Nvidia beat signals ongoing AI boom | LinkedIn

In a first-quarter earnings report hyped as a bellwether for tech stocks and a burgeoning AI economy, Nvidia blew past Wall Street forecasts and posted $26 billion in sales — a 262% increase from one year ago. The company, whose microchips power everything from Google’s Gemini to OpenAI’s ChatGPT, also projected $28 billion in sales for the current quarter. The figure not only exceeds the $26.6 billion analysts had forecast, but it also signals that spending on artificial intelligence remains strong.

Nvidia's Earnings Call Insights

Some people are worried about Nvidia growth deceleration. Nvidia is not. Here are the top 5 takeaways from its earnings call:

- Multimodal learning is powering the next immediate phase of AI growth.

- Auto's (self-driving, EV expansion) expected to be Nvidia's largest share of data center revenue this year.

- Sovereign AI (nations building domestic computing) is helping diversify geographic revenue streams.

- CEO Jensen Huang sees a significant number of generative AI startups in line to change industries.

- Huang suggests that AI demand is not slowing down and anticipates scaling significantly in the coming years.

Find the full analysis at Axios

To view or add a comment, sign in

Nvidia Stock Performance

Nvidia's stock crossed $1,000 per share for the first time today, after the company reported Q1 2025 revenue up 262% to $26.04 billion. Not only did Nvidia beat expectations for the sixth quarter in a row, but the company provided an even stronger outlook for Q2 2025.

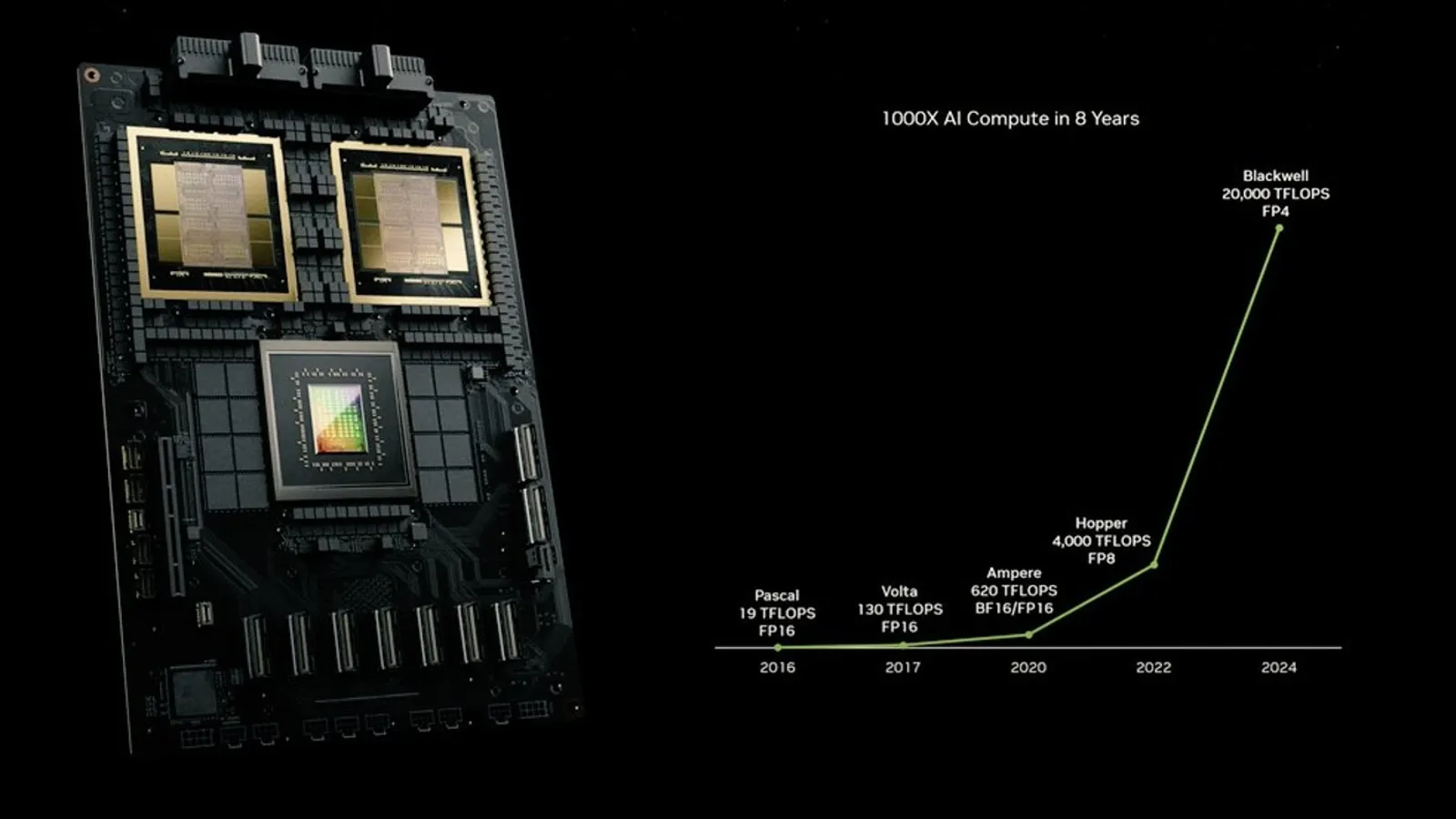

Nvidia also announced a stock split of 10 for 1 on June 7, 2024. CEO Jensen Huang mentioned the company's expectations of significant revenue from its next-generation AI chip, Blackwell. Nvidia plans to release a new AI chip annually to keep up with the demand in the AI market.

To view or add a comment, sign in

The Future of NVIDIA and AI

During their earnings call, NVIDIA announced a 10-for-1 stock split and reported a significant earnings beat. With a revenue increase of 1,100% over the past 5 years, Nvidia continues to show strength in the AI market.

The stock split will provide existing shareholders with additional shares, further solidifying Nvidia's position in the market. The company believes in the longevity of the AI boom, with plans to innovate and release new AI chips to meet the growing demand.

Understanding AI and Reasoning

Listening to the NVIDIA earnings call sparked a discussion on the capabilities of AI models like LLMs to "reason." There is a distinction between "inference" and "reasoning," and it is essential to understand the limitations of current AI technologies in terms of true reasoning abilities.

Deriving conclusions from data (inference) is different from the comprehensive cognitive process of generating, testing, and validating hypotheses and solutions (reasoning). As the AI race continues, it is crucial to recognize the nuances between inference and reasoning in AI models.

For more information, visit https://lnkd.in/grb4RpGe