JPMorgan Says META Stock Will Lead This Key Market

Meta Platforms (META) could become a leader in multiple big markets in the near future if the US economy continues a path towards a downturn. With recession fears growing, investors are looking for safe options in growing sectors to invest in, namely in the tech industry. According to experts at JPMorgan, the Facebook creator could become the top stock option amongst internet-based companies.

JPMorgan's Analysis on META Stock

Indeed, J.P. Morgan has named Meta Platforms’ META stock among its top picks in the internet sector amid tough economic conditions. Analyst Doug Anmuth from J.P. Morgan also recently reiterated his Buy rating on META stock at a price target of $725. This implies an ROI of 25% from current levels. The analyst cites META’s AI dominance and the upcoming Llama 4 launch, which is set to boost monetization and long-term growth.

Additionally, the bank emphasized Meta’s massive advertiser base, noting that the company has tens of millions of advertisers, with over 80% of its ad revenue coming from performance and direct response (DR) advertising.

Positive Projections for META Stock

Analysts from Wolfe Research also are raising their projections for META stock in the near future. The analysts suggest that Meta’s business messaging opportunity could generate $30-40 billion in revenue. The firm believes this “modest near-term upside” could positively impact Meta’s FY25/26 Other-FOA revenue estimates beyond the previous conservative guidance. Additionally, Wolfe Research believes that the medium-term opportunity is even more promising, with the analysts predicting “a high-single-digit to low-double-digit billion-dollar incremental revenue opportunity” in the coming years.

:max_bytes(150000):strip_icc()/GettyImages-2204478386-3c527df0ddc34614911895074d19a991.jpg)

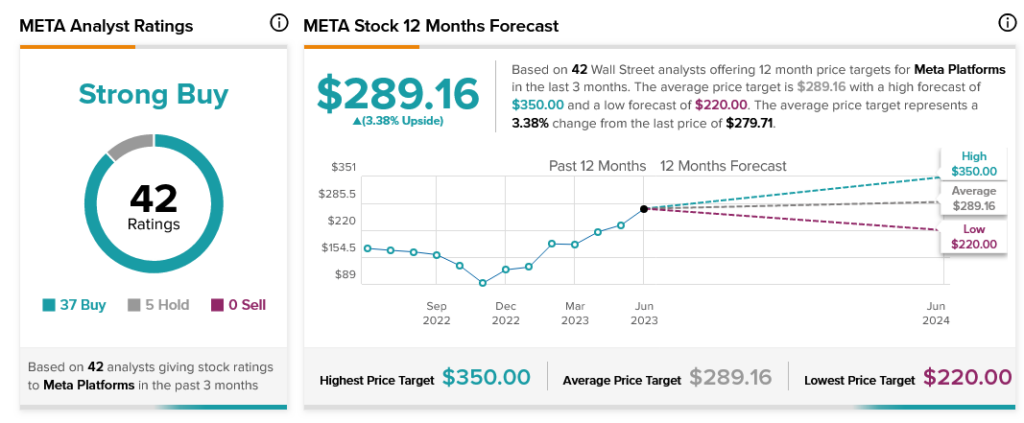

Market Ratings and Price Target

According to TipRanks, META stock has a consensus Strong Buy rating among 48 Wall Street analysts. That rating is based on 44 Buys, three Holds, and one Sell assigned in the last three months. The average META price target from TipRanks is $763.71, implying a 31.14% upside from current prices. CNN data reveals similar optimism. Over the next year, CNN projects META stock to trade at a Median of $775.00, reflecting 32% ROI potential.

Investors are keeping a close eye on Meta Platforms’ META stock as it shows promising growth potential in the tech industry.

Disclaimer: Our articles are NOT financial advice, we are not financial advisors. All investments are your own decisions. Please conduct your own research and seek advice from a licensed financial advisor.