2025 Digital Media Trends | Deloitte Insights

Deloitte Insights and our research centers deliver proprietary research designed to help organizations turn their aspirations into action.

For personalized content and settings, go to your My Deloitte Dashboard.

Stay informed on the issues impacting your business with Deloitte's live webcast series. Gain valuable insights and practical knowledge from our specialists while earning CPE credits.

Join host Tanya Ott as she interviews influential voices discussing the business trends and challenges that matter most to your business today.

Looking to stay on top of the latest news and trends? With MyDeloitte you'll never miss out on the information you need to lead. Simply link your email or social profile and select the newsletters and alerts that matter most to you.

2025 Digital Media Trends

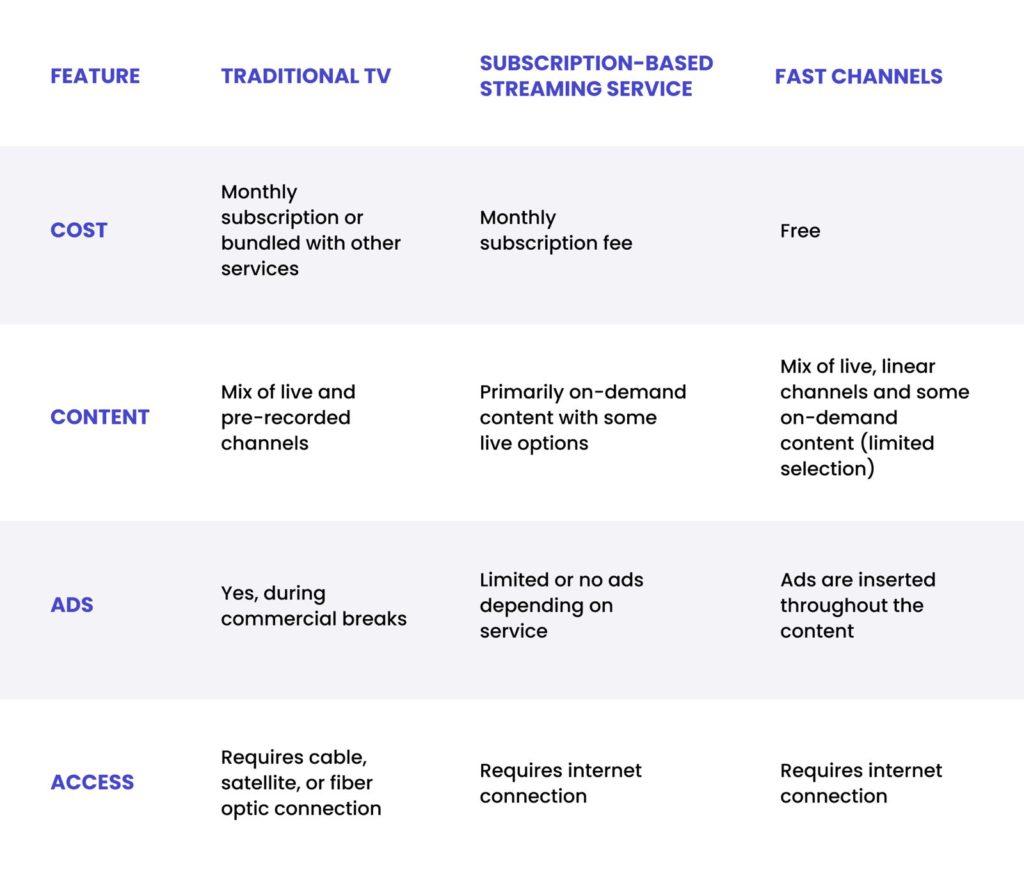

People still want the TV and movie experience offered by traditional studios, but social platforms are becoming competitive for their entertainment time—and even more competitive for the business models that studios have relied on. Social video platforms offer a seemingly endless variety of free content, algorithmically optimized for engagement and advertising. They wield advanced ad tech and AI to match advertisers with global audiences, now drawing over half of US ad spending.1

As the largest among them move into the living room, will they be held to higher standards of quality?

Shifting Preferences

This year’s Digital Media Trends lends data to the argument that video entertainment has been disrupted by social platforms, creators, user-generated content (UGC), and advanced modeling for content recommendations and advertising. Such platforms may be establishing the new center of gravity for media and entertainment, drawing more of the time people spend on entertainment and the money that brands spend to reach them.

Our survey of US consumers reveals that media and entertainment companies—including advertisers—are competing for an average of six hours of daily media and entertainment time per person. And this number doesn’t seem to be growing.2

Looking across generations, preferences among respondents appear to be shifting away from pay TV and toward streaming video services, social video platforms, and gaming.

Streaming on-demand Video Revolution

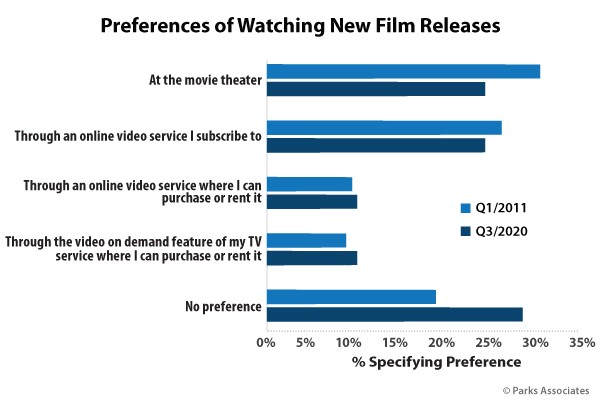

Although TV once dominated video entertainment time, we now see US audiences—and especially younger generations—engaging more evenly with SVOD companies, social platforms, gaming, and even audio entertainment like music and podcasts. And they are using different devices to consume media.

This can further fragment the landscape of entertainment and make it more challenging for services and brands to reach audiences, and for providers to gather more people onto their services.

Competition for Entertainment Spending

Media and entertainment companies may also be competing for a fixed amount of entertainment spending. We do not see those surveyed spending more money on subscriptions, and many report fatigue with having to manage multiple subscriptions to get the content they want, and frustrations with rising subscription prices.

The median household annual income in the United States is about US$80,000 and is only now rebounding from COVID-19 pandemic declines that began in 2020. At the same time, consumer prices have climbed for most goods.

In Deloitte’s January 2025 ConsumerSignals survey, about half of US households say they have no money left over at the end of the month after meeting their expenses.

Cable and Satellite Television

Cable and satellite television remain significant players in media and entertainment, though subscriptions continue to decline. We found that 49% of consumers surveyed currently have a cable or satellite TV subscription, down from 63% three years ago.

The primary reasons subscribers report paying for these services are to watch live news and sports. However, the market continues to fall, likely because SVOD services now offer more live sports options, and social media provides free sports clips and news recaps.

Older generations are more likely to maintain cable or satellite TV subscriptions, but younger subscribers are considering terminating their subscriptions due to cost factors and quality of service.

Live-streaming TV services offer an alternative, are slightly more popular with younger generations surveyed, and live-streaming TV subscribers in our survey report spending 35% less monthly on average for these services.