Where Will Alphabet Be in 5 Years?

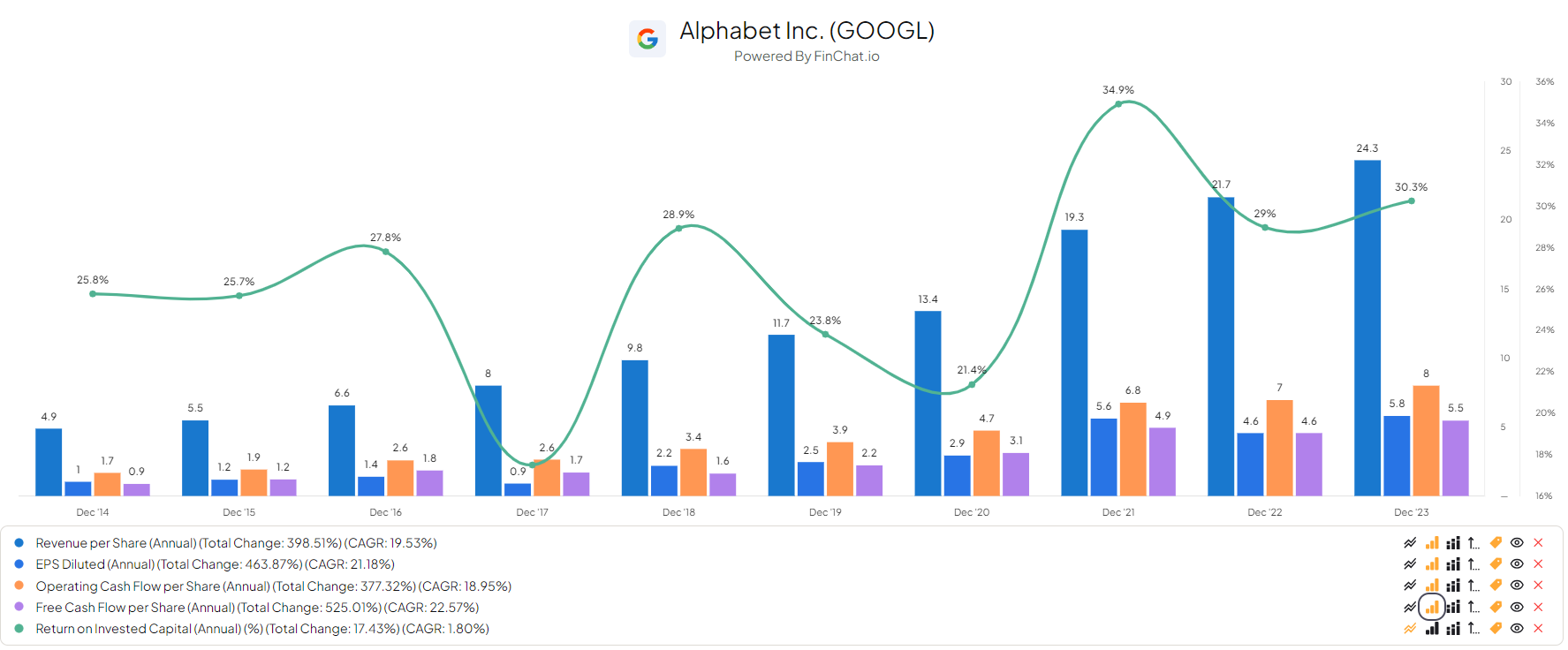

Today, the lowest-valued stock in the "Magnificent Seven" is Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and it's not close. In fact, Alphabet even trades at a lower valuation than the overall market. That's quite a shocking development considering Alphabet's long track record of success and innovation capabilities.

Alphabet's Business Landscape

The market is currently focused on the rise of artificial intelligence chatbots and their implications for Alphabet's core Search business. However, not only is Alphabet making solid moves to sustain Search's relevance, but the company also has not one but three other major businesses growing really fast.

Five years from now, Alphabet's earnings look like they'll be more balanced between not just a resilient Search business but also all four of these major business lines.

At first glance, it's unsurprising that investors may be worried about AI's impact on Alphabet. After all, Alphabet has long had a virtual monopoly on Search, which is a very profitable business that routinely grows double-digits year in and year out.

