Nicolas Boucher on LinkedIn: 30 Ways to Use ChatGPT for Finance

Are you curious about how to use ChatGPT for finance and business purposes? Look no further! In this article, we will provide you with 30 examples of how you can use ChatGPT to enhance your productivity and efficiency in finance and business.

1) Productivity:

- Idea generation

- Correcting a text

- Summarizing a text

- Translating a text

- Rewrite something complicated in a more simple and easy to understand language

- Research terms and definitions (for example accounting standards)

2) Tutorial for tools

If you are looking for tutorials for software such as Excel, PowerPoint, Word, PowerBI, SAP, Quickbooks, and other software, ChatGPT can provide you with valid tutorials and shortcuts.

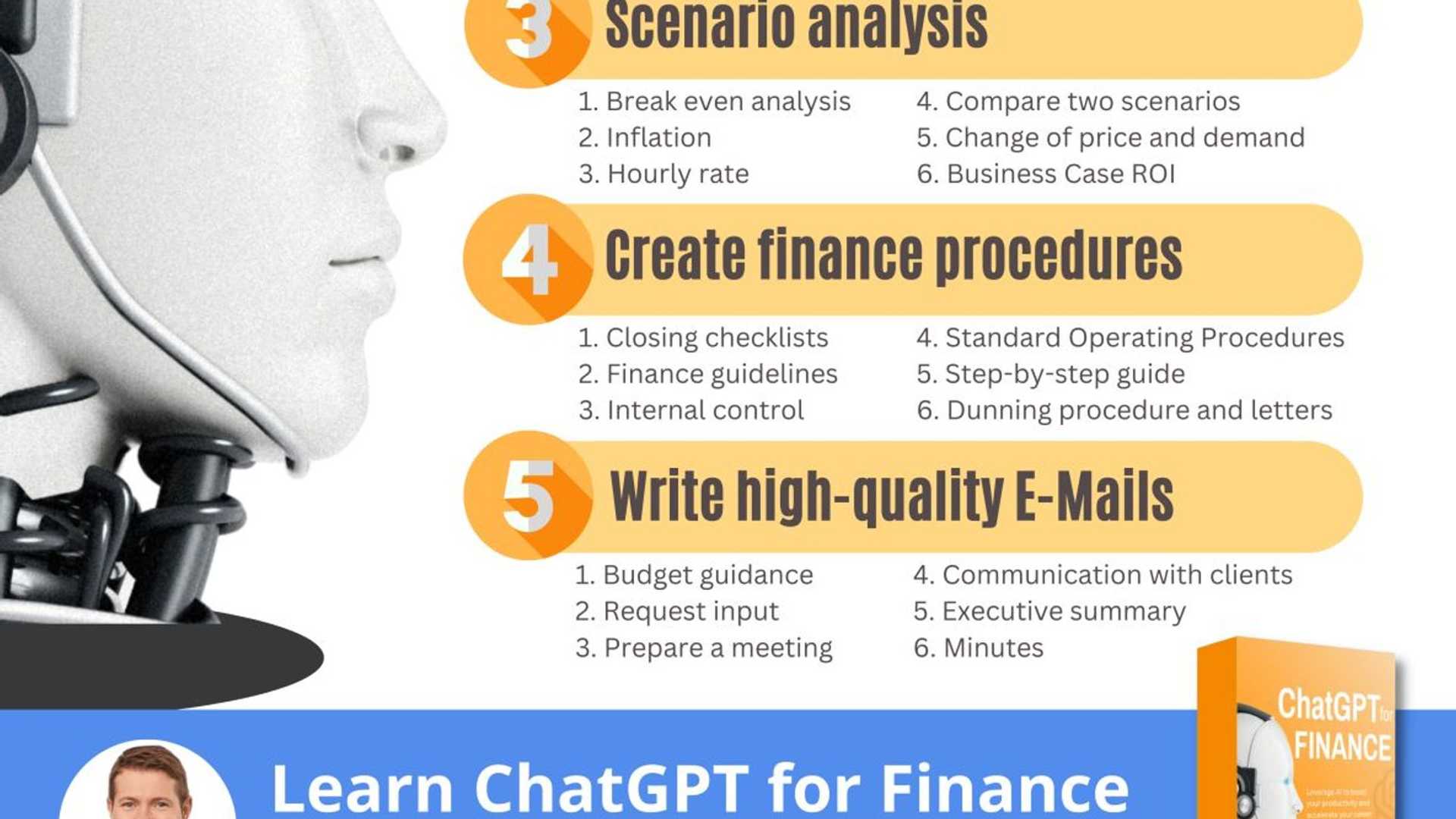

3) Scenario analysis

- Break even analysis

- Compare two scenarios

- Change of price and impact on demand (elasticity)

- Hourly rate

- Effect of inflation

- Business case ROI

4) Create finance procedures

- Closing checklists

- Standard Operating Procedures

- Internal control

- Step-by-step guide to make a task

- Dunning procedure and letters

- Finance guidelines

5) Write high-quality emails

- Budget guidance

- Request input

- Prepare a meeting

- Executive summary

- Minutes

- Communication with clients and suppliers

If you are new to ChatGPT and want to learn how to use AI to boost your career, a step-by-step instruction guide has been created just for you! The guide is 92 pages long and explains how to use ChatGPT to create Excel Formulas, analyze figures, write emails, write SOP, and much more.

For advanced learners, the first Advanced ChatGPT for Finance workshop has been created with two sessions lasting two hours each. In this workshop, you will learn how to use ChatGPT and Python to create financial statements and other financial analyses such as the PVM analysis. With more than 14 years of experience in Finance, Nicolas Boucher understands the daily tasks and needs of finance professionals and has designed these learning opportunities around those needs.

Activity Based Costing – A Guide for Finance Professionals

Activity-Based Costing (ABC) is a cost accounting method designed to allocate overhead costs more precisely than traditional methods. Here is a brief guide:

1/ Definition

ABC is a method of cost accounting to allocate overhead costs more accurately than the traditional method.

2/ Specificities

While traditional cost accounting allocates overhead costs using only one arbitrary rate, ABC allocates overhead costs more accurately. This is accomplished by arranging overhead activities in cost pools.

3/ Cost pools

A cost pool is a group of costs based on either a cost center, a group of cost centers, or a measurable activity (measured as a % of the total time spent by a group of people). Examples of cost pools include warehouse management, customer service, maintenance, R&D, technical trainings, and warranty costs.

4/ Measures

After defining cost pools, you need to define the unit measures. You will use the unit measures to allocate the cost pools to the products. Examples of unit measures include the number of units produced, the number of orders, the amount of material used, percentages, and square meters used.

5/ Pros of the ABC method

- More accurate

- Multiple rates can be used

- Better view of product profitability

- Can help reduce structure costs by selecting activities that have a significant impact on product cost

6/ Cons of the ABC method

- Difficult to implement

- Cannot be used for external reports as COGs and SGA are mixed in the product costs

- Needs the right level of detail and consistency of methods

- Overhead costs are not directly allocated

7/ Case study

The case study presented in the article shows how two different products can have different profitability based on the type of cost accounting used. ABC provides a more precise allocation than traditional cost accounting and takes into account factors such as R&D and warranty costs.

8/ Conclusion

Use the ABC method when you have difficulty understanding the profitability of your products. Make sure to use this information when developing your Go-To-Market Strategy to maximize the profit of your business based on its available resources.

9/ Critics on ABC

Like everything in finance, ABC is not a perfect method that fits all businesses. Limitations include but are not limited to difficulty of implementation and the need for consistency in methods.