3 No-Brainer Artificial Intelligence (AI) Stocks to Buy Right Now

Artificial intelligence (AI) investing remains a dominant theme in the current markets. It is crucial for investors to have exposure to this trend, as it holds the potential to be a game-changing technology similar in impact to the internet.

Top AI Stocks to Buy

My top three picks for AI stocks today are Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Meta Platforms (NASDAQ: META). These companies are significant players in the AI industry and present as attractive investment opportunities at the moment.

Nvidia and Taiwan Semiconductor primarily operate in the hardware sector of AI. This area offers great investment potential without the need to pick a specific winner. Nvidia's GPUs, in combination with chips from Taiwan Semiconductor, are essential for training and running AI models, making them indispensable regardless of which AI company emerges as a leader.

Taiwan Semiconductor stands to benefit significantly from the ongoing AI spending surge by supplying chips for Nvidia GPUs and other AI accelerator devices. The company anticipates robust growth in AI-related revenue, with a mid-40% compound annual growth rate (CAGR) projected over the next five years.

Investment Potential

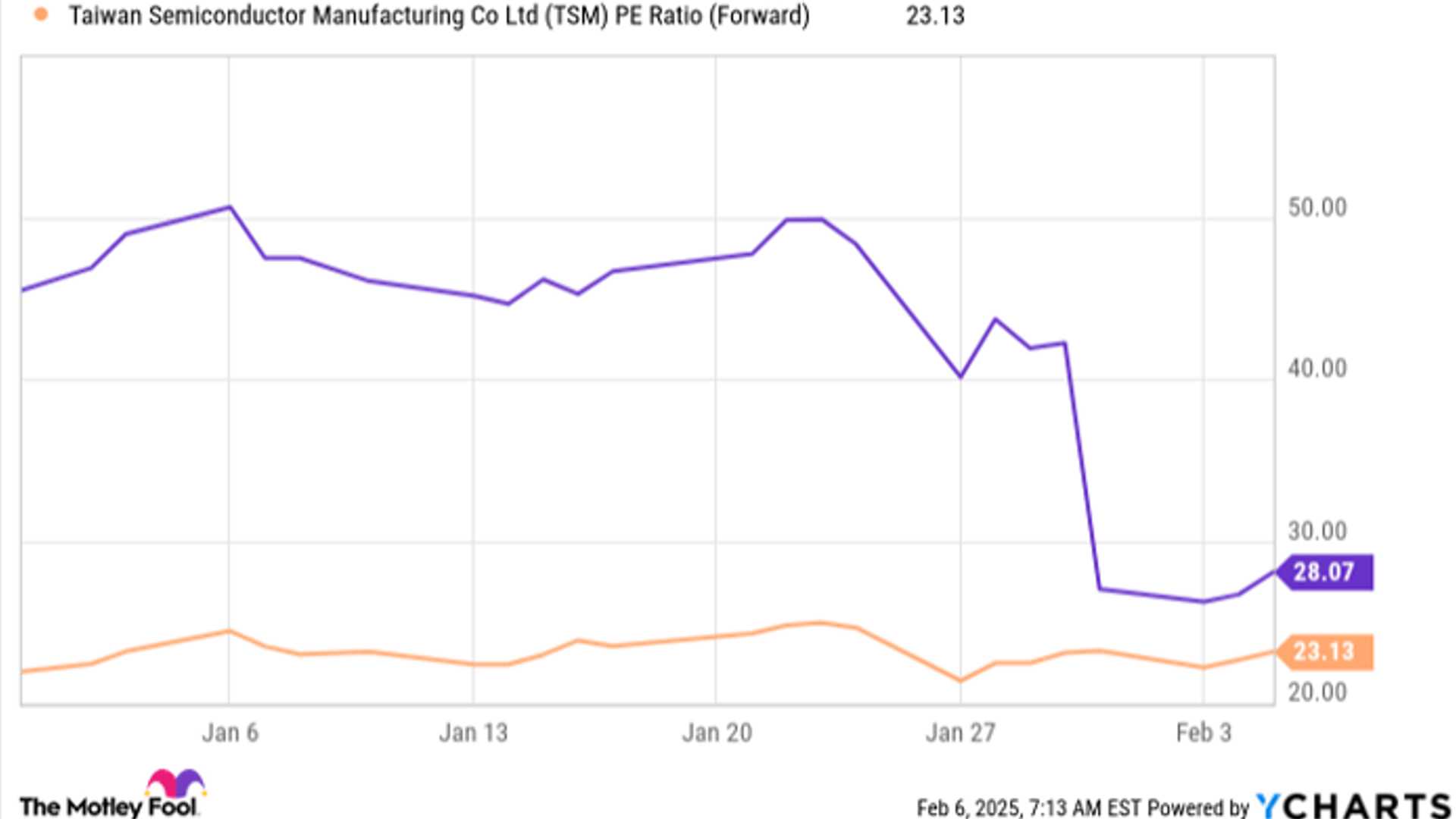

Both Nvidia and Taiwan Semiconductor are well-positioned in the AI arms race and are currently trading at appealing valuations. When considering their forward price-to-earnings (P/E) ratios, these companies are attractively priced relative to their expected above-average growth rates.

Meta Platforms, on the other hand, operates more on the application side of AI. The company's core business of advertising on social media platforms is robust, with impressive revenue growth and operating profit margins. Meta is channeling some of its profits into AI investments, aiming to enhance its AI capabilities significantly.

Future Outlook

Meta's ambitious AI investment plans, including a substantial capital expenditure focus on computing power, position the company for potential breakthroughs in AI technology. CEO Mark Zuckerberg envisions a future where Meta's AI agents rival mid-level engineers in problem-solving capabilities, presenting a significant advancement in engineering power.

Despite the AI focus, Meta Platforms maintains a solid base business, making it a relatively safe AI investment choice. With a forward earnings multiple of 28, the stock presents as a compelling investment opportunity in the AI sector.

Investors looking for promising AI stocks should consider these three companies for their growth potential and strategic positions in the evolving AI landscape.