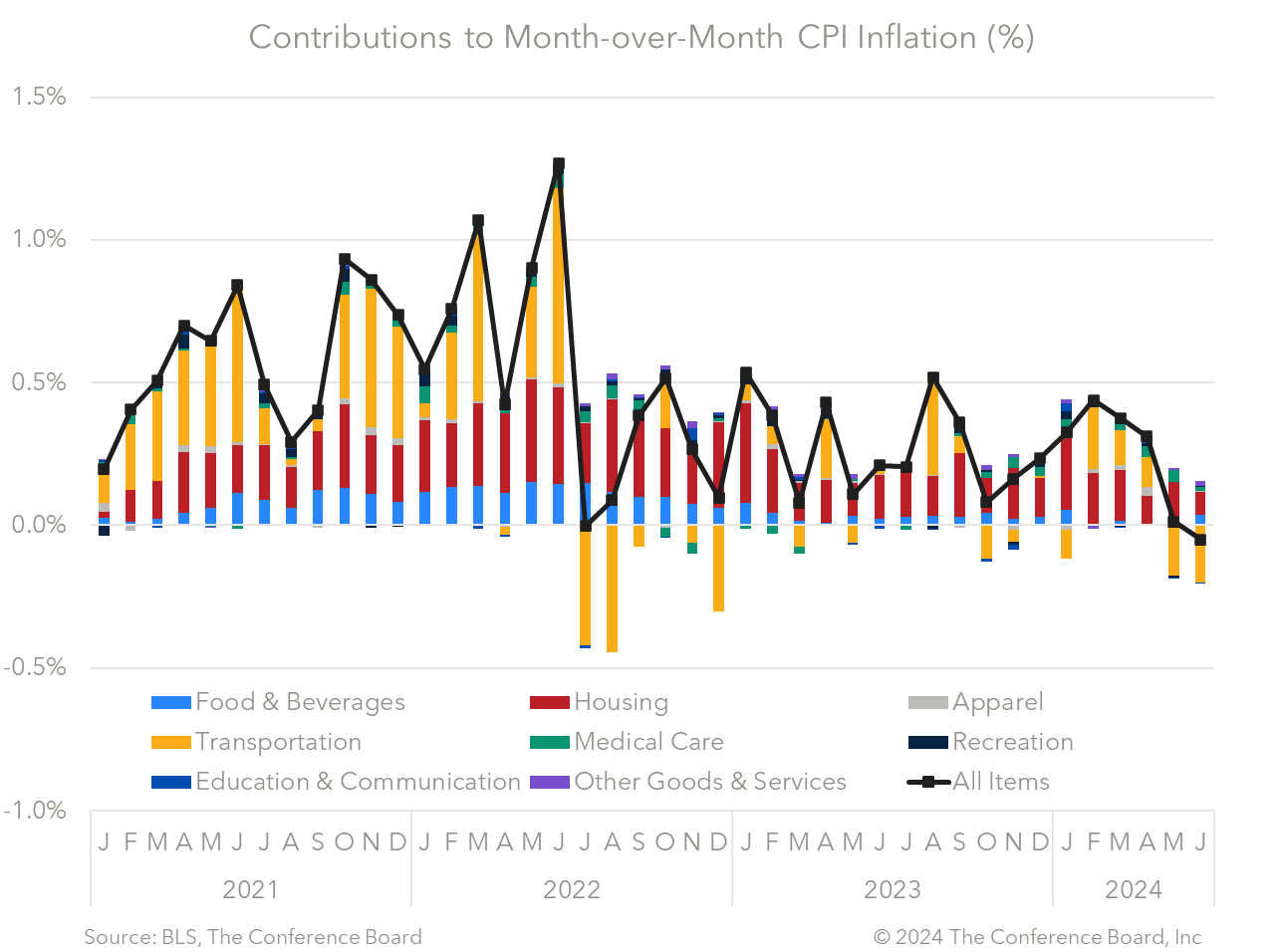

As the financial world grapples with shifting economic indicators and political uncertainty, insights from leading experts offer a crucial perspective on what lies ahead. With inflation showing signs of easing and the Federal Reserve signaling a likely rate cut, the focus now shifts to earnings performance and broader economic trends. Adding to this complexity are political developments, such as the possibility of a Republican sweep.

The latest June 2024 inflation report revealed a softer-than-expected outcome, causing varied reactions across major stock indices. Initially, futures surged in response, but have since fluctuated. Currently, the Dow is showing gains, the S&P is up slightly, and the NASDAQ is just below the flatline. Inflation dropped by a tenth of a percent month-over-month, contrary to economists’ forecasts of a rise.

Expert Perspectives

Chris Harvey, Head of Equity Strategy at Wells Fargo Securities, and Mike Feroli, Chief U.S. Economist at JPMorgan, shared their perspectives on the current financial situation in an episode of CNBC’s Fast Money. Chris Harvey is cautious about the concept of market rotation due to ongoing uncertainties about earnings. While he doesn’t oppose rotation, he pointed out that investor confidence is still shaky.

Mike Feroli discussed the anticipated rate cuts and the economy's current state, expressing his views on potential future trends.

Further discussions highlighted the impact of a Donald Trump presidency and a possible Republican sweep on economic policies and markets.

Federal Reserve Rate Cuts and Economic Reports

In another episode of Fast Money, Chris Mman, Chief Investment Officer at Lafayette College, discussed the potential timing for Federal Reserve rate cuts and their implications on the market and labor trends. He emphasized the importance of upcoming economic reports in influencing the Fed’s decisions.

:max_bytes(150000):strip_icc()/indexesfeb13-9c40a8a741cd4ce5940b455fda140ada.png)

Political uncertainties and their impact on the economy were also part of the broader discussion, emphasizing the Fed's focus on data-driven decisions.

Meta Platforms Inc. (NASDAQ:META) Financial Performance

Meta Platforms Inc. (NASDAQ:META) dominates the social media space with platforms like Facebook, Instagram, and WhatsApp, each attracting billions of users. This large user base creates substantial revenue opportunities through targeted advertising, a key driver of Meta Platforms Inc. (NASDAQ:META)’s financial success.

:max_bytes(150000):strip_icc()/indexesmarch30-4879127ff21c4365881aad96cd940168.png)

Financially, Meta Platforms Inc. (NASDAQ:META) posted $39.1 billion in revenue, reflecting a 22% year-over-year increase, alongside a 38% operating margin and $13.5 billion in net income. Meta Platforms Inc. (NASDAQ:META) also generated $10.9 billion in free cash flow and returned value to shareholders through stock repurchases and dividends.

Analysts' Optimism and Strategic Positioning

Analysts remain optimistic about Meta Platforms Inc. (NASDAQ:META) due to its strategic positioning and growth potential. Meta Platforms Inc. (NASDAQ:META)’s dedication to evolving its platforms and exploring new technological frontiers indicates a promising future, making Meta an appealing choice for long-term investors.

Mar Vista Focus strategy's perspective on Meta Platforms, Inc. (NASDAQ:META) further adds to the positive outlook, highlighting the company's strategic shifts and focus on AI development.

Conclusion

Overall, Meta Platforms Inc. (NASDAQ:META) stands out as a strong contender in the fast money stocks landscape, with a solid financial performance and optimistic analyst outlook. The company's commitment to innovation and strategic adjustments bode well for its long-term success in the market.