Alphabet's Response to AI Threats

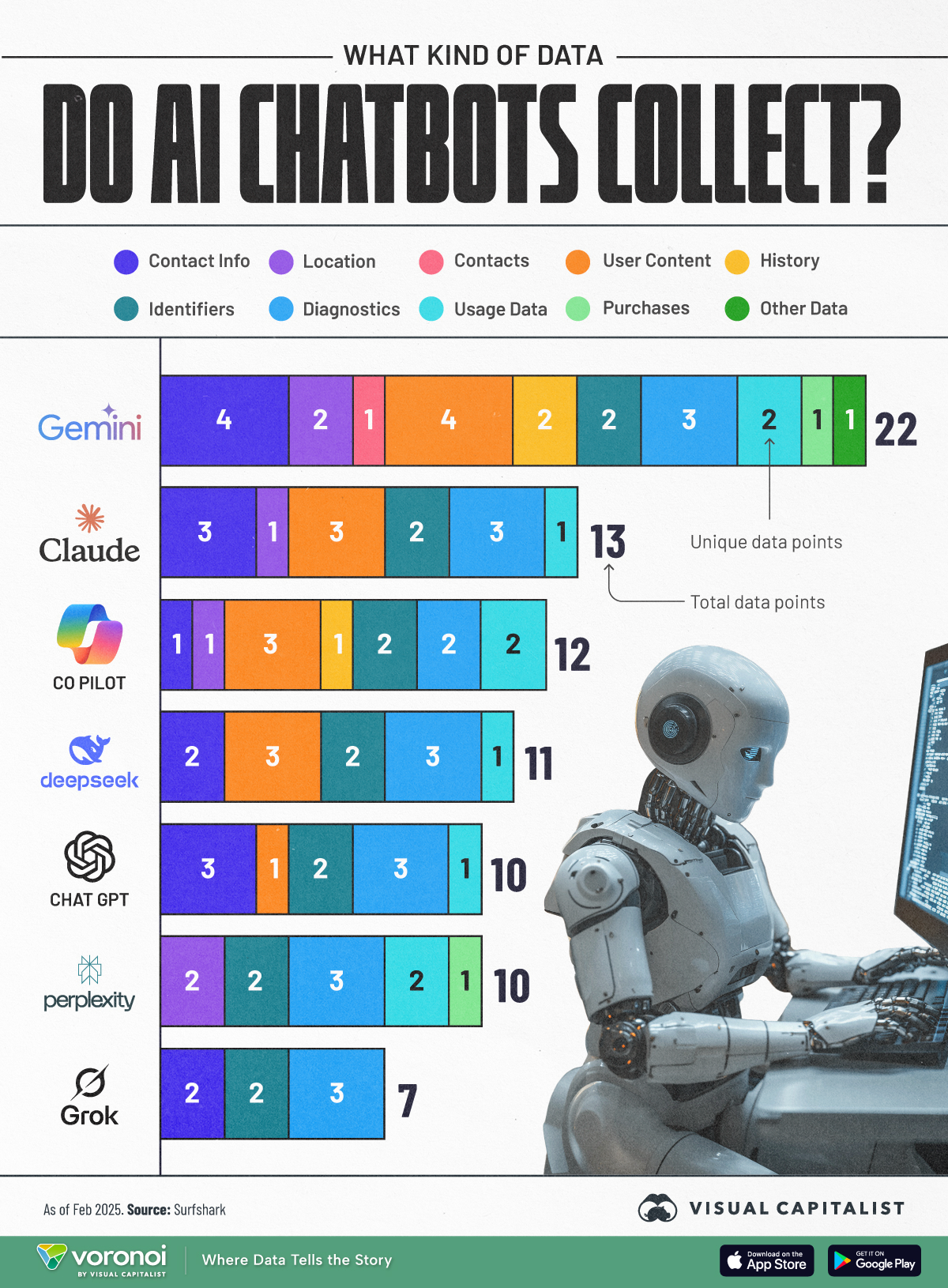

Alphabet has rapidly caught up in frontier large language models (LLMs), rolling out its Gemini 2.5 model one month ago. Upon the rollout, Gemini is generating positive reviews, with some saying that in several use cases, Gemini 2.5 compares favorably to ChatGPT 4.5, which is currently regarded as the best-in-class model.

Investors may also be underestimating the advantages Google Search has as consumers adapt to using AI. Alphabet is infusing and improving the existing Search experience -- which is still a part of billions of people's daily routines -- with increased AI capabilities.

Alphabet is currently testing a new Search feature called "AI mode," which allows for even more complex multipart and multimodel queries and enables follow-up questions. The beta testing began last month, and when AI mode is rolled out, Alphabet will have two AI enhancements to the existing Search experience, along with the premium Gemini model.

Future Growth Drivers

While Search is still Alphabet's main business, at 56% of revenue and likely an even higher share of profits, Alphabet has been cultivating several other segments for years that are just now hitting inflection points. The three key future growth drivers are YouTube, Google Cloud, and Waymo.

YouTube ads grew 15% last year, and Google Cloud saw a 31% revenue increase to $43.2 billion. Waymo, while currently generating losses, has shown significant growth potential in the autonomous taxi market.

Conclusion

While Search will continue to be a significant revenue generator for Alphabet, the company's future success in businesses like Google Cloud and Waymo will be crucial in shaping its trajectory in the next five years. With a strong foothold in multiple promising sectors, Alphabet is poised for continued growth and innovation.