It's Time To Buy Muni Bond Funds—Here's Why And Where

Good news for savers in fairly high tax brackets: Yields on municipal bonds are good, comfortably ahead of what you can clear from Treasury bonds. Municipal bonds are worth considering for any fixed-income money you have in taxable accounts. For tax-sheltered accounts like IRAs, munis are inappropriate.

Why Municipal Bonds are a Good Investment

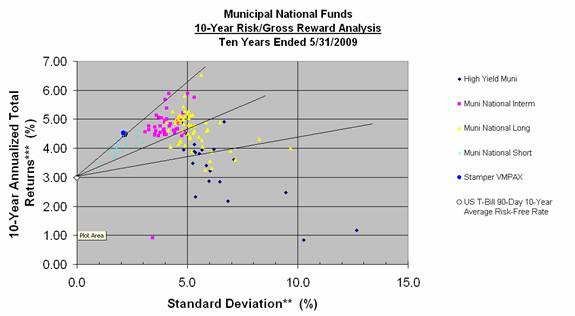

For taxable accounts, munis are a buy. Yields on municipal bonds are currently attractive, making it a good time to invest. Patrick Haskell from BlackRock states that real and nominal yields on municipal bonds are at favorable levels. For bonds due in ten years, tax-exempt yields are 80% of U.S. Treasury yields, making them a good option for investors in higher tax brackets.

:max_bytes(150000):strip_icc()/municipalbond.asp-final-7beba4dac48840a1ad473ddb1c3f8f2d.jpg)

While there is some risk involved, long-term municipal bonds remain attractive even after factoring in this risk. In the event of federal tax changes impacting municipal debt, existing bonds will be grandfathered.

Where to Invest in Muni Bond Funds

When considering investing in municipal bonds, there are several options available, including individual tax-exempt bonds and bond funds. Fidelity offers a wide selection of individual tax-exempt bonds, while there are also exchange-traded funds (ETFs) and mutual funds to choose from.

When it comes to individual bonds, it can be challenging to research and trade them effectively. On the other hand, muni bond funds offer easier liquidity and diversification. Vanguard offers a variety of mutual funds with competitive expense ratios for investors to consider.

Considerations for Investors

Investors should be aware of the risks associated with callable bonds and how they can impact expected returns. Municipal bond yields may overstate expected returns due to call provisions and interest rate fluctuations.

For individuals in moderately high or very high tax brackets, municipal debt is usually more rewarding than Treasury debt. However, it's essential to assess the potential impact of taxes and call provisions on investment returns.

Tax Considerations and Fund Advantage

State tax rates vary, affecting the overall tax implications of investing in municipal bonds. Investors should also consider the advantages of investing in municipal bond funds over individual bonds, especially in terms of tax treatment on gains.

By investing in municipal bond funds, investors can benefit from lower capital gain tax rates compared to individual bond investments, making them a more tax-efficient option for long-term investors